4 Big Reasons Why Short-Term Muni Bonds Should Excite You

Municipal bonds might not be the first thing that comes to mind when you think of a sexy investment. They don’t typically command news headlines like the stock market or bitcoin.

That doesn’t mean investors should disregard short-term munis. In fact, munis play a very important role in any serious portfolio. Below are four big reasons why you should get excited about muni bonds.

-

Tax-free income!

As you might already know, muni bonds are debt instruments used primarily to finance state and local infrastructure projects. When policymakers introduced them in 1913, they wanted to make sure investors were amply incentivized to participate. To that end, the decision was made to reward muni investors with tax-free income at the federal level and, in many cases, at the state and local levels.

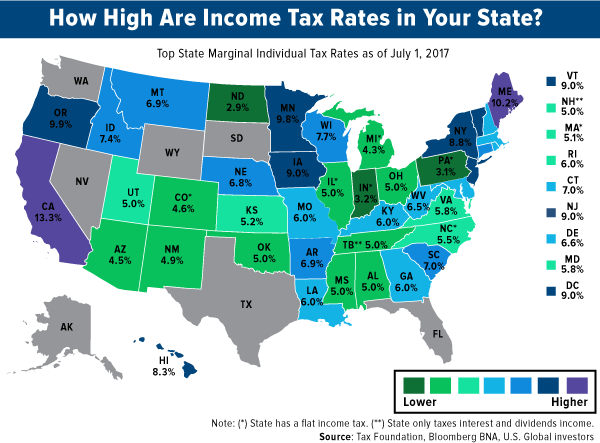

For residents of high-tax states such as California, New York, Oregon and others, this feature should be especially appealing.

Even if you don’t live in one of those states, munis can help you preserve—and therefore compound—more of what you earn. Who doesn’t like getting something for nothing?

-

New tax law has actually boosted demand for munis.

But wait! Doesn’t the recently signed tax overhaul tarnish munis’ allure? Not so fast.

The new law, which went into effect January 1, caps the state and local deductions taxpayers can take at $10,000. That makes municipal bonds even more valuable as a portfolio diversifier, particularly for households with hefty tax bills.

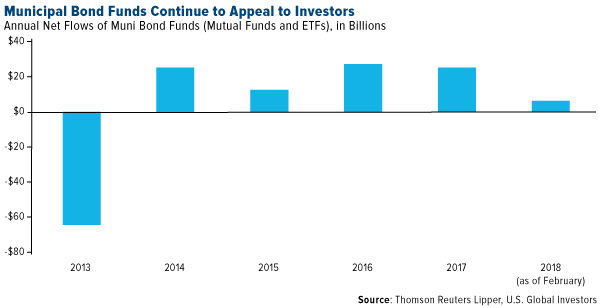

Healthy inflows so far this year suggest demand for munis remains strong. For the week ended February 21, muni bond funds, including mutual funds and ETFs, took in $347 million of net new money, raising overall net inflows for 2018 to $6.8 billion.

It’s still early in the year, but this puts the muni market on track for the fifth straight year of positive flows since 2013. That year, outflows totaled a record $64.2 billion on rising Treasury yields and the looming bankruptcy proceedings of Detroit and Puerto Rico.

-

Calm in times of rising interest rates.

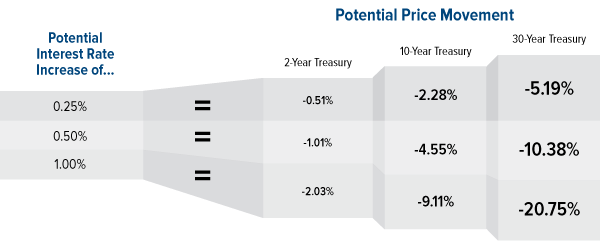

You might think longer is always better, but in the case of munis, it pays to be short. That’s because short-term munis—those with a duration of around one or two years—are less sensitive to interest rate stimulation than longer-term instruments. (Bond prices fall when rates go up, and vice versa.)

That’s especially relevant now, as we’re in a new rate hike cycle, with at least three increases projected for 2018. Although new Federal Reserve Chair Jerome Powell is not expected to differ much from his predecessor Janet Yellen with regard to monetary policy, no one knows for sure what steps he’ll take if inflation rises too quickly or the U.S. economy begins to overheat.

Below, you can see what might happen to Treasury yields with each successive rate hike. Note that the longer the maturity, the more wildly it changes. Munis could be similarly affected.

-

Calm in times of market turmoil.

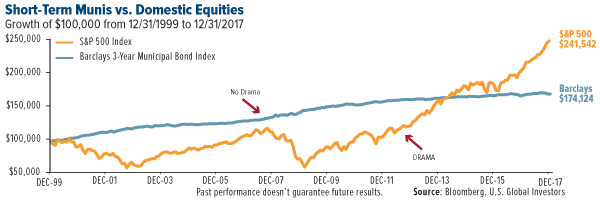

Municipal bonds have been steady growers not just in times of rising interest rates but also during market downturns. In the past 20 years, the stock market has undergone two massive declines, and in both cases, short-term, investment-grade munis—those carrying an A rating or higher—helped investors stanch the losses.

Case in point: In 2008, the S&P 500 Index fell nearly 40 percent, its worst annual performance since 1931. That same year, the Barclays Capital 3-Year Municipal Bond Index gained 5.5 percent.

More recently, munis outperformed the market in 2015 and were the best performing fixed-income asset, beating Treasuries and corporate bonds.

Still not convinced?

Imagine that in 1999 you invested $100,000 in an S&P 500 fund and the same amount in a short-term muni fund. Because of the tech bubble rout, it would have taken your equity position 14 years to finally catch up with your debt position.

The S&P 500 is now further along than munis, based on that initial investment back in 1999, but if another significant correction were to happen, investors might be reassured to know that part of their portfolio was in short-term, high-quality municipal debt.

So again, although municipal bonds might not get the same amount of attention as stocks, cryptocurrencies and other hot assets, they nevertheless can play an indispensable role in a well-structured portfolio. When allocated appropriately, they can help you keep more of what you earn in your pocket, and really there’s nothing sexier than that.

Click here to explore investment opportunities in municipal bonds!

*********

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The Barclays Capital 3-Year Municipal Bond Index is a total return benchmark designed for short-term municipal assets. The index includes bonds with a minimum credit rating BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 2 to 4 years.

Diversification does not protect an investor from market risks and does not assure a profit.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of