China Continues To Grow Its Gold Reserves

Strengths

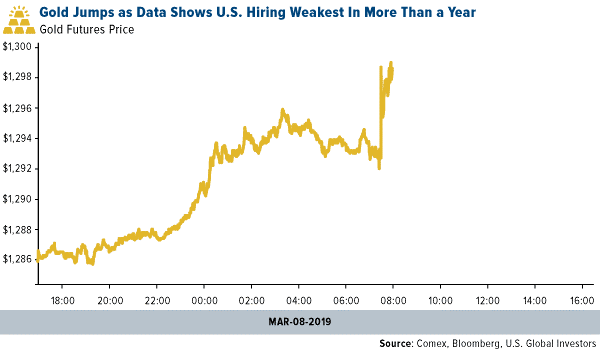

- The best performing metal this week was silver, up 0.87 percent and rallying strong on Friday alongside gold. Gold traders were again split this week on their outlook for gold as U.S.-China trade talks remain in the headlines. The yellow metal advanced the most in two weeks on Friday morning as investors awaited the release of the February jobs report for clues on the health of the economy, according to Bloomberg data. The jobs report showed that hiring slowed in February, with the economy only adding 20,000 jobs.

- China grew its gold reserves for the third straight month to 60.26 million ounces, up from 59.94 million ounces in January, according to data on the People’s Bank of China website. Robin Bhar, head of metals research at Societe Generale SA said: “Ongoing efforts to diversify total reserves – away from the U. S. dollar – have prompted gold purchases by the PBOC, which we believe will continue.” Physical gold demand also picked up in major Asian hubs this week, as bullion was sold at a premium for the first time in more than three months in India, the world’s second largest consumer, according to Reuters.

- Rhodium, palladium’s lesser known sister, rose to a nine-year high this week. Demand for all platinum-group metals mostly comes from autocatalysts used in gasoline cars, which are benefiting as the world steers away from diesel vehicles. Bloomberg writes that palladium has jumped 20 percent so far this year while rhodium is up 19 percent. Australian gold output hit an all-time high in 2018, according to mining consultant Surbiton Associates. The second biggest gold producing nation mined 317 tons of the yellow metal, worth around A$17.3 billion.

Weaknesses

· The worst performing metal this week was platinum, down 4.81 percent as a forecast for wider surplus added to the price erosion. Gold fell to its lowest since January early this week as investors weighted the prospects of a U.S.-China trade deal that could lift tariffs and lessen the appeal of safe haven assets. The Perth Mint reported that gold coin and minted bar sales dropped to an eight-month low in February. Sales fell to 19,524 ounces, down from 31,189 ounces in January. BullionVault’s gold index, that measures the balance of gold buyers against sellers, fell to 52.2 in February, down slightly from the 52.6 reading in January.

· Commodity ETFs saw outflows for the fifth straight week, with investors pulling out $904 million in the week ended March 7, compared with $410 million in the previous period. The VanEck Vectors Junior Gold Miners fund saw outflows of $142.5 million on one day, reducing the fund’s assets by 3.4 percent. ETFs cut 355,901 troy ounces of gold from their holdings and brought this year’s net purchases to 942,406, according to data compiled by Bloomberg.

· De Beers, a major diamond seller, is having the worst start to a year since 2016, selling just $990 million of diamonds in January and February. Bloomberg writes that sales are usually the biggest at the start of the year. The World Platinum Investment Council said in its quarterly report that the platinum surplus will persist for a third year as stronger demand is offset by increasing global supply of the metal. The expected surplus this year is 680,000 ounces, up from 645,000 ounces in 2018.

Opportunities

· RBC says that gold’s recent sell-off “is a buying opportunity for those looking to make medium- to longer-term gold allocations.” The group continues by saying that the gold price risk is skewed to the upside in 2019 and likely in 2020 as well. Goldman Sachs raised its gold and silver forecasts, predicting that late-cycle worries will continue. The bank raised its gold forecasts by $25 an ounce to $1,350, $1,400 and $1,450 an ounce for the three-, six- and 12-month periods. Bank of America forecasts that palladium will extend its rally to $1,800 an ounce by the end of this year and could even go to $2,000.

· According to Ned Naylor-Leyland, manager of the $330 million Merian Gold & Silver Fund, gold’s rally is just the beginning and could take off once investors fully factor in the Fed’s more dovish tone, writes Bloomberg. “I don’t think many investors have probably realized the prime beneficiary of dovish forward guidance is monetary metals,” says Naylor-Leyland. He also says that silver is the best way to drive a return profile in the metals asset class. Economic concerns grew this week on the news that the U.S. trade shortfall grew by more than $100 billion. Bloomberg reports that government revenues, compared with the same month a year earlier, have declined for 10 months in the past year since the Tax Cuts and Jobs Act took effect in January 2018. The Trump administration had promised that the tax cuts would essentially pay for themselves with higher revenue generated by a stronger U.S. economy.

· The government in Zimbabwe is reversing rules that require locals to hold at least a 51 percent stake in platinum mines and will allow foreigners to own a 100 percent stake. This measure is to help stimulate foreign investment. Zimbabwe has the world’s second-largest known reserves of platinum group metals and established deposits of gold, diamonds, lithium and more.

Threats

· Venezuela’s central bank president had been gone for weeks and no one knew where he went. Turns out he was on a tour meeting with officials in ally nations Turkey, China and Russia to discuss financing and banking. The longer the Maduro regime is in power, the longer the potential threat of more selling of gold reserves, which has shown to negatively affect the gold price globally by adding more supply to the market as in the prior week.

· The drama surrounding Barrick Gold Corp’s attempt to woo Newmont Mining Corp continues. Barrick’s biggest shareholder, Joe Foster of the VanEck International Investors Gold Fund, opposes the acquisition and instead is pushing for a joint venture between the two gold mining giants. Additionally, Newmont’s board unanimously rejected Barrick’s $17.8 billion takeover bid, saying that the previously announced takeover of Goldcorp would be better for the company. Barrick CEO Mark Bristow said that they will “definitely not” withdraw the hostile offer for Newmont.

· Sibanye Gold, South Africa’s top gold miner, said this week that the nation’s double-digit electricity price increase could pose a threat to even more jobs as the viability of mines comes into question. South Africa’s power regulator approved a 13.8 percent hike in tariffs by the state-owned utility, which is higher than the 9 percent increased planned on by Sibanye, writes Bloomberg. A spokesman for the company said that “these kinds of increases, well above inflation, pose a risk to the sustainability of the industry and to job creation.” The price of gold would need to increase to keep up mine viability. Sibanye is already considering cutting more than 6,000 jobs amid unprofitable gold shafts.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of