This Past Week In Gold

COT data suggests a top is in for the metals.

GLD – on sell signal.

SLV – on sell signal.

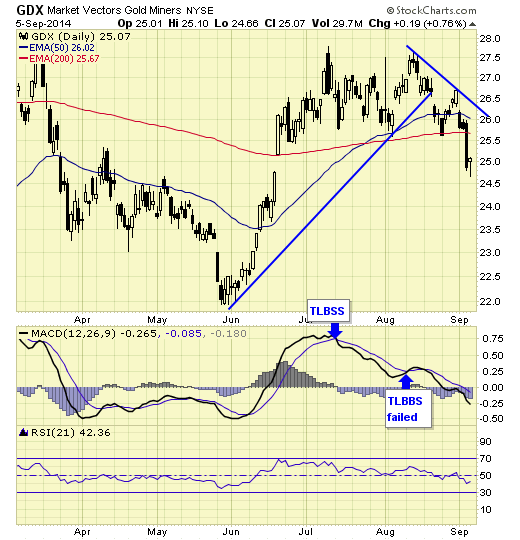

GDX – on sell signal.

XGD.TO – on sell signal.

CEF – on sell signal.

A strong dollar is not supportive for the metals.

Since our major buy signal on USD in 2011, metal prices have fallen significantly and until this trend is reversed from a long term perspective, I can only suggest on trading the gold sector but not holding for the long term.

This long term chart shows clearly the inverse relationship between dollar and precious metals, and we must respect that despite many fundamental and sentimental reasons why some of us have fallen in love with the metals in recent years.

Summary

Long term – on major sell signal since Mar 2012.

Short term – on sell signals.

Gold sector cycle – down as of 8/8

COT data suggests a top is in for the metals.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.