Gold: The End Game And Headwinds

The US jobs report is scheduled for release at about 8:30AM on Friday. As I’ve noted many times, gold has a rough general tendency to trade lower in the days before that report is released.

When the report is released, gold tends to trade wildly. In the days following the report, gold has a general tendency to move higher.

This is the 8-hour bars gold chart. On cue, gold is drifting lower ahead of this jobs report.

I realize that many investors in the gold community are wondering why gold is soft during what is usually a strong seasonal period.

It’s important to understand what creates the seasonal price action. The Indian love trade is the major factor, and Indian farmers are the main buyers. They are very averse to debt, just like the Western gold community is.

These farmers are coming off back-to-back years of serious drought and low crop yields. This year’s crop is good, but the farmers are focusing on paying back their substantial debts that accumulated over the previous two years.

The bottom line is that Indian love trade demand is not likely to return to normal until 2017.

Gold is well-supported by the love trade, but it’s not the main price driver right now, and gold does face light headwinds in addition to the demand weakness in India and the US jobs report.

The price action for the dollar versus gold is highly correlated to the dollar’s action against the Japanese yen.

Unfortunately, this daily bars chart shows a potential upside breakout for the dollar against the yen. Given the massive decline in the dollar over the past year against both the yen and gold, a rally is to be expected at some point.

As I’ve mentioned, gold is very well supported though, mainly by what I refer to as the “competitive cost of carry” trade. FOREX money managers view gold as a competitive currency. They are buyers, but not because gold is about to rise dramatically.

They simply like gold as a competitive currency.

This is the eight hour bars T-bond chart.

The US T-Bond has been drifting lower since early July, and so has gold. That’s not a coincidence…and it’s another modest headwind for gold.

If Janet Yellen had raised interest rates aggressively this year, it would have incentivized banks to move the enormous QE “money ball” out of the Fed, and into the fractional reserve banking system.

That would have created significant inflationary pressures, and gold would benefit. Instead, Janet has yet to do anything, and so the main price driver for gold continues to be the cost of carry factor, rather than inflation.

A drift downwards in T-Bonds raises the cost of carry for gold, without affecting the money ball sitting at the Fed. That means gold could continue to trade in this sideways drift with a downwards bias until Chinese New Year buying begins in December.

Empires are born, and empires die. Right now, the American empire is dying, and the empires of China and India are being born. The death of the American empire is not caused by debt or even demographics. It’s caused by time.

There’s a time to live, and a time to die, and it’s the American empire’s time to die. Insane levels of debt and entitlements do appear as an empire reaches the end of its life, but reducing those debts and entitlements doesn’t change the fact that it’s time to die.

The 2008 super-crisis involved limited deleveraging, and massive transfer of leveraged assets from the private sector to the public sector (central banks). The next crisis will be a full deleveraging event that involves both public and private assets. I call it the “End Game”.

As it unfolds I expect markets to act more like they did in 1929 than 2008, and end with gold revaluation. The 1930s gold revaluation was really a revaluation of US government gold, and a devaluation of the American citizen. This revaluation will be best described as a revaluation of the gold held by Chindian citizens, and a massive devaluation of the citizens of the Western world.

Business cycles tend to last about eight years. The current up cycle is long in the tooth, and as it ends, the end game winds will begin to blow. Opportunities for gold to stage a parabolic price advance only occur about once every eight years, and the next opportunity is coming soon.

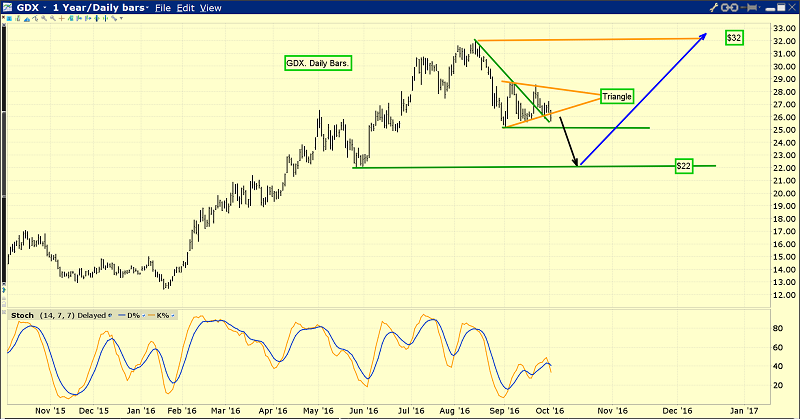

In the meantime, the general theme of transition from deflation to inflation continues. This is the daily bars GDX chart. Like gold, gold stocks are well-supported here, but likely to drift a little lower for a month or two. The $22 area for GDX is a key buying area.

This is the important oil chart. Oil is by far the most significant component of most commodity indexes. The OPEC deal is just another indication that oil is poised to begin a major move higher in 2017. This will bring new inflationary pressures to the entire world, and a new wave of inflation-oriented gold stock buying, from the world’s mightiest institutional investors!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Grease My Gold Stock Wheels!” report. I cover 5 hot gold stocks that are rising while the sector swoons, and 5 red-hot oil and gas stocks that are in rally acceleration mode, with key buy and sell points for all of them!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: