Gold and Silver A Buy?

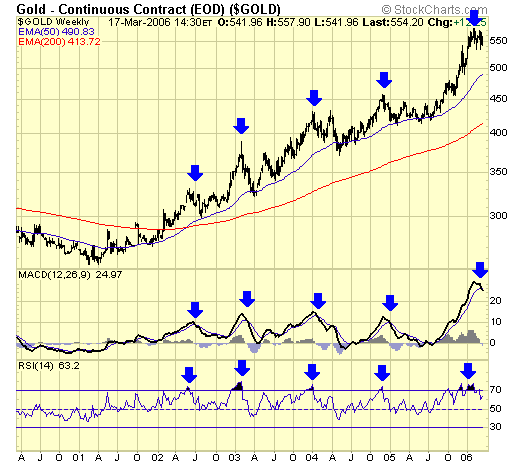

With silver breaking to new highs, a lot of excitement is generated. Precious metals and related stocks are once again in the spot light, with many bullish analysis supporting a continued move higher. If you are a long term investor and truly committed, just close your eyes and buy. Because as you can see from the chart below, all those before you who had a terrible sense of timing and ended up buying at the exact tops in the past four years, are now profitable. Therefore, unless we are staring at THE top right now, chances are good that gold prices will eventually be higher, much higher. However, suffering a drawdown is never fun, those with buyer's remorse will very unlikely to be able to hold when their investments are down double digits, thus, people do lose money in a bull market. So, to be different, lets first look at when we should not buy.

As a market timer, my job is to spot those buying opportunities, when a correction or pullback has completed. Technical analysis is not as complex as what most people think. In fact, it could be quite simple. To buy the dips of a bull market, you simply wait when the market is oversold, or at the minimum, when the market is no longer overbought. Have a look again at the chart above, do we have to be an expert to know that now is not the time to buy? But if you must, be mentally prepared that a pullback to the 50ema support translates into a 10% drawdown, and a full correction to the 200ema support could set you back 25 to 30%. And, what is the chance that this is THE top? Well, I don't know anyone who bought gold at $800 twenty six years ago and still holding, but I do know quite a few who bought Nortel at $80 in 2000 and are still holding…..not a pleasant topic.

How about silver? Silver is making a lot of noise now, but if you look at it objectively, the time to buy is after a correction, not before. Do I know a correction is coming? Yes. Do I know when? No. Unless you are a short seller, it matters not when the correction comes, it matters when the correction is over.

Technical analysis is not difficult at all, providing that we do not overlook the obvious. What is so obvious about the chart above? Silver has only been overbought twice: once in early 2004, and NOW. Both came off a parabolic rise of just over 60%, and as with all corrections in bull markets, the drop was breath taking, hard and fast.

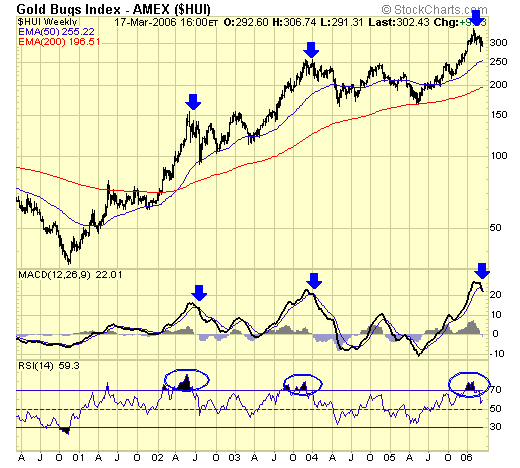

How about metal stocks? From a weekly chart perspective, metal stocks have been this overbought only twice, and both times they led the metals down for a significant correction, not just in price, but in time as well. This is what we call a "corrective phase" of a bull market, and our leading indicator has identified this "CP" back in February. Some suggest that this time is different, the metals will lead stocks higher. Perhaps, but not so far.

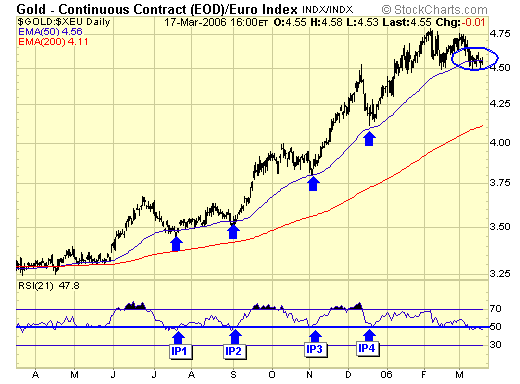

In December, after gold fell $50, I issued a buy signal for all foreign investors, and it was very timely indeed. It was a fourth such signal according to our trading model. But some of our European subscribers are asking why we did not issue another buy signal in February when price appeared to have found support at the 50 ema again. This, we intend to keep as secret.

Canadian gold buyers were also alerted in December, and now gold is a hold, not another buy.

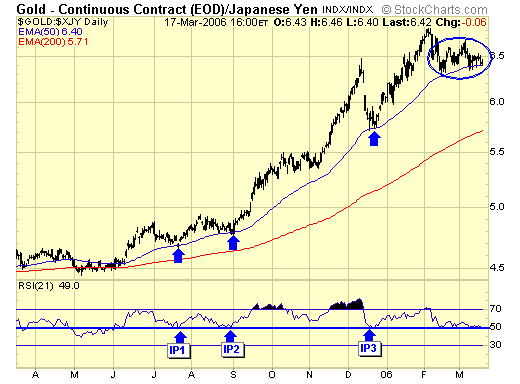

Japanese buyers also had excellent buying opportunities in 2005, but now must also hold and not buy again until the risk is acceptable.

Summary

It is never a popular thing to do when writing about corrections in the gold sector, especially when most analysts are looking up, not down. Going against consensus is not the best way to attract new subscribers, but then again, it is my obligation to show what I see in all honesty, whether I am correct or not. The market always has the final say.