The One Thing That Will Stop Gold's Bleeding

Summary

-

Geopolitical tensions are high, yet gold still isn't responding to it.

-

A rising crude oil price isn't helping, either.

-

A reversal of equity market weakness will serve as a gold rally catalyst.

For the last four sessions, the price of gold has fallen and closed at new lows for the year. We’ve talked all week about how gold can’t seem to get a foothold despite having several prospective “hooks” for attracting safe haven demand among investors. In today’s commentary, we’ll look at the one thing that will most likely inspire new bids for gold in the coming weeks. We’ll also examine the current internal status of the actively traded gold mining stocks, which mostly remain under selling pressure.

The latest graph of the iShares Gold Trust (IAU) tells the story for gold. It’s a tale of an asset which has been completely ignored by investors despite possessing every reason for gaining their notice. Geopolitical and economic concerns ranging from the U.S.-China trade war to rising fuel costs and Iran sanctions have converged to create the perfect opportunity for investors to re-evaluate the safety benefits of gold. Yet so far none of these growing concerns are having an impact on the gold price. Indeed, gold has instead accelerated its decline as the list of worries has increased in the last two weeks.

Source: BigCharts

Even a highly publicized rally of the crude oil price has failed to reverse gold’s slide. The August oil futures price has risen to new highs for the year in complete contrast to gold’s recent performance. This is all the more unusual given that oil rallies have often produced gold rallies in the past due to gold’s extreme sensitivity to this commodity. Fund managers historically have viewed oil as an inflation proxy, and when they see the oil price rally they often look to other inflation-sensitive commodities like gold as profitable speculative trades by extension.

Source: BigCharts

Source: BigCharts

The biggest obstacle standing in the way of gold reversing its decline is of course the rising trend in the U.S. dollar index (DXY). Although the dollar was virtually unchanged on Thursday, it has hit new highs for the year this week and is putting serious pressure against gold due to the metal’s currency component. A reversal of the dollar’s upward trend is the most basic requirement which would allow gold to begin reversing its decline.

Source: BigCharts

What would be the most likely catalyst for a dollar index reversal and a gold rally in the coming weeks? The most obvious scenario would be the cessation (temporarily at least) of the trade war fears which have greatly contributed to selling pressure in the global equity markets. As I explained in a recent commentary, increasing fear among equity investors doesn’t always translate into an immediate flight-to-safety response into gold.

Rather, it’s when those fears have lifted that investors usually turn to gold. The reason is because of the all-too-human tendency to overreact and raise cash during a market panic. But once the stock market weakness (and dollar strength) has lifted, investors are able to make a more reasoned assessment of how much protection they need in their portfolios against geopolitical risk. Hence the historical tendency among investors to make after-the-fact purchases of gold.

On the gold mining stock front, the NYSE Arca Gold Bugs Index (HUI) reflects the recent increase in selling pressure among the actively traded mining shares. This is a direct consequence of the recent plunges of the gold and silver prices. Despite holding up fairly well against the selling pressure which has plagued gold bullion for the last two weeks, HUI has finally succumbed to that downward pressure and is threatening to break its pivotal intermediate-term low, which was established in March.

What would be the most likely catalyst for a dollar index reversal and a gold rally in the coming weeks? The most obvious scenario would be the cessation (temporarily at least) of the trade war fears which have greatly contributed to selling pressure in the global equity markets. As I explained in a recent commentary, increasing fear among equity investors doesn’t always translate into an immediate flight-to-safety response into gold.

On the gold mining stock front, the NYSE Arca Gold Bugs Index (HUI) reflects the recent increase in selling pressure among the actively traded mining shares. This is a direct consequence of the recent plunges of the gold and silver prices. Despite holding up fairly well against the selling pressure which has plagued gold bullion for the last two weeks, HUI has finally succumbed to that downward pressure and is threatening to break its pivotal intermediate-term low, which was established in March.

Source: BigCharts

It’s not helping the near-term cause of the gold stocks that internal momentum for the mining stock industry is in decline. Shown below is the daily progression of the cumulative 10-week new highs and lows for the 50 most actively traded gold stocks. This shows us the incremental demand for gold stocks better than perhaps any other indicator. For that reason, until this indicator has reversed its decline investors should generally steer clear of initiating new long positions among the gold mining shares.

Source: WSJ

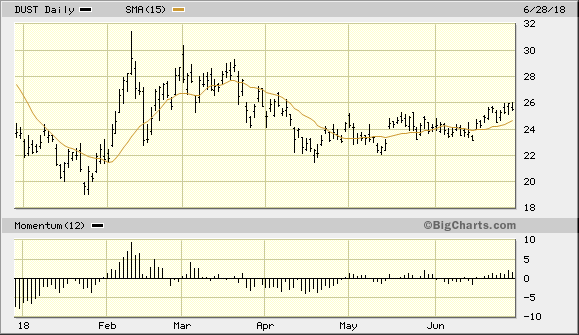

Another way of looking at the weakness among the gold mining stocks is through the lens of an inverse exchange-traded fund. Shown below is the daily graph of the Direxion Daily Gold Miners Index Bear 3X Shares (DUST). This ETF trades inversely to the XAU index; that is, when the gold mining stocks as a group rises, DUST declines and vice-versa. As can be seen here, DUST has been on a steadily rising upward slope since double-bottoming above the $22.00 level in April and May.

Source: BigCharts

Although DUST has been slowly gathering strength to launch an assault on its major intermediate-term top from February, the buyers of this ETF haven’t consolidated enough control yet to warrant a declaration of an intermediate-term bull market in DUST. If the DUST price can close decisively above the $26.00 level shown in the above graph, however, the ETF will be well on its way to recovering all its losses since its February peak.

On a strategic note, I recommend that investors continue to avoid new commitments to the iShares Gold Trust (IAU), my gold proxy and preferred gold trading vehicle, until a bottom is technically confirmed. We’ll let the market tell us when the selling pressure has abated enough to warrant initiating new long positions in gold and the gold mining stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

********