Stock Market Crash Forecast…7 + 7 + 7

Today some witless pollyannas will say the title of this article is inappropriate. Unfortunately, these hapless souls suffer from excessive greed, rampant euphoria and hyper-complacency. Furthermore, they are ignorant of stock market history…and its immutable cycles (where only magnitude and duration vary). They foolishly delude themselves that the US Fed has “banned” bear markets and has discovered the “magic elixir” to kill all potential bears…while they are still cubs or in hibernation.

But stock market sage Adam Hamilton knowledgeably observes:

“Stock markets are forever cyclical. Stock prices don’t move in straight lines forever, they endlessly rise and fall. Great cyclical bulls that earn investors fortunes are followed by brutal cyclical bears that create the best opportunities to buy low again.

“The serious risk historically is that market selloffs tend to be proportional to the rallies that led into them. The longer stock markets climb without a major selloff to rebalance sentiment, the more unbalanced trader psychology becomes to the greed side. This necessitates commensurately larger and/or sharper selloffs to bleed off the excess euphoria and bring sentiment back into line. That means we are in for a doozy of one today!” (Source: Major Stock Selloff Looms 2 )

Dire Conditions Are Developing For Another Horrific Bear Market

The analysis below forecasts that a Bear Market In Stocks Is Brewing On The Horizon. However, the Fed’s artificial levitation prevents us from predicting when exactly the sharp correction will indeed begin. But rest very well assured the bears are gathering…and will eventually and inevitably strike when least expected.

The number “7” is considered lucky to many cultures in the world. However, the summation of 7 + 7 + 7 in this case may add up to a Stock Market Crash Forecast. Consider: the NASDAQ peaked in 2000 and in 2007, which kicked off horrific bear markets. And 7 years later in 2014 technical indicators are once more suggesting that another peak is forming in the NASDAQ Composite. Moreover, the current market peak has formed a Bearish Double Top with the peak of early 2000.

What happened to stocks subsequent to the 2000 and 2007 peaks?

From March 2000 the NASDAQ was hammered down more than -75% during a horrific 31-month bear market. And although the 2007-2009 bear market was less devastating, the NASDAQ nevertheless plummeted a hair-raising -55% during 16 months.

This begs the question: How far might stocks be beaten down in the next bear market?

Well no one knows for sure. However, historical data may provide lines of probability.

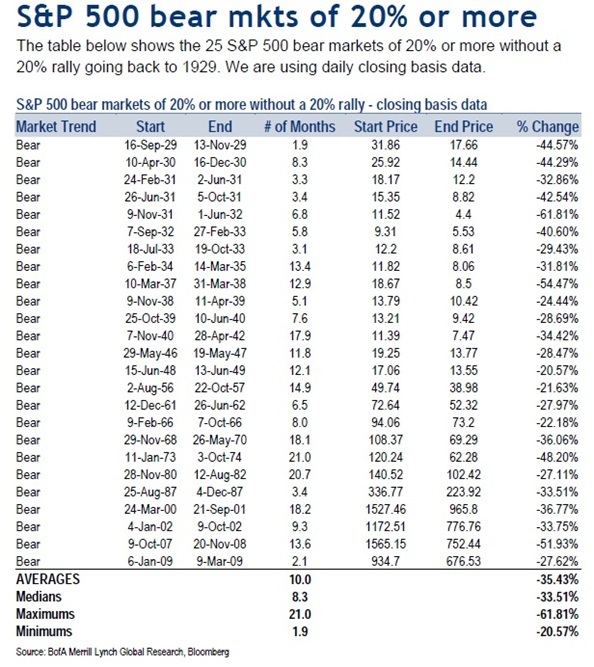

Source: History Of U.S. Bear & Bull Markets Since 1929

Since 1929 there have been 25 bear market in US stocks, where the average loss was -35% over an average duration of 10 months. Therefore, if we project the historic bear market average to the present emerging bear market, we might see the S&P500 Stock Index fall to about 1300 --- and the corresponding Dow Index might find bottom at about 11300. Moreover, the average duration suggests the bear market might find bottom in the second half of 2015.

However, prudent investors must be aware that maximum bear market loss was in 1932, when stocks plummeted -62%...in less than 7-months!!

“The study of history, while it does not endow with prophecy, may indicate lines of probability.”

- John Steinbeck

Prudent and smart investors will hope for the BEST, but will prepare for the WORST.

Related Stock Market Crash Articles:

Gold Stocks and The Great Crash of 1929 Revisited

Great Crash Of 1929 Similarities Suggest Gold Prices Will Soar In 2014

1927-1933 Chart of Pompous Prognosticators

Puncturing Deflation Myths, Part 1 Inflation During The Great Depression

Blue Skies and Market Blues (1929 & 2000)

The Most Equitable Measure Of Stock Market Valuation Is Market Cap/GDP

********