Gold Price Special Update

With things shaping up so well for gold, we can certainly take any short-term correction in our stride, and more than that, we can seize upon it as an opportunity to build positions further across the sector, whether by means of ETFs, stocks or options, and of course, gold itself.

Several factors suggest that a modest short-term correction is likely before the major breakout occurs. Gold is overbought after its recent runup and is rounding over beneath the major resistance approaching $1400, as we can see on its latest 6-month chart below. Thus, the appearance of a short-term bearish “shooting star” candlestick on its chart on Friday coupled with its latest COTs showing Commercial short and Large Spec long positions hitting rather extreme levels suggests that it is likely to react back over the next week or two to allow things to cool for a bit before the major breakout occurs. The current COT structure IS NOT regarded as bearish overall, because we would expect speculators to pile in at the start of a big move – positions can be expected to get much more extreme once the big breakout occurs, flying off the charts and staying high as the 1st major upleg of the new bullmarket unfolds.

Click on chart to popup a larger, clearer version.

Fundamentally, the compelling reasons for a major gold bullmarket are coalescing fast. After putting a sticking plaster on the system for the past 10 years by means of “Quantitative Easing” – stop and think about this term for a minute, someone was obviously charged with the task of “putting lipstick on a pig” by coming up with it, what they really mean is State counterfeiting – if you did what they have been doing in your backyard, printing money, you would risk ending up in jail – they have done it on a much grander scale and are still free to walk the streets – that plaster is now coming off and things are now unravelling fast. The Fed’s attempt to return to relative normality by raising rates and scaling back their bloated balance sheet quickly came off the rails, leaving them as impotent bystanders. They have abandoned ship and we are now staring at the prospect of QE on an even grander scale than hitherto coupled with NIRP (Negative Interest Rate Policy), as the masters of the system move from pillaging the populace by means of interest rates way below the real rate of inflation to outright grand larceny in the form of bail-ins (theft of funds from bank accounts) and negative interest rates. Needless to say, negative interest rates just by themselves are going to make gold look like a very attractive alternative to stashing cash in the bank and getting fleeced, and quite obviously, the trend towards zero and even negative interest rates will remove support for the dollar which will tank, providing a powerful tailwind for gold which has been held in restraint over the past year or so (at least against the dollar) partly by the dollar’s rally on the back of rising rates.

The combination of QE and NIRP are just one factor, albeit a big and important one, that will drive gold higher. There are others, like the fact that Central Banks are buying gold at a record rate. They know that the writing is on the wall for the doomed fiat system and that gold will hold its real value no matter what. That’s why they are stashing gold away as fast as they can. In addition, there is a larger geopolitical reason for bigger more powerful countries like China and Russia to accumulate gold, which is that if they are to push the dollar off its perch as the global reserve currency – a necessary step to take the wind out of the sails of the predatory US Military – Industrial complex, which has a nasty habit of starting wars to achieve its geopolitical objectives – then they are going to have to find alternatives to trading in dollars, and to the SWIFT system etc. and be able if they wish to back their currencies with gold. Their move in this direction is what makes the current situation so dangerous, because the US Neocons are not going to take this lying down, which is why they are trying to a stoke a war with Iran – they reason that they have better odds of tipping the geopolitical scales in their favor if they get a conflict going now than if they leave it until China has become a lot stronger, and the recent incidents involving tankers near to the Persian Gulf are obvious “false flag” events which a compliant media are blaming on Iran. This also explains the trade war with China, which is a blatant attempt to “throw a spanner in the works” of the Chinese economy – they couldn’t care less about their own citizens’ standard of living dropping significantly due to big price increases for a wide range of everyday goods.

According to recent surveys the Military is the one government organization that US citizens still trust and apparently take pride in. This is nice to know considering that they are forking over nearly $1 trillion dollars a year of their hard-earned cash to fund it. Many years ago the Military learned the propaganda value of putting on colorful parades and displays to amuse the masses, but nowadays it goes much further than that; the Military are intimately involved with Hollywood and basically help filmmakers in creating dramatic and often expensive special effects involving hardware and pilots etc. in exchange for being portrayed in a positive light, and this has paid off in spades in terms of their public image. A classic example that always gets top billing at the Dr Goebbels Institute of Propaganda film festival is the blockbuster “Independence Day”. This film is a real treat for students of brainwashing and propaganda and is a marvel of political correctness – the world is saved by the US military, and specifically by the teamwork of an athletic handsome black pilot and a mastermind Jew. The General is an affable tough guy and the President just happens to be a dashing ex-pilot who gets stuck in flying planes – maybe this is where George W Bush got the idea for his "Mission Accomplished" stunt on a carrier after the invasion of Iraq which looked like it was on the high seas but was actually about 1 mile off the coast of San Diego with the cameras all pointing out to sea. This film is very entertaining, as it should be given how much it cost, but it was certainly money well spent from the standpoint of the military.

