This Past Week in Gold

GLD – on sell signal.

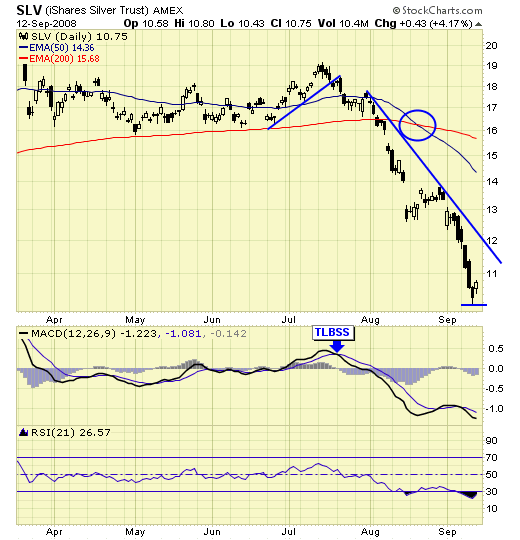

SLV – on sell signal.

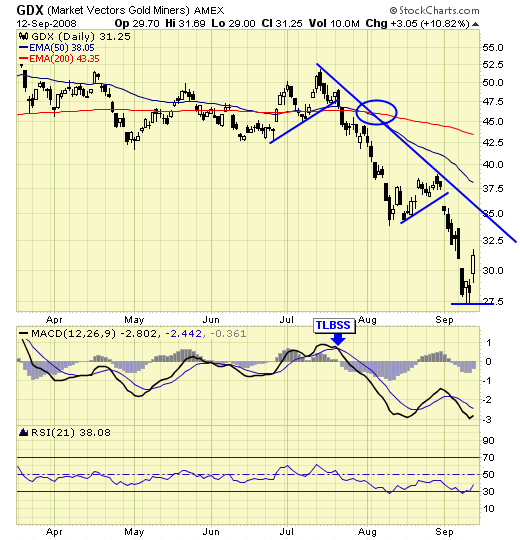

GDX – on sell signal.

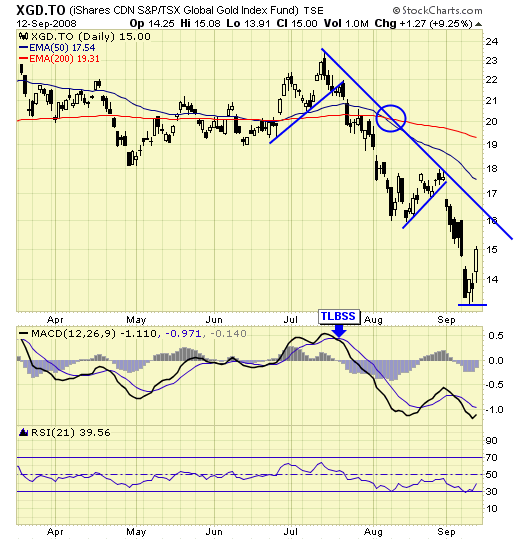

XGD.TO – on sell signal.

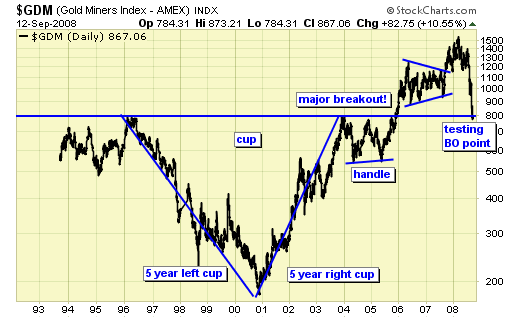

From a long term perspective, this week’s price action was very constructive as prices tested the breakout point which occurred in Dec 05, and closed the week above it. This 800 level on the $GDM also represents a 50% retracement of the entire bull market.

Summary

All four ETFs remain on sell signals, but if Friday’s price action is an early indication, we should see fresh buy signals in the sector in the next few days.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

End of update