This Past Week In Gold

COT data suggests a top is in for the metals.

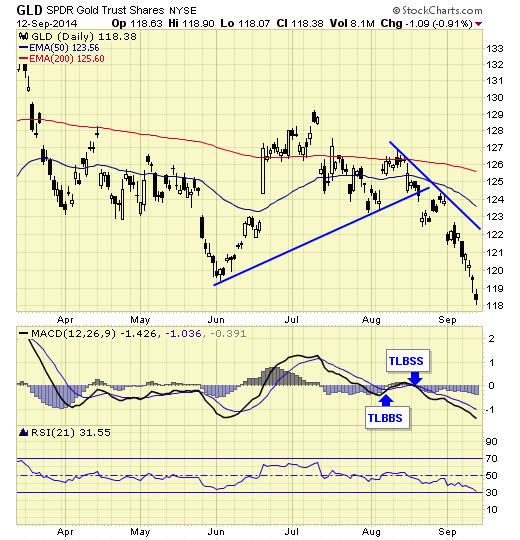

GLD – on sell signal.

SLV – on sell signal.

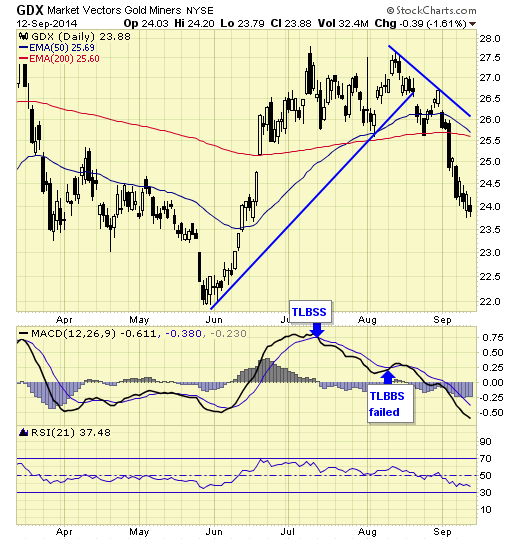

GDX – on sell signal.

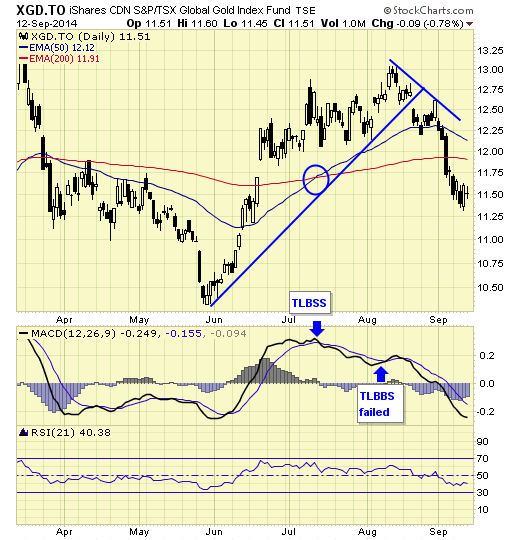

XGD.TO – on sell signal.

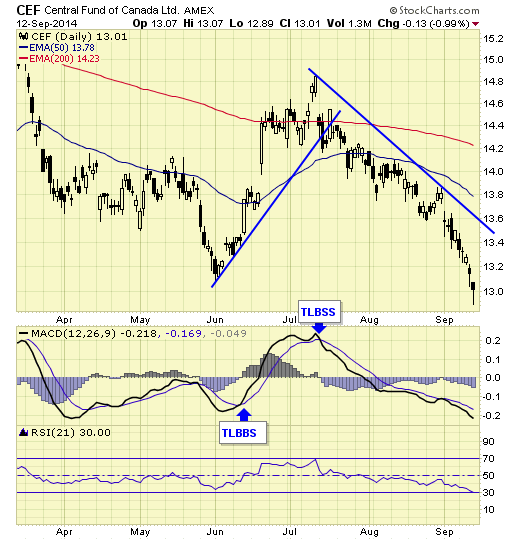

CEF – on sell signal.

Silver has a tendency of leading gold up and down. A breakdown from the currently year long consolidation will affect the entire precious metal sector.

Summary

Long term – on major sell signal since Mar 2012.

Short term – on sell signals.

Gold sector cycle – down as of 8/8

COT data suggests a top is in for the metals.

Also see: This Past Week in Silver

********

Free reports this week only:

In appreciation of your constant feedback and comments, receive this week’s updates and reports at no cost and without obligations. Your email addresses are not kept on file and there will be no solicitations from us.

Send your request to: [email protected]

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.