We Were Wrong on Gold

In the past few weeks, my analysis on the gold sector has turned from bearish to bullish. But I also realized that I could be early, or wrong. Like Carl Swenlin always says, technical analysis is a windsock, not a crystal ball.

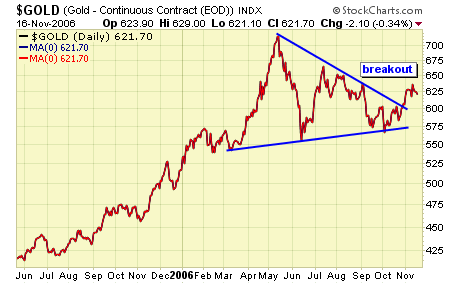

I wasn't the only analyst to spot the major breakout in gold. But a breakout is a breakout, until it breaks down. The gold chart still looks bullish, although a retracement back to $600 is likely before the rally resumes.

As most gold traders know, gold stocks often lead bullion on the way up, and on the way down. Bullion only fell $2 today, but the $HUI plunged 4%. We have a sell signal today on the $HUI, officially ending the buy signal of 10/13.

US traders bought GDX at $35.43, and got stopped out today at $37.74, for a profit of 6.5%. Stand aside for now.

Canadian traders bought XGD at $70.29, and got stopped out today at $75.80, for a profit of 7.8%. Stand aside for now.

Summary

Yes, we may be wrong on our analysis about the potential of the gold breakout, and the potential of this rally. In fact, this could be just a big fakeout before gold plunges to oblivion. ( I enjoy getting the gold bugs all worked up) Anyone who has traded the gold sector more than a few years knows how volatile this market is, and things can change on a dime. Perma gold bulls can simply sit thru all the corrections without blinking an eye. After all, if they survived the twenty year bear market, what is the big deal of a few corrections? For us mortals, capital preservation is priority, and by staying disciplined to our signals and set ups, we can be wrong but we are never wrong for long. And sometimes, we even get rewarded for our mistakes. I am now 100% cash and wait for the next set up, either long or short. If you need help with entries and exits in the gold market, consult a market professional.

********