Can Trump Dig Coal Out Of Its Slump?

Flanked by coal workers, President Donald Trump signed the American Energy Independence Executive Order last week, directing the Environmental Protection Agency (EPA) to review the Clean Power Plan, former President Barack Obama’s signature environmental policy. Unveiled in August 2015, the plan is intended to reduce carbon dioxide emitted from U.S. power plants 32 percent by 2030. Because Trump cannot directly overrule this particular regulation, the EPA must come to a finding on whether it needs to be modified or repealed.

Shares of American coal mining companies jumped in response last Tuesday. Kentucky-based Ramaco Resources closed up more than 13 percent, with impressive gains also made by Cloud Peak Energy and Peabody Energy.

As expected, the executive order prompted criticism from environmentalist groups and acclaim from business leaders and workers in the energy sector. Among the media outlets that heaped praise on Trump was the Wall Street Journal’s editorial board, which wrote that the president “deserves credit for ending punitive policies that harmed the economy for no improvement in global CO2 emission or temperatures.”

I believe the editors make a valid point that Obama’s plan accomplished too little at too great expense. However, there are two points on which I might disagree with others.

One, part of Trump’s goal here is to make America energy-independent, as the order’s name implies. Free of burdensome regulations, it’s believed, U.S. energy can be unleased, and we can become a net-exporting nation. The truth is that the U.S. has never been so energy-independent as it is now, even in the face of strict Obama-era rules and regulations. In January, the Energy Information Administration (EIA) forecasted that, even with the Clean Power Plan in place, the country would be a net energy exporter by 2026. Trump’s executive order is unlikely to move that target significantly. And remember, thanks to fracking and the recent lifting of a 40-year ban on oil exports, the U.S. is now a net petroleum exporter.

Two, Trump’s efforts are seen as benefiting the coal industry the most, but I think there are greater forces at work than regulations, as restrictive as they’ve become.

Where Have All The Coal Jobs Gone?

To be clear, I don’t think anyone sincerely believes Trump can “save” coal or coal miners’ jobs. We can probably all agree, however, that he’s at least seeking a way for the coal industry to do what it can to compete with other forms of energy, including renewables and fracking. Coal might very well continue to lose share in the U.S. even after regulations are lifted. That’s fair. But it will be the free market making the choice to retire coal, not government officials.

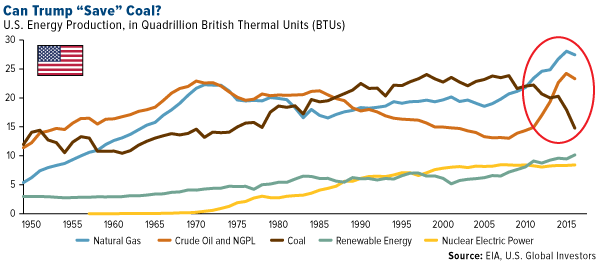

It’s important to recognize that coal faces several challenges that deregulation won’t be able to block. For one, the fracking boom flooded the market with cheap natural gas, compelling many U.S. power plants to make the switch from coal to gas. Thanks to fracking, gas and oil production now outpaces coal production. By 2040, natural gas will account for 40 percent of U.S. energy production, and renewables will have a larger share than coal, according to EIA estimates.

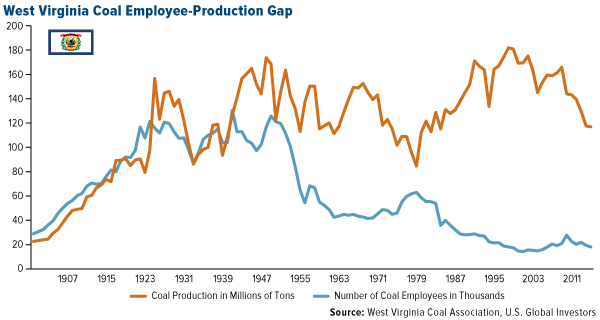

Take a look at the 114-year history of the coal industry in West Virginia, the second-largest U.S. coal producer after Wyoming. Since shortly after World War II, the number of coal mining jobs has steadily decreased. In 2014, the state industry employed a little over 18,000 people, a far cry from the 125,000 it employed in 1948.

Interestingly, though, annual production levels since 1948 have remained within a 100-million-ton range. This suggests that, like fracking, better and more efficient mining tools and methods have offset the need for so many workers. More is done with less. It’s safe to say we can’t wholly blame regulations for the decline in coal jobs.

Growing Demand In Renewables

Also working against coal is the rising demand in renewable energy, specifically solar. This is reflected in the growing number of jobs in solar energy installation, to say nothing of solar manufacturing, project development, and sales and distribution. In 2016, more than 137,000 people were employed in solar installation in the U.S., compared to a little over 50,000 people in coal nationwide.

According to the Solar Foundation, the industry accounted for one out of every 50 new U.S. jobs in 2016, the fourth consecutive year in which solar employment grew more than 20 percent.

As I’ve written about before, the surge in solar demand is a boon for copper, necessary for the conduction of electricity, and lithium, used in lithium-ion batteries to store the energy.

Consumers More Confident Than At Any Time Since 2000

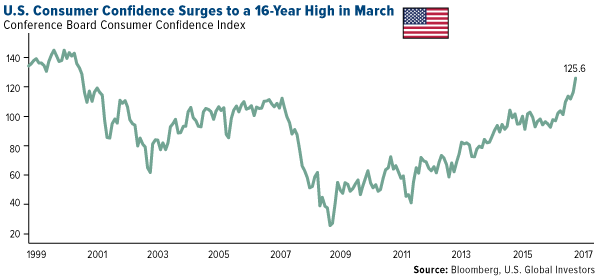

President Trump’s policies aren’t just exciting coal workers. Consumer confidence rose sharply to a 16-year high in March on an improved jobs market and the potential for robust economic growth. The Conference Board’s Consumer Confidence Index hit 125.6, its highest reading since January 2000 during President Bill Clinton’s final days in office.

This comes as optimism among CEOs and business owners stands near all-time highs as well. In December, the month after the presidential election, the National Federation of Independent Business’ (NFIB) Small Business Optimism Index soared to 105.8, up from 98.4 in November, a 12-year high. Since then, the index has held above 105, indicating that, despite recent legislative and judiciary setbacks, Trump’s pro-growth agenda continues to excite small business owners.

Gold on the Mind

Tomorrow, April 4, I will be speaking at the European Gold Forum in Zurich, Europe’s most prestigious gold and silver investing conference.

In the meantime, I had the pleasure to sit down with Louisa Bojesen, anchor for “Street Signs” at CNBC International’s London location. We discussed gold’s relationship with negative real interest rates both in the U.S. and U.K., South African gold mining stocks and fiscal policy in the States, among other topics.

You can watch the interview here.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every invest.

The Consumer Confidence Index (CCI) is an indicator which measures consumer confidence in the Economy.

The National Federation of Independent Business’s (NFIB) Index of business optimism is based on responses from 1221 member firms.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 12/31/2016.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of