Low Gold Price Could Boost Mining Acquisitions

Strengths

- On July 17, in the first update since 2009, the People’s Bank of China said it owns about 1,658 metric tons of gold, implying purchases of just 100 tons a year. That’s significantly less than consensus expectations and thus leaves the door open for further accumulation as China attempts to internationalize the Renminbi.

- China has revealed an active yet patient “bargain hunting” accumulation strategy for its gold reserves. Chinese consumers historically bought gold in anticipation of a rally. However, for the government, the metal’s low price remains critical for the central bank to accumulate it.

- According to Commerzbank AG, after a relentless stretch of losses in the gold price over the past week since the Bank of China’s announcement, is due for a pause. The bank said the market selloff has ended for now and investors should exit their short positions and buy in, perhaps triggering a near term rally in the gold price. It is likely that buying that started late in the afternoon at the close of the week reflected some short covering.

Weaknesses

- In Asian trading hours early in the week, investors dumped more than $500 million worth of bullion in New York in a matter of seconds with selling occurring almost simultaneously on Chinese markets. The sheer scale of order flow across both the Shanghai Gold Exchange and the Shanghai Futures Exchange, where combined volume on Monday surpassed the notional equivalent of 250 tons, led many market trackers to speculate that Chinese hedge funds were behind the move. The moves have the hallmarks of speculative selling to push the price lower, given the size and timing of the orders to sell.

- With gold prices tumbling to five year lows, investors aren’t just selling out, they’re betting against it. Speculators in July amassed record short holdings in the metal. Also telling is that the number of hedge funds that are hoping to profit from declines is near a record high. Further signs of trouble are the fact that Indian jewelry bargain hunters are holding off from buying because they believe the collapse in price has further to run.

- The Bloomberg Commodities Index dropped to a 13-year low this week, weaker than after the financial crisis of 2008 and the eurozone crisis of 2012. South Africa’s index of gold mining stocks fell to the lowest level since April 2001, as the precious metal slid to a five-year low with local producers battling rising costs. Lastly, money managers are holding the smallest net-long bets on gold since the U.S. government data begins in 2006.

Opportunities

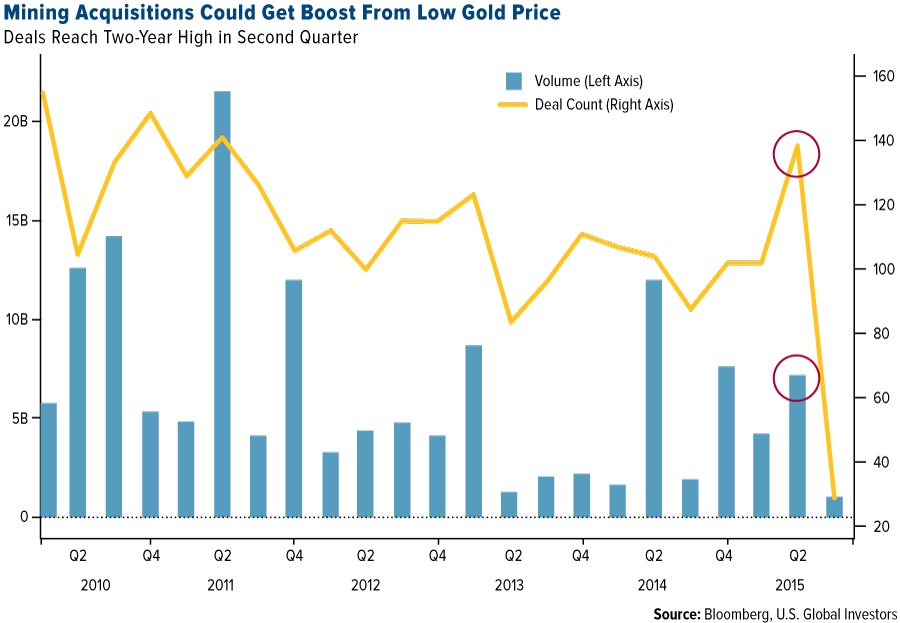

- If low gold prices persist this may increase the appeal of mining companies on a valuation basis. Gold mining companies are already trading at an eight-year low on an enterprise value-to-reserve and resource basis, according to Bloomberg Intelligence data. Deals for gold miners reached a two-year high in the second quarter when the premium paid for companies approached its highest in 12 years.

- The ratio of paper claims to physical gold continues to creep higher, going from 75:1 to 95:1 in the last month as gold traded down 7.5 percent. On Monday, about 7,000 gold futures contracts, representing about 21.8 tons of paper gold, were dumped at market in one minute driving the price down to $1,080. This could be a turning point given that in the first two weeks of 2014, the ratio of paper claims to physical gold went from 76:1 to 112:1 and gold went up by almost $200/oz in the following two months.

- Canaccord Genuity maintained its buy rating and C$5.00 price target on Klondex Mines following better than expected consolidated second quarter operating results. Sales exceeded their expectations by 10 percent, primarily due to higher mill throughput and considerably higher gold grades. Management also increased FY2015 guidance to 125-130 thousand ounces. This marks the second consecutive year that Klondex has raised guidance. Klondex currently trades at more than a 10 percent discount to its peers based on premium to net asset value. Canaccord believes this is an attractive entry point into one of the highest quality intermediate gold producers in the sector.

Threats

- According to Morgan Stanley, gold could tumble to $800/oz under their worst case scenario. Getting there would require U.S. policymakers to start raising interest rates, another correction in China’s stock market and a sell-down of reserves by central banks. Furthermore, Barnabas Gan, the most accurate forecaster of precious metals in rankings compiled by Bloomberg, predicts gold will reach $1,050/oz by December.

- Global mining companies are facing a looming succession crisis. Several mining CEOs have reached or are nearing retirement age and industry executives, recruiters and analysts worry that there is not enough people with the right skills and experience to replace the old guard. Mark Bristow, CEO of Randgold Resources, said that there is a shortage of potential CEOs because the industry doesn’t invest in people.

- According to a labor relations consultant, a pay strike at South African gold companies could result in bloodshed at the mines.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of