Several Gold Companies Release Positive Drilling Results And Production Updates

Strengths

- Gold rose for the first time in four days on Friday after holdings in exchange-traded products (ETPs) backed by bullion saw the largest increase in more than six weeks. Silver rose the most in a week.

- March gold imports for India came in at about 125 tons versus 60 tons a year ago. Furthermore, year-to-date (YTD) imports are at about 900 tons versus 662 tons the previous year.

- Several companies released positive drilling results and production updates this week. Klondex Mines announced that one of the veins drilled in its Midas Phase I program yielded 280.3 g/t of gold equivalent to over 1.5 meters. Lake Shore Gold’s first quarter preliminary gold production came in at 53,000 ounces, up 19 percent year-over-year. St. Barbara announced record gold production of 111,288 ounces in the first quarter of the year. Lastly, Claude Resources also set a quarterly record with production of 21,067 ounces.

Weaknesses

- Federal Reserve policy minutes released this week from their most recent meeting showed officials were split last month over whether they would raise interest rates in June. Short sellers used this as an opportunity to push gold down for a third day.

- Armed robbers walked away with an estimated $8.5 million of gold from the refinery at McEwen Mining’s El Gallo 1 Mine in Mexico’s Sinaloa state on Tuesday. The gold was contained in an estimated 900 kilograms of gold-bearing concentrate. The company announced that while it is insured, the policy won’t be enough to cover the entire expected loss. Apparently the furnace to produce the doré bars was offline for repairs, thus causing the gold concentrate to build up. This hints at the robbery being an inside job, with someone with knowledge of the buildup likely tipping off an outsider.

- Norilsk sees South African output of platinum declining in the next several years. With output already falling, however, it is troubling that there has not been a positive price response.

Opportunities

Furthermore, looking at the grade that has been processed (head grade) versus reserve grade, companies are currently processing close to reserve grade. Over the last five years, the average head grade is within 2 percent of reserve grade. Head grade in general has been seeing a decline in values since 2001 but dropped abruptly in 2005, forcing companies to struggle to keep their operations profitable.

- In a new report, RBC Capital Markets analysts identify three phases gold miners have historically gone through in response to low commodity prices: rationalization, restructuring and refinancing. Their view is that we are still in the rationalization phase, when management teams think prices will recover in the near term. Given this outlook, they respond to market conditions with “temporary fixes” such as cuts to sustaining capital. However, as we move into the restructuring phase, there is an uptick in insolvencies and mergers, and in the refinancing phase, optimism ticks up and well-financed companies try to consolidate mining camps. The RBC analysts believe these latter phases are coming soon.

- Goldman Sachs published a report warning that capex cuts could threaten future production. In response to the multiyear commodity price correction, gold miners globally have cut capex by 52 percent since year-end 2012, which Goldman forecasts will drive a 7-percent decline in production by 2018 from today’s levels.

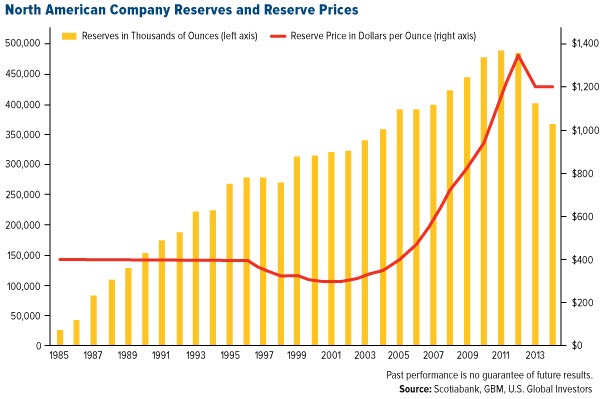

- Bank of America/Merrill Lynch published a report in which they argue that while producers have been focused on maximizing free cash flow from operations, there is a concern that not enough attention is being paid to the declining reserves trend. The average reserve life index for the North American gold producers has plunged 23 percent from 13 years ago at year-end 2012 to 10.2 years at year-end 2014.

- This relates to a study from Scotiabank, illustrated in the chart above, that argues the decline in reserves in 2014 came about mainly because companies did not replace depletion as the gold price used for reserve analysis was flat.

Threats

- India is the world’s biggest consumer of gold, and its ancient temples have collected billions of dollars in jewelry, bars and coins over the centuries which are hidden securely in vaults. Now the government plans to get its hands on this temple of gold, estimated at about 3,000 tons, to help tackle India’s chronic trade imbalance. Prime Minister Narendra Modi’s government is planning to launch a scheme in May that would encourage temples to deposit their gold with banks in return for interest payments. The government would melt the gold and loan it to jewelers to meet an insatiable appetite for gold and reduce economically crippling gold imports. Key to Modi’s plan will be the interest rates offered for gold deposits. If India can cut imports, that would pressure gold prices that fell to a four-month low last month before recovering.

- In Greece, hundreds of supporters and opponents of Eldorado Gold’s mining operation clashed despite police efforts to separate them. Police said more than 2,000 supporters and 850 opponents were involved. The mine operation has sharply divided residents, with some fearing environmental damage and a drop in tourism. Others welcome the nearly 2,000 jobs it provides at a time of economic crisis.

- The Greek energy minister derided Eldorado Gold, saying the company “can’t act like a state within a state.” It said the government won’t be blackmailed and condemned the blocking of roads by Eldorado workers during Easter period.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of