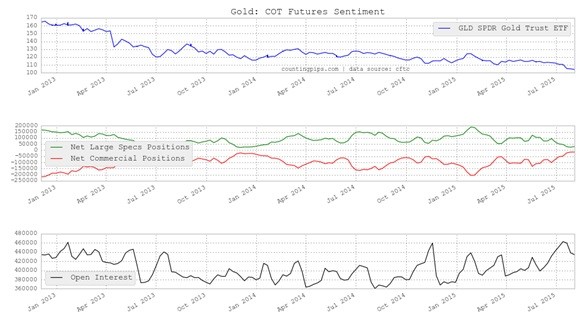

Gold Speculators Add To Bullish Net Positions For First Time In 6 Weeks

Gold - COT Futures Sentiment

Gold speculative positions rose last week

GOLD Non-Commercial Positions:

Gold speculator and large futures traders added to their gold bullish positions last week following five weeks of decline, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +29,900 contracts in the data reported through August 4th. This was a weekly change of +5,435 contracts from the previous week’s total of +24,465 net contracts that was registered on July 28th.

The uptick in the weekly net speculator positions (+5,435 net contracts) was due to a gain in the weekly bullish positions by 1,815 contracts combined with a decrease in the weekly bearish positions by -3,620 contracts.

Gold Commercial Positions:

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) reduced their overall bearish positions for a sixth week to a net total position of -14,820 contracts through August 4th. This was a weekly change of +446 contracts from the total net position of -15,266 contracts on July 28th.

GLD ETF rises:

Over the weekly reporting time-frame, from Tuesday July 28th to Tuesday August 4th, the price of the (ARCA:GLD) Gold ETF , which tracks the gold spot price, declined from approximately $105.02 to $104.31, according to ETF price data of the SPDR Gold Trust ETF (GLD).

Last 6 Weeks of Large Trader Positions

|

Date |

Open Interest |

Change OI |

Net Commercial Positions |

Weekly Com Changes |

Net Large Specs Positions |

Weekly Spec Changes |

|

20150630 |

442301 |

11323 |

-74769 |

26119 |

67155 |

-27959 |

|

20150707 |

452145 |

9844 |

-52589 |

22180 |

50448 |

-16707 |

|

20150714 |

462664 |

10519 |

-48469 |

4120 |

47824 |

-2624 |

|

20150721 |

459760 |

-2904 |

-21584 |

26885 |

28279 |

-19545 |

|

20150728 |

438282 |

-21478 |

-15266 |

6318 |

24465 |

-3814 |

|

20150804 |

434273 |

-4009 |

-14820 |

446 |

29900 |

5435 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and non-reportable traders (usually small traders/speculators)

********

Courtesy of http://countingpips.com/