Another reason why the US wants to attack Iran becomes clear when you understand that China has created a system whereby it can buy oil outside of the US dollar system, by making direct payments in Yuan convertible into gold and this is already a reality because a Yuan denominated crude oil futures contract started trading last year – and where does China get a lot of its oil from? – you guessed it, Iran. This move by China is a serious and direct threat to both the dollar and the Treasury market, especially as China is the world’s biggest oil importer so a lot of oil money is going to go into the Yuan and thence to gold, instead of dollars which will be a massive driver for higher gold prices. So you see, the Neocons have a compelling geopolitical reason for attacking Iran, as they see it, that goes beyond the top priority of pleasing Israel, which is to both punish Iran for trading outside of the dollar system and to shut off its oil supplies to China, enabling them to damage China further. Even rabid warmongers like John Bolton understand that a ground war in Iran is a non-starter, so they will probably settle for bombing it back to the stone age by wrecking its infrastructure and oil terminals and port facilities etc, which is their standard way of dealing with any country that seriously opposes them. It remains to be seen whether China and Russia will stand by and watch if this happens or whether they will mobilize to defend Iran – if they do we will be looking at World War 3, and come to think of it, it’s high time we had another major war – and perhaps after it we won’t have to put up with endless nostalgic ceremonies about the Battle of the Bulge, D-day, Dunkirk, Iwo Jima and Pearl Harbor, Verdun etc, because they will have more recent conflicts to celebrate. If conflict with Iran erupts then it will be difficult if not impossible to ship oil through the Straits of Hormuz, which will cause a cathartic spike in the oil price because a third of the world’s oil passes through these straits – and in the gold price, and the US won’t mind this so much because it is now a big oil producer.

Another factor that will be a big driver for more QE on an epic scale will be political pressure from the Millennial generation in the US. This is the generation that has grown up with an “entitlement mentality”, but unfortunately, after the gross indulgences of the “boomers” and the cynical self-serving ravages of the Neocons and their cronies have left the economy as a debt-wracked house of cards, they are finding that their almost worthless production line college degrees don’t guarantee them much more than a legacy of debt and a career as a burger flipper, and that’s only until the robots take over. So they have given up on the normal aspirations of making a home and working to accumulate capital etc, and instead you see them everywhere playing incessantly with their cellphones and taking cheap flights to places where they can take loads of selfies to impress their virtual friends, in short living as permanent adolescents. When times get a lot tougher they are going to DEMAND that the government takes action and prints a lot more money, and when we combine this with the dollar’s looming crash caused by the loss of its reserve currency status it is easy to see how the economy of the US could end up one day like Venezuela or even Zimbabwe.

Worldwide, fiat is now in serious trouble as its endgame nemesis approaches, with the outlook for the dollar actually being worst of all, because of the magnitude of dollar based debt and its impending loss of reserve currency status. The coming panic and chaos will force a return to fiscal prudence, and that must mean a reset and return to a gold standard. This is another reason that countries that see this coming, like China and Russia, are stashing away gold as fast as they can.

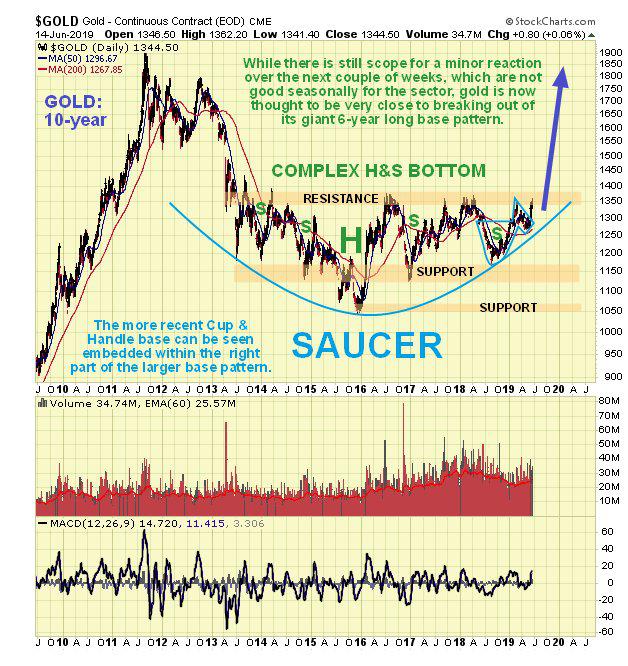

Finally, we will end by reviewing again the increasingly fascinating – and indeed awesome – long-term 10-year chart for gold. This shows that, notwithstanding any minor short-term reaction over the next few weeks, gold is about ready to break out of its gigantic 6-year long base pattern, which has taken the form of a complex Head-and-Shoulders bottom / Saucer, into a bullmarket that is expected to be spectacular and dwarf all previous ones, for the compelling reasons set above.

The expected near-term minor PM sector correction will be the occasion for us to focus on more specific investments across the sector, in ETFs, stocks and some options for those looking to leverage gains.

*********