Here’s How Hungary Reduced Risk Without Forfeiting Returns

Hungary isn’t known today as one of the world’s top gold producing countries. There was a time, though, when it accounted for around three quarters of Europe’s entire output of the yellow metal, if you can believe it. According to historian Peter Sugar’s A History of Hungary, the central European country was a “veritable El Dorado” in the 14th century, and its gold pieces circulated widely across the entire continent, competing with those minted in Italy and England.

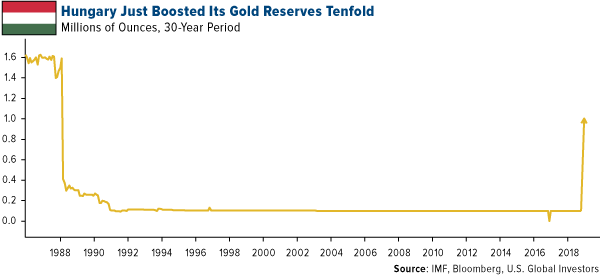

It was this rich mining heritage that Hungary’s central bank evoked when it announced last week its decision to increase gold holdings tenfold, from 3.1 metric tons to 31.5 tons, taking gold’s share of total reserves to 4.4 percent. (Gold accounts for 73.5 percent of U.S. reserves, by comparison, the most of any country.) Hungarian central bank governor Gyorgy Matolcsy described the move as one of “economic and national strategic importance,” adding that the extra gold made the country’s reserves “safer” and “reduced risk.” This is the first time since 1986 that Hungary has increased its gold holdings.

The country isn’t alone in its mission to diversify. This month we also learned that Poland became the first European Union (EU) member to increase its gold reserves in two decades. The Eastern European country added as much as 9 metric tons of hard assets between July and August of this year. Central banks in Russia, Turkey and Kazakhstan have also kept up their gold buying, representing close to 90 percent of the activity we’ve seen this year.

Meanwhile, the EU has continued to print paper money.

For more, watch emerging Europe analyst Joanna Sawicka’s full explanation by clicking here.

A Good Store of Value

So why should banks—or investors, for that matter—be interested in boosting their gold holdings? One reason is timing. Until recently, gold prices have been relatively affordable, trading at 52-week lows of around $1,180 an ounce in mid-August and at the end of September. Central banks’ investment was wisely made. From those lows, gold is now up more than 4 percent on stock volatility.

Check out the chart below. I think it’s fascinating to see the relationship between dramatic moves in the stock market and people’s interest in gold. When stocks sold off a couple of weeks ago, Google searches for “gold price” jumped to their highest in at least a month. This shows, I believe, that people recognize gold as a good store of value when market volatility reemerges.

Gold Has Helped Improve a Portfolio’s Risk-Adjusted Returns

Returning to what Hungarian central bank governor Matolcsy said about risk reduction, a certain amount of gold has been shown to improve a portfolio’s Sharpe ratio, according to the World Gold Council’s (WGC) most recent Gold Investor. The Sharpe ratio, in case you’re unaware, measures a portfolio’s risk-adjusted returns relative to its peers, based on standard deviation. The higher the ratio is over its peers, the better the risk-adjusted returns.

Analysts at New Frontier Advisors found that an institutional portfolio with a 6 percent weighting in gold had a higher Sharpe ratio than one without any gold exposure. This means that volatility was reduced without hurting returns.

Although analysts were looking at Chinese portfolios in particular, the WGC’s Fred Yang believes these findings can just as easily be applied to portfolios that are invested in U.S.-, European- or U.K.-listed assets. The “research indicates,” Yang says, “that most well-balanced portfolios would benefit from a modest allocation to gold.”

I’ve often advocated for a 10 percent Golden Rule—with 5 percent in bullion, the other 5 percent in gold stocks—and so New Frontier’s research is illuminating. It also helps explain Hungary and Poland’s actions, as well as those of other net purchasers of gold.

Holding Firm Against Rising Treasury Yields

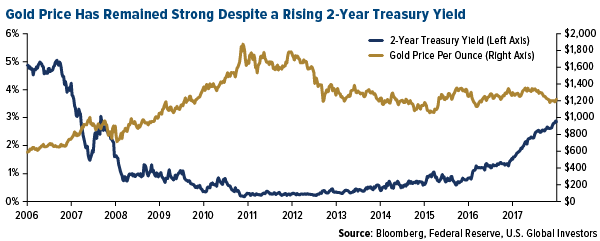

I’ve shown many times in the past that the price of gold is inversely related with real rates. The yellow metal has especially struggled when Treasury yields have outpaced inflation.

The two-year Treasury yield, for instance, is just under 3 percent today, a more-than-10-year high. Because consumer prices are rising at 2.3 percent year-over-year, according to the latest report from the Labor Department, the two-year has a positive real yield—and this has historically weighed on gold.

You would think, then, that its price would be much lower than it is. I’m impressed with how well it’s held up.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Diversification does not protect an investor from market risks and does not assure a profit.

Get more of my thoughts on gold’s performance by watching the latest Frank Talk Live! View it by clicking here!

*********

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of