Financial Armageddon Looms On The Horizon As The EURO UNION IMPLOSION Nears

History is testament that an ill-conceived fetus is doomed to a handicapped crippled adulthood. Thusly, many rational pundits perceive the hodge-podge jumbled union of many European nations, known as the Euro Union. But just as oil and water cannot be blended nor melded into a stable liquid, it logically follows that the haphazard mixture of many radically diverse nations are likewise immiscible…and will probably collapse in the not too distant future.

History is testament that an ill-conceived fetus is doomed to a handicapped crippled adulthood. Thusly, many rational pundits perceive the hodge-podge jumbled union of many European nations, known as the Euro Union. But just as oil and water cannot be blended nor melded into a stable liquid, it logically follows that the haphazard mixture of many radically diverse nations are likewise immiscible…and will probably collapse in the not too distant future.

Implosion of the European System

“…Europe is made up of a good number of historically distinct nations whose diversity of political cultures, even though this diversity is not necessarily marked by national chauvinism, has sufficient weight to exclude recognition of a “European People” on the model of the United States “American people.” THIS IS A MUST READ: http://monthlyreview.org/2012/09/01/implosion-of-the-european-system/ )

Ardent students of history all agree that one of the vital pillars of economic stability is its banking system. Indeed a nation’s financial system fuels economic grow. Consequently, when the banking system is weak for whatever reason, the economic and political stability will indubitably suffer. Here below are irrefutable examples of several Euro Union banks that suffered severe financial damage – as demonstrated by the relentless decline of their stock values.

Indisputable signs the Euro Union is heading for Dissolution

Sadly, many prominent Euro Union banks are helter-skelter heading into bankruptcy. Here are several negatively outstanding examples…showing how European investors have trashed their stocks.

One of France’s Largest Banks (Societe Generale)

http://stockcharts.com/h-sc/ui?s=SCGLY&p=D&yr=9&mn=0&dy=10&id=p80809548087&listNum=1&a=458743218

National Bank of Greece

http://stockcharts.com/h-sc/ui?s=NBGGY&p=D&yr=10&mn=0&dy=0&id=p39180612032&listNum=1&a=458733195

Bank of Ireland

http://stockcharts.com/h-sc/ui?s=BKIR.L&p=D&yr=12&mn=0&dy=0&id=p06414319248&listNum=1&a=458748105

Banco Espirito Santo SA (Portugal)

Its stock plummeted from $25/share in year 2000 to being delisted at ZERO in year 2014:

http://www.google.com/finance?cid=670802

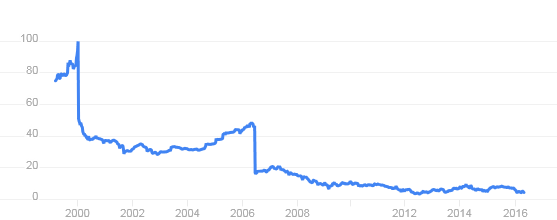

Banco Populare (Italy)

Its stock was hammered down from $100/share in year 2000 to only $4/share in 2016.

Once powerful Credit Suisse Bank of Switzerland may fall to $4/share if the Bear Flag triggers

During the past six years the three largest Euro Union banks have been devastated. Namely, Deutsche Bank, Commerzbank and Credit Suisse. Their share prices has lost between -72% to -93% since 2010.

A Must Read: Bankrupt Banks Brutally Bleeding…Worldwide

Yet another ominous clarion call heralding the collapse of the ill-fated Euro Union is its currency (i.e. the Euro).

Since 2010 the Euro currency has steadily fallen -24% vis-à-vis the US greenback…and looks to continue and ACCELERATE its decline in the coming months…and perhaps well into 2017.

Other Geopolitical Experts Concur The Euro Union Will Likely Implode

http://nationalinterest.org/feature/the-eu-will-likely-implode-15314

To put is all in a nutshell, one must recognize that the ill-fated Euro Union and its continually weakening euro currency were ill-conceived from conception. Moreover, even worse managed during its 17-year lifetime. Consequently, the Euro Union and its euro money are destined to find peace in the monetary graveyard…as so many other currencies have been laid to rest in history. CONTRARILY, the US greenback will soar…especially as interest rates rise in the USA.

Bank on it (pardon the sadly sardonic pun).

********

Related Research

Implosion of the European System

Macy's Crushed By Amazon, Italian Banks Crushed By Euro

Slaughter Of The PIIGS Looms On The Horizon

Why the Eurozone was always doomed to fail

The Ultimate Demise Of The Euro Union

Euro Forecast Via Cartoons…Can The PIIGS Fly?

How the EU could collapse in 2016

Gartman says the euro 'is doomed to failure'

BREXIT WATCH: IMF Adds To Stark Leave Warnings By Bank Of England