Gold Stocks: Earnings Make Charts

Most gold analysts think that gold is in a bull market, or a bear market. They use charts and US economic reports to try to prove that the gold price is ready to move substantially higher or lower.

In contrast, I’ve argued that the world gold market is in a state of transition. It’s transitioning from a Western fear trade orientation, to an Eastern love trade orientation, and thus gold is on the cusp of a “bull era”.

The last century was dominated by the America. During America’s “heyday”, companies like Xerox and General Motors staged relentless increases in quarterly earnings, and this was consistently followed by massive increases in their stock prices.

That’s because institutional money managers base their liquidity flows on earnings reports. They don’t care if a chart looks bullish or bearish.

They care about earnings growth and cash flow growth.

Even more importantly, mainstream money managers look for consistency of earnings growth, and consistency of cash flow growth.

Price drivers like QE, Greece, and OTC derivatives don’t create cash flow and earnings growth consistency for gold stocks. They create volatility, and that’s not something that an institutional money manager likes to see.

I don’t think most investors realize what kind of sea change is taking place in the gold stocks sector right now. It’s a process that can turn gold stocks into one of the most stable cash flow cows… in the history of investing.

In China and India, good economic news is a reason to buy gold, and bad economic news is also a reason to buy gold. The steady rise in demand created by industrialization in these countries, coupled with static mine supply, is poised to turn the gold stocks sector into an institutional darling.

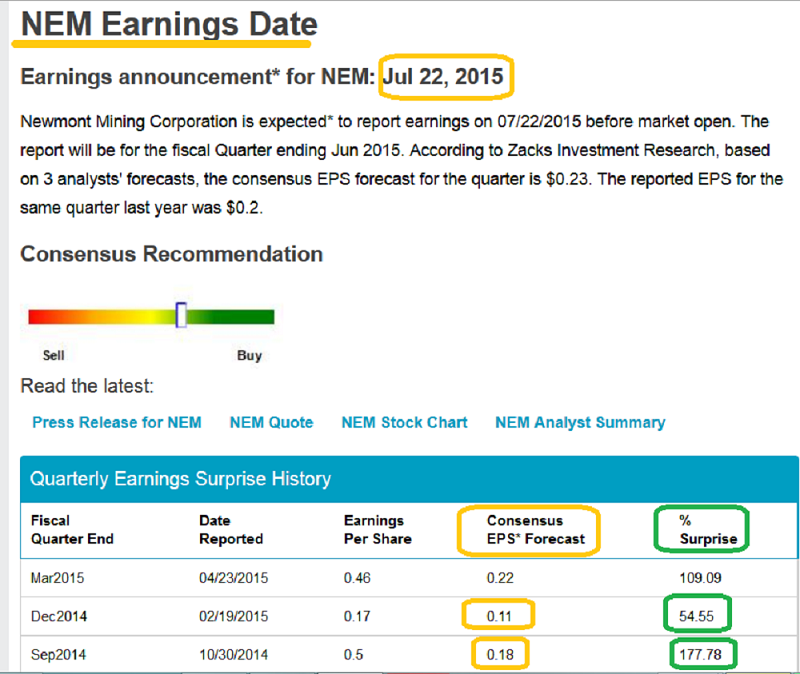

That’s a snapshot of recent quarterly earnings for Newmont.

Once a company starts to show sizable increases in quarterly earnings and cash flow, institutional money managers of size begin to pay serious attention to that company.

Newmont is a gold stock sector leader, and it’s staged some phenomenal and consistent growth in quarterly earnings. That has stunned institutional money managers, and brought them to the investment table.

The next Newmont earnings report is scheduled for July 22. If there’s another upside surprise, institutional money is going to pour into Newmont, and the stock should begin a new leg to the upside.

That’s another look at Newmont, using the weekly chart. Chindian demand can realistically add about $100 - $200 to the gold price floor, over the next 18 months. It can do it in a very stable manner.

To most amateur investors living in the legacy of fear trade era, that might not seem like much of a price spike. To an institutional money manager following earnings reports from companies like Newmont, Barrick, Agnico Eagle, and Goldcorp, it turns those companies into consistent cash cows.

Gold stock charts can’t be used in isolation from earnings reports. The reason that most investors were so negative about gold stocks at the end of 2014 was because they were focused on things like QE and rate hikes, rather than corporate earnings.

That’s why they missed the boat with Newmont, and it’s why they may miss the entire gold stocks sector boat, as it sails up the chart, in 2016!

Newmont is probably going to move steadily towards the $40 area in 2016. Investors who waste time waiting for some magical “chart breakout” will never make any serious money in the market, and certainly not with a key stock like Newmont.

As Newmont moves towards $40, I expect GDX will rise towards $38. That’s the weekly chart for GDX.

No chart formation is going to move GDX higher or lower. It’s institutional liquidity flows that matter, and as mining costs stabilize, and Chindian demand is already quantified by top bank economists as steadily rising, good earnings reports will make the entire Western gold community happy, and GDX will move towards $38!

When the fear trade dominated gold price discovery, it was very difficult for money managers to make long term projections about the gold price. That’s changed with the rise of the love trade, and the rise in oil supply.

As Iran is welcomed back into the international community, even more oil supply will make its way onto the market. Also, China may have large reserves of oil and gas that can be tapped by the use of fracking. Fuel prices for gold mining are becoming incredibly stable, and the love trade is creating stable and consistently growing demand.

The bottom line is that here’s never been a better time in history to confidently invest in gold stocks, than right now! That’s the daily chart for GDXJ. Junior and intermediate gold stocks that have decent AISC (all-in sustaining costs) can do extremely well in the bull era.

Yesterday’s price, volume, and oscillator action was impressive. Note the beautiful position of the 14,7,7 Stochastics oscillator, at the bottom of the chart. The traditional summer rally for gold stocks may now be in play!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Sweet Spot!” report. I highlight gold and silver stocks in the $3 – $6 price range, that could be catapulted higher over the next 18 months, as institutional money managers pour earnings-oriented liquidity into them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: