Gold & Silver…Jobs Report Tactics

Gold has a rough general tendency to decline during the week leading up to the release of the US Employment Situation Report (jobs report).

Following the release of that report (Friday at 8:30AM), gold tends to begin a decent minor or intermediate trend rally.

Gold has exhibited this trading pattern for quite some time. It is likely to continue to do so, for the foreseeable future.

On this two hour bars chart for gold, I’ve highlighted the gold price action during the week leading up to the release of the August 1st jobs report. The minor trend decline is clear.

Here, I’ve highlighted the nice rally that began following the release of that report. The minor trend strength of the rally is clear.

The next jobs report is only a few days away, and gold is exhibiting a typical minor decline leading up to the release of the report. The minor trend decline is clear.

It’s important that the Western gold community doesn’t confuse the jobs report trading pattern for gold, with the big picture for gold.

The jobs report moves the price of gold in isolation from the big picture, and does so in a very minor way.

Amateur investors that use leverage to invest in gold, will easily be frightened by the price action created by night time liquidity flows from funds and banks on the COMEX, particularly as the jobs report approaches.

Many of the gold market sell-offs that precede the jobs report tend to begin around 2AM – 4AM New York time. Some gold community analysts have suggested that this is market manipulation that regulators should investigate on a trade by trade basis.

Regardless of whether there should be an investigation or not, leveraged gold investors should “dial down” their use of leverage, so they don’t read more into the gold price action than is actually there. Gold can easily trade in the $1250 - $1260 range before the release of Friday’s jobs report, and investors need to be able to handle that price action, without breaking down emotionally.

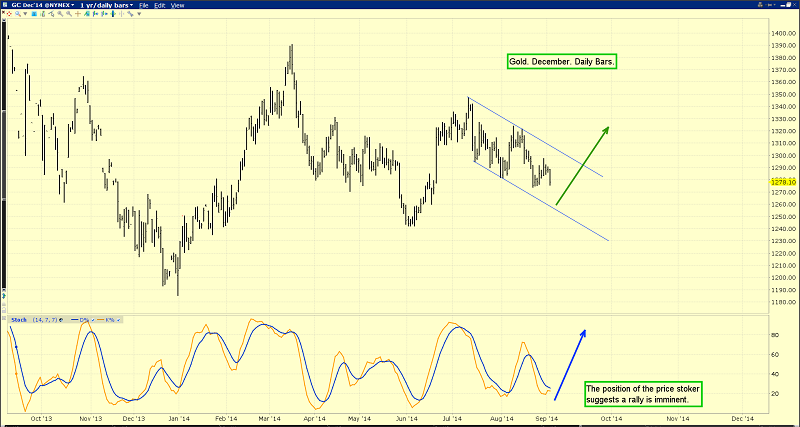

That’s the daily bars chart for gold. Technically, gold appears to set to rally from around the time the September 5th jobs report is released.

Is the rally likely to be a little one, or a big one? That’s the weekly bars chart for gold. It’s clear that larger rallies tend to occur after the price stoker (14,7,7 Stochastics series) lead line has declined to the 10 area.

It’s at about 38 now, which is a decent position, but one usually associated with minor trend rallies, rather than large intermediate trend movements.

Fundamentally, there’s a lot of good news for gold. Gold is the world’s strongest asset, and it’s getting stronger with each passing day. Please click here now. It appears that Chinese commercial bank holdings of gold have exceeded the gold held by the Chinese central bank, and their holdings appear to be accelerating.

During the first half of 2014, Chinese gold demand was not spectacular, but it was decent, and it appears to be rising again.

In India, ‘The April-June shortfall in the broadest measure of trade rose to $7.8 billion from $1.2 billion the previous quarter, the Reserve Bank of India said in a statement yesterday. That’s lower than $21.8 billion a year earlier and amounts to 1.7 percent of gross domestic product. The RBI considers a deficit of 2.5 percent of GDP as sustainable. Gold imports surged 65 percent in June after the government allowed more banks and traders to buy bullion overseas. India is easing emergency measures taken when the deficit widened to an all-time high, as faster growth boosts inflows.“The deficit is getting easily financed,” Sonal Varma, chief economist at Nomura Holdings Inc. in Mumbai, said by phone. “As the economy grows, imports will grow, so there will be some widening in the current account deficit, but we don’t expect it to be above sustainable levels.”’ – Bloomberg News, September 2, 2014.

The Indian central bank considers the current account deficit (CAD) to be sustainable at 2.5% of GDP. Oil imports are a much bigger contributor to the CAD than gold imports are, and oil has been declining, while the economy is starting to strengthen.

In my professional opinion, India’s central bank should be in a position to lower interest rates, just as the Fed begins a tightening cycle. That should create massive institutional stock market liquidity flows out of America, and into India, which is phenomenal news for gold investors.

If Western economy interest rates were eight percent now, their economies would make the Great Depression of the 1930s look like a super boom. Yet, despite an eight percent interest rate, the Indian economy is picking up steam, and could reach 6% GDP growth by the end of fiscal 2015, which is March 31, 2015.

What happens to Indian GDP, if rates decline to 7%, 6%, or 5%? If it happens, Indian stock markets could look like Apollo rockets on steroids! The average Indian citizen’s favourite way to celebrate all good news… is to buy gold!

Many individual gold stocks have staged relentless rallies throughout the months of July and August, and ETFs like GDX are beginning to substantially outperform gold bullion. I expect the rally following the jobs report to show an acceleration of that trend.

I often refer to silver bullion as “Queen Gold’s little brother”. I realize that many investors in the silver community are probably disappointed with the fresh minor trend lows being made by silver this morning, but my suggestion is to stay focused on the weekly chart stoker (14,3,3 Stochastics series).

I don’t see anything on this chart that should worry a patient silver investor. The stoker is “near, but not quite here”, areas where intermediate trend rallies typically begin. After the jobs report is released, I expect silver to bring some serious satisfaction, to all rally enthusiasts!

*******

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gimme The Uptrends!” report. Some gold and silver stocks that seem immune to the summer doldrums, and are rallying relentlessly. I’ll show you the top ten holdings in my “Uptrends Tracker Portfolio”, and why I have them there!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: