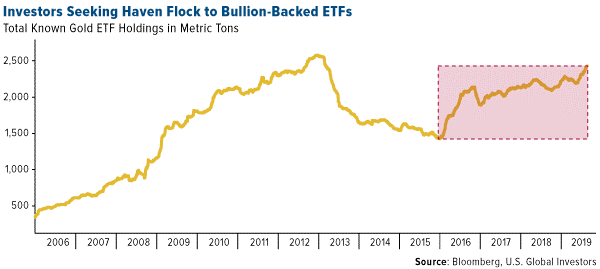

Inflows Into Gold ETFs Hit 1,000 Metric Tