The Inflation-Adjusted Price Of Gold

The price action continues to be superb for most mining stocks held by the Western gold community.

The price action continues to be superb for most mining stocks held by the Western gold community.

Now, silver bullion is poised to join the upside fun. That’s an indication that the current rally will enter its final stage. The final stage of a major rally in any investment class can produce truly spectacular gains for investors.

Huge value-oriented funds are buyers of an array of gold stocks, and so for the past few weeks I’ve suggested that if there has ever been a time for the average Western gold community investor to “chase price” in the gold stock sector, that time is now.

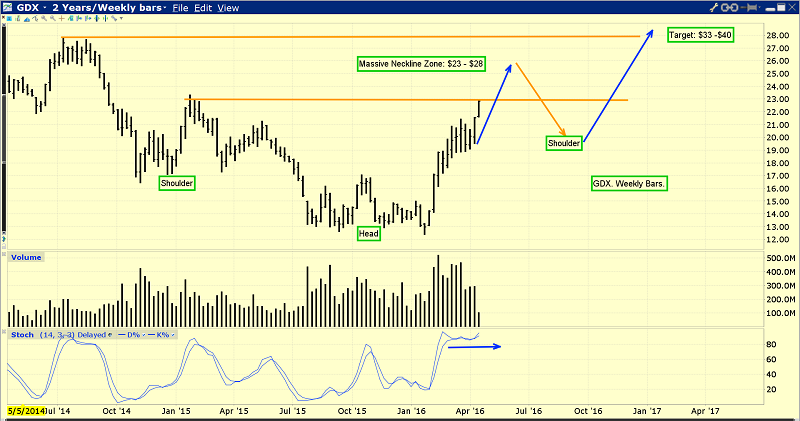

This is a picture of the big gold stocks from a technical standpoint. This weekly GDX chart shows the development of a massive inverse head and shoulders bottom.

Once the right shoulder is completed by a brief pause in the $23 - $28 area, GDX should surge to my $33 - $40 target zone. The bottom line is that good times are here, for gold stock enthusiasts across the world!

This daily chart shows silver poised to burst up from its own inverse head and shoulders bottom, and race towards my $18 target zone.

Both the Bank of Japan (BOJ) and the US Central Bank have major announcements coming on April 27. HSBC economists are forecasting that Japan could announce what I’ve dubbed a “QE For The Citizens” program. The BOJ may actually print money and give it to the citizens to spend. That’s very inflationary.

Institutional buying of gold stocks in anticipation of such a program may be adding fuel to the current “rocket rally”. Also, savers are one of the main backbones of capitalism. I think Janet Yellen probably wants to raise rates in America on the same day that the BOJ’s Kuroda announces what is essentially a helicopter money drop.

A rate hike in America on April 27 could cause a horrific US stock market sell-off. Janet’s first rate hike caused a major equities market meltdown and a surge into the yen and gold.

A second hike, against the background of helicopter action in Japan, could see the yen ignored as a safe haven. Gold and silver may stand alone, as the safe havens for institutional liquidity flows.

US T-bond yields have been in a bear market for about 35 years, just as T-bond prices have been in a 35-year bull market.

When yields enter a bull market, it’s generally reflected in the gold price as a ratio against the US monetary base. That’s the gold versus money base long term chart, courtesy of macrotrends.net.

It can be argued that gold has not experienced a real bull market since the one that ended in 1980. That’s because it’s only when T-bond yields enter a real bull market that the inflation-adjusted price of gold enters a major bull market, measured in US dollars.

That’s another macrotrends.net chart. It shows the inflation-adjusted price of gold over the long term. I’ve annotated it with an inverse head and shoulders bull continuation pattern.

The rough target of the pattern is $3200+. A breakout above the neckline would likely coincide with a surge in the US inflation rate, and with the start of a new bear market in US T-bond prices.

Was the entire gold price rally during the 2000 – 2011 time frame really just a giant bear market rally? Well, when viewed on the gold versus money base and inflation-adjusted price charts, the answer is probably: Yes.

The good news is that rising inflation is now launching a new major bull market for gold in inflation-adjusted prices, and against the US money base. That’s why gold stocks are staging such a stunning performance against all fiat currency, and against gold too!

If gold is beginning a fresh inflation-adjusted bull market, gold stocks are likely only beginning what could be a multi-decade period of dramatic outperformance against fiat currencies and gold bullion.

There is no price driver that gets an institutional money manager more excited about gold stocks than inflation. There’s too much risk involved in placing bets based on geopolitics, short term Fed programs, and other events involving great fear. The inflation trade for gold is best described as a kind of hybrid of both the love trade and the fear trade. It’s something that money managers can quantify, discuss with institutional investors in a calm manner, and get a solid response from those discussions.

The new bull market in gold stocks versus gold marks the end of a 20-year bear market. To be sure if the main theme is going to be rising inflation, then other key commodities will be signalling higher prices too. That’s the daily oil chart.

Oil is the largest component in most commodity indexes. Mike Rothman is the former top energy analyst for both ISI and Merrill Lynch. His influence in the institutional investor community can be substantial, and he just outlined a case for a 100% increase in the price of oil by the end of this year. The technical action I see on the chart supports his solid fundamental thesis. I predicted oil would begin a major rally from the green trend line I put on the oil chart, and that appears to be exactly what is happening.

This is the daily gold chart. One item of minor technical concern is the small head and shoulders top pattern that have appeared. A similar top pattern appeared on gold stock ETFs, and it was destroyed as they rocketed higher over the past few days.

Sometimes gold stocks lead gold, and sometimes gold leads the stocks. The good news is that even if there is a pullback in the gold price, the inflation focus of large value fund managers, Kuroda’s money drop helicopters, European NIRP policy, and another stock market panic in America are all likely to combine, and make that pullback very short-lived.

Eager gold stock enthusiasts can confidently buy more of their favourite gold stocks on every ten dollar pullback in the price of gold, and do so in the welcome company of many of the world’s most powerful money managers!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Oil Stocks & Silver Stocks Fun!” report. I cover four great junior oil stocks and four great silver stocks that are poised for upside leadership in 2016, with key buy and sell tactics for each of them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: