Dollar Breaks Out

Yesterday saw one of our most important predictions become reality—the dollar broke decisively out of its Head-and-Shoulders bottom. We can clearly see this breakout on the latest 6-month chart for the U.S. dollar index shown below. Fundamental reasons for this are believed to include the current (weak) trend to higher rates in the U.S., and perhaps more importantly, the euro starting to unravel if Catalonia succeeds in its push for independence from Spain. Whatever, this chart says the dollar index is going to advance to our target in the 97 area.

The importance and validity of this breakout is emphasized by dollar proxy UUP also breaking out yesterday on the highest upside volume for many months.

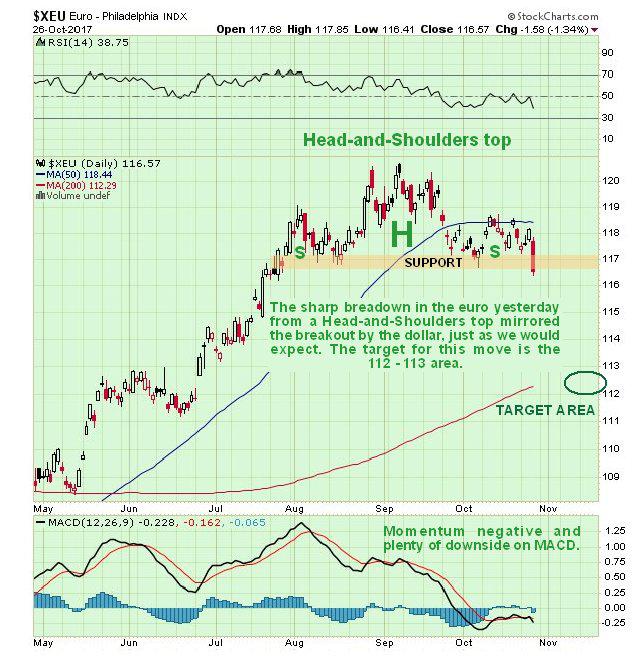

A big component of the dollar index is the euro, and not surprisingly the euro broke down from a Head-and-Shoulders top yesterday that is the inverse of the Head-and-Shoulders bottom in the dollar. The European Union is threatening to fall apart, and if Catalonia succeeds in breaking away from Spain, it is likely to close the lid on the euro's coffin.

While gold and silver valiantly struggled to hold up yesterday, the same cannot be said of precious metal stocks, and the Market Vectors Gold Miners ETF, GDX, dropped away quite hard, so we can expect gold and silver to follow suit as the dollar rallies.

Finally the Gold Miners Bullish Percent Index shows that there is still quite a bit of bullishness waiting to be wrung out of the sector. Those long PM stocks should hedge their positions and the most cost effective way to do this is via Puts in something like GLD, which have good liquidity. With inverse ETFs you can be swindled out of your due gains as they often do not perform as they should. GLD November or December 118 or 119 Puts will serve the purpose. Or if you are nimble you can simply step aside and buy back cheaper when the dollar rally has run its course.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.