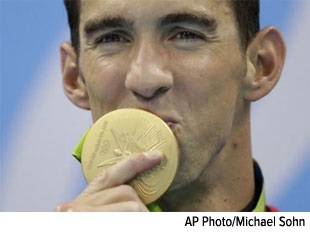

Go Gold!

Last Friday marked one week since the start of the Rio de Janeiro Olympics, and it’s been nothing short of amazing. Michael Phelps, whose name should forevermore be synonymous with the Olympics, won his 22nd overall gold medal. He also was awarded his 13th individual gold, effectively breaking a record last set in 152 B.C. by legendary runner Leonidas of Rhodes.

What I find most remarkable about Phelps’ success is that he’s had to overcome strong personal challenges to reach the level he’s at. He was diagnosed with attention deficit hyperactivity disorder (ADHD) at a young age, and when he chose to get off his medication, he turned to swimming. More recently, he’s dealt with alcoholism, which landed him a DUI in 2014. His is a quintessentially American story of otherworldly success born out of failure, of meeting the obstacles that block his path to his goals head on.

When Phelps made the decision to compete in his fourth Olympics, he reteamed with his longtime swim coach Bob Bowman and set his mind to training harder than he ever had before—which, at his “advanced” age of 31, would be necessary if he hoped to have a shot at winning the gold.

The most decorated Olympian in history, Phelps, like all winners, focuses on winning. Losers, on the other hand, focus not on winning but on the winners in front of them. They’re more concerned about the short-term noise, at the expense of their long-term goal. The image at the top is a perfect illustration of this, with Phelps’ competitor clearly more concerned with “the Baltimore Bullet” than his own performance.

But many investors, I’ve found, are the same way. Today there’s a lot of noise and distraction, which can influence investment decisions. Much of that distraction is coming from the presidential election, which is already turning out to be one of the most negative and highly contentious in American history.

Trump Self-Sabotages

Someone who could benefit from Phelps’ steadfastness and commitment to his craft is the Republican presidential candidate, Donald Trump, who all too often sabotages his own campaign with controversial and incendiary remarks.

We saw this happen last week. While speaking to the Detroit Economic Club, Trump promised that, if elected, he would place a “temporary moratorium” on any new financial regulation. Further, he would repeal the Dodd-Frank Act and reform the tax code to include only three income-tax brackets, down from the current seven.

These are solid proposals, appealing to not only everyday taxpayers but also many of the CEOs I speak with on a regular basis. After all, they’re the ones who must deal with regulations on a daily basis.

The problem, though, is that Trump can’t stay on message. In the opening image, Trump is more like the guy who’s distracted by Phelps rather than Phelps himself. Trump invariably will say something inflammatory soon after making a sensible remark on policy, thereby effectively resetting the news cycle. In last week’s case, it was his comment on “Second Amendment people”—a veiled threat against Hillary Clinton, some interpreted—that dominated the headlines, taking all attention away from the moratorium on financial regulations.

Research Firm: Get Ready for Madam President Clinton

The cover of TIME’s August 22 edition displays a striking likeness of Trump melting like an Air Wick candle. A single word punctuates the stark image: “Meltdown.” Whether or not you support the New York billionaire, you must admit that the “Trump train” has repeatedly jumped the track since the Republican convention. What’s more, we just learned that GOP Chairman Reince Priebus is being pressured by dozens of Republican insiders to withdraw all party support, including campaign financing, from Trump’s candidacy.

Things aren’t looking good. Even regression analysis now appears to show that Trump’s chances are retreating.

In a new report, investment research firm Ned Davis makes the case that, based on historical precedent, economic as well as stock and bond market performance so far this year is pointing to an incumbent party victory in November. The chart below shows that the upward trajectory of the Dow Jones Industrial Average in 2016 more closely resembles the average performance seen in all years when the incumbent party—Republican or Democrat—held on to office.

According to Ned Davis strategists Ed Clissold and Victor Jessup, “When the economy has not been in a recession, the odds of the incumbent party retaining control of the White House has jumped to 71 percent.” Since 1900, presidential elections have landed during recessions five times. In four of these instances (1920, 1932, 1960 and 2008), the incumbent party lost. The exception was 1948 when Harry Truman won—just barely, if you remember your history—but the recession began the same month as the election.

The group points out, however, that it’s extremely rare for a two-term Democrat to pass the baton to a new Democrat via election. How rare? The last time this happened was in 1836, when Andrew Jackson—the very first Democratic president—was succeeded by Martin Van Buren.

Hillary for Precious Metals

I’m very often asked which candidate will be better for gold: Trump or Clinton? The honest truth is that the answer changes week-to-week. Sometimes it’s Trump because he has demonstrated unpredictability and unpreparedness. Other times, it’s Hillary because she has proposed policies that were clearly inspired by the socialist leanings of Bernie Sanders, who still remains very popular among far-left Democrats. In her economic address last week, she laid out her plan to make college “debt-free” and tuition absolutely “free” to children from families who earn less than $125,000 a year.

To make this plan happen, of course, income taxes will most likely need to be hiked. And if history tells us anything, it’s that gold demand has increased when socialist policies threatened economic growth. The price of gold is inversely correlated with the five-year and 10-year Treasury yields, which fall when the economy is floundering. This makes the yellow metal all the more attractive to investors.

That’s why I always recommend a 10 percent weighting in bullion and gold stocks, in both good and bad times. Gold has a history of holding its value even during economic turmoil, which is why it’s prudent to maintain an allocation in your portfolio.

Alibaba Beats Expectations. Is China Next?

Last Thursday, giant Chinese ecommerce site Alibaba posted spectacular numbers, suggesting a turnaround for the world’s second biggest economy possibly isn’t too far behind. Alibaba—whose 2014 IPO stands as the largest in U.S. history, according to Renaissance Capital—posted quarterly revenues of $4.8 billion, a whopping 60 percent increase from the same time last year, and the biggest ever since before the company went public.

This is constructive news for China. Alibaba works with a reported 8.5 million sellers, from mom-and-pop-type shops to multibillion-dollar, international corporations, making for a good cross-section of the Chinese economy. (You could argue the same of Amazon and the U.S. economy.) That Alibaba’s sales are up indicates that consumption in China is stronger than perhaps analysts anticipated. Indeed, Beijing reported that retail sales grew nearly 11 percent in the second quarter year-over-year, beating estimates of 9.9 percent.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of