Velocity Of Money And Gold

The velocity of money is declining. What does it mean for the gold market?

The velocity of money is declining. What does it mean for the gold market?

What is the velocity of money? It refers to how fast money passes from one holder to the next and is commonly defined as the rate at which money is exchanged from one transaction to another. Simply put, the velocity of money is the number of times one dollar is spent to buy goods and services per unit of time. It is the value of transactions (GDP) divided by the supply of money. For example, if the velocity is 2, it means that a $10 bill is financing $20 worth of transactions in a given period. Therefore, the higher the velocity of money is, the more transactions are occurring between people (and vice versa). This is why it is considered a good indicator of real economic activity.

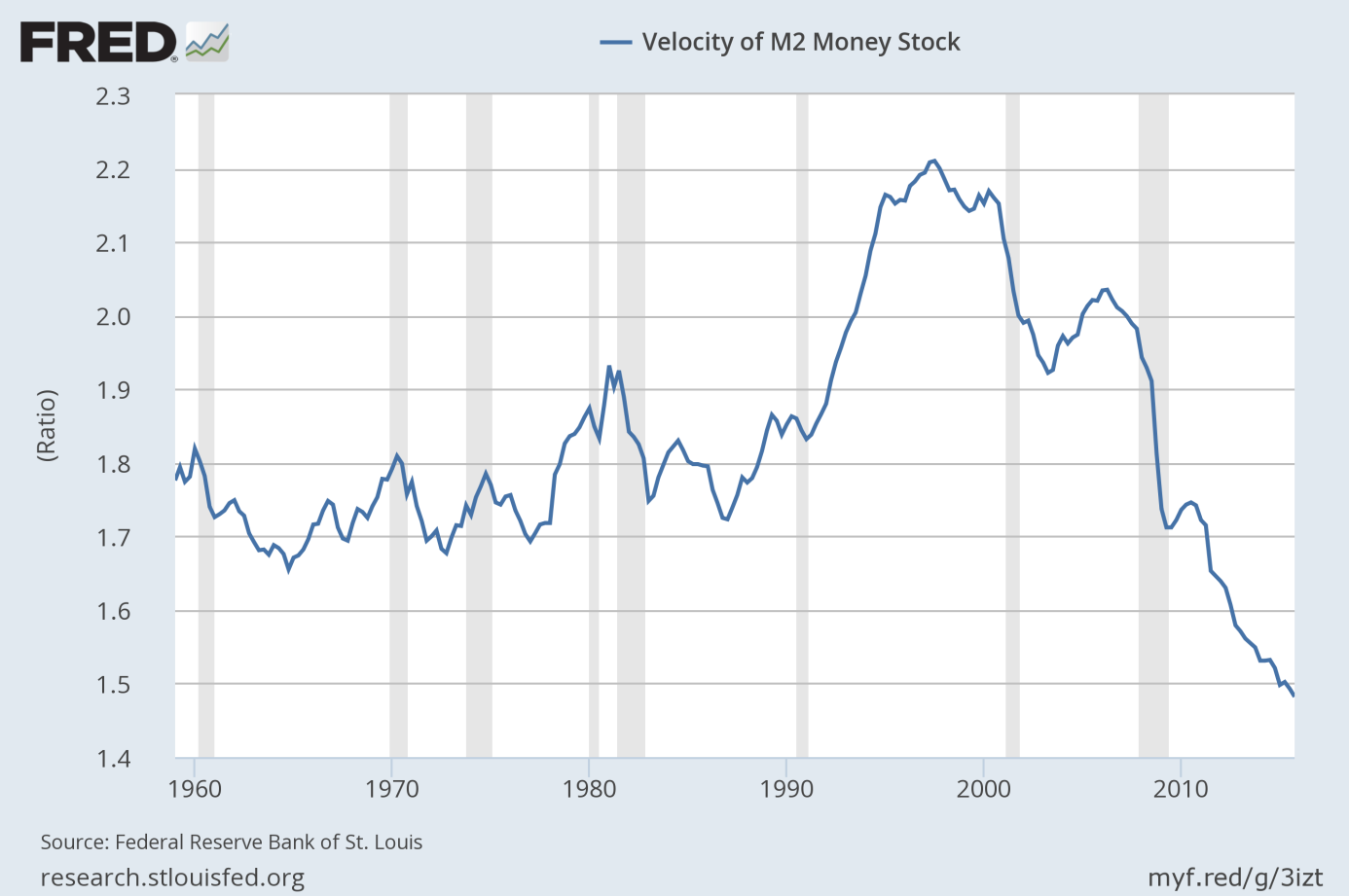

Why are we writing about the velocity of money? The reason is that it is at its worst level since 1959. As one can see in the chart below, the velocity of M2 money has been systematically declining since 1997. And it plunged after the financial crisis when banks and the private sector started hoarding cash.

Chart 1: The velocity of M2 money in the United States from 1959 to 2016.

The declining velocity of money partially explains why the Fed’s easy money is not helping the real economy. The U.S. central bank expands the money supply like mad, but people remain conservative and do not spend money, increasing their cash reserves instead. This is why the link between monetary policy and inflation has become loose recently.

Summing up, the velocity of money is declining. It should be positive for the gold market as it indicates sluggish economic activity (the GDP grows slower than the money supply) and ineffective monetary policy. However, there is no clear correlation between gold prices and the velocity of money, therefore, investors should not invest in gold only based on this indicator.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium-term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.