This Oil Rally Could Have Much Further To Go

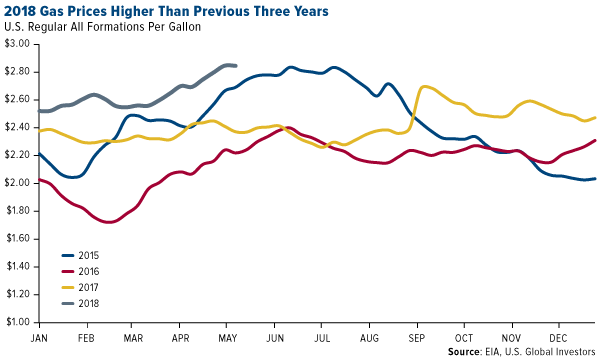

For more than a week now, West Texas Intermediate (WTI) crude oil has been trading north of $70 per barrel, a level we haven’t seen since November 2014. Gas prices are likewise trending up, as I’m sure you’ve noticed. According to the American Automobile Association (AAA), the average cost for a gallon of regular gas was $2.88 on May 15, up nearly 25 percent from a year ago.

This will inevitably push inflation up even higher. In April, consumer prices advanced 2.4 percent year-over-year, their fastest pace since February 2017.

Energy the Best Performing Sector for the Three-Month Period

The good news is that energy stocks are also recovering. The S&P 500 Energy Index, which tracks heavy hitters such as Chevron, Exxon Mobil, Marathon Petroleum and more, is up almost 7 percent year-to-date, and 46 percent since its low in January 2016. As of May 15, energy was the top-performing sector for the three-month period, returning 14.5 percent.

Those returns could grow even more, if Bank of America Merrill Lynch’s latest forecast proves accurate. Analysts there believe the price of oil could climb back up to the $100 range as early as next year, which would add another $1 to the cost of a gallon of gas.

Speaking to CNBC this week, famed energy analyst Dan Yergin, winner of the Pulitzer Prize, said that Brent crude, the international oil benchmark, could reach $85 a barrel by July. This would serve as a “big stimulus” for U.S. drilling activity, he noted. I would add energy share prices to that assessment.

U.S. gas prices peaked at $4.11 a gallon in July 2008, according to AAA, and if you’re like me, you’re probably in denial that we might have to start paying that again at the pump. We’re not quite there yet, but it might be time to get your portfolio ready by adding to your energy exposure.

Venezuela Oil Output Deteriorates Further Ahead Of Sunday’s Presidential Election

So what’s driving the current rally?

Besides greater global demand—supported by a healthy, expanding economy—two things in particular are keeping prices buoyant right now. Number one, President Donald Trump’s decision to pull the U.S. out of the Iran nuclear deal has the potential to curb exports out of the Middle Eastern country, by as little as 200,000 barrels per day (bpd) or as much as 1 million bpd, depending on your source. Iran is responsible for about 4 percent of the world’s supply, so the impact is not insignificant.

Global oil supply is also being squeezed right now by worsening economic conditions in Venezuela. A member of the Organization of the Petroleum Exporting Countries (OPEC), Venezuela sits atop the world’s largest proven oil reserves—and yet its monthly output has been declining rapidly for more than two years. In January, the most recent month of data available, the South American country pumped only 1.67 million bpd. The International Energy Agency (IEA) estimates output fell an additional 60,000 bpd in February. That’s a 31-year low with the exception of a brief period between December 2002 and February 2003 when oil workers went on strike, sending global prices soaring.

Venezuela’s crumbling economy will be top of mind this Sunday as its citizens go to the polls for the first time since socialist President Nicolas Maduro took power in 2013. Although hyperinflation has made the bolivar more worthless than tissue paper, and food and medicine shortages are an everyday thing now, it’s hard to imagine Maduro not walking away with a second term.

Venezuela is one of the most corrupt nations in the world, and the U.S. plans to hit back with steep oil sanctions following Sunday’s election. The beleaguered country is the third-largest supplier of crude to the U.S., following Canada and Saudi Arabia. Such sanctions would be a crippling blow not only to its oil industry but also the government’s already-fragile budget.

As unfortunate as this is, it nonetheless presents an opportunity to energy and oil investors, with additional upside potential as the country’s oil supply tightens even further.

Watch this brief video on opportunities in energy and natural resources by clicking here!

The S&P 500 Energy Index comprises those companies included in the S&P 500 that are classified as members of the GICS energy sector.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2018: Exxon Mobil Corp., Chevron Corp., Marathon Petroleum Corp.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

*********

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of