Simple Profits on the GLD

Note: I'm no longer affiliated with www.traderscorporation.com

Keeping it simple is easier said than done. But over the years, I've learned to achieve simplicity by necessity. Managing a portfolio of stocks is almost a full time job, and unless you are a good stock picker, your overall return on stocks may very well under perform the ETFs and funds.

One of the best trading vehicles right now is the GLD. It is very liquid, excellent daily volume, and simple to execute. There is a lot of new attention in the past few months with gold reaching over $700, and this attracts many newcomers, thus providing more trading opportunity due to increased volatility.

Our trading model gave us a buy signal in March, which resulted in a 24% return. Then the sell signal in May prompted us to short GLD with a 13% return. Today (6/29) we had a buy signal and we are long again at $59.52, risking under 3% if support fails and we need to exit.

Therefore, we have made 37% profit in six months which is excellent in our books. What I like about GLD is that it has been providing us very decisive entries and exits, and the fact that the chart is very clean and price swings are very orderly. These are near perfect trading conditions, seldom found in individual stocks.

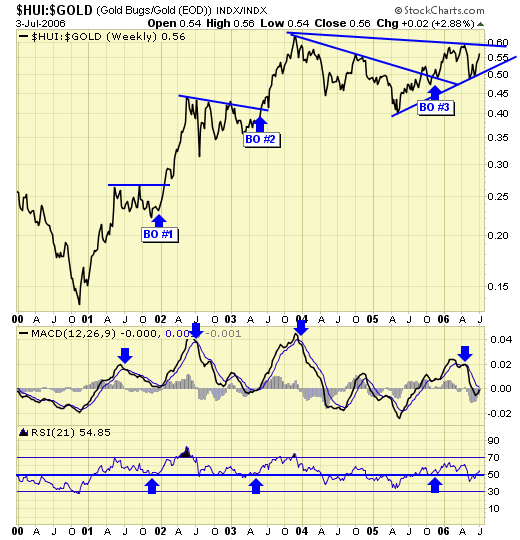

The reason I favor GLD over GDX or gold funds at the moment is what our "breakout model" is indicating. Active traders in the gold sector are familiar with the $HUI:GOLD ratio, but very few look at this ratio from a longer time frame. This breakout model has been very effective in identifying the major breakouts of this bull market, because a major move will not occur until a breakout occurs. Those who have been with us since 2001 recall the huge rally we had in early 2002, then another in 2003, and the most recent from Nov 2005. However, the breakout in Nov 2005 did not lead to a new high in the ratio, and since has pulled back. Therefore, we are now winding up for another possible breakout, or breakdown. But until we have a clear break one way or another, it is best to trade those which near perfect set ups, and currently, GLD fits the bill.

In the event of a breakout, then ETFs such as XGD.TO and GDX would be a better choice because they will outperform GLD. Conversely, if we have a breakdown, shorting the ETFs would be more profitable than shorting the GLD.

Summary

One of the great benefits being in the advisory business is the opportunity to communicate with thousands of traders/investors every year. Unfortunately, many market participants focus on the wrong "W", thus lead to poor returns and in many cases, losses. The three "W"s are when, what, and why.

In sector timing, we are concerned first with "when". Precise entry and exit to the markets with manageable risk.

Then we pay attention to "what", by picking the best set up among the ETFs and funds.

As to "why", we don't really care.

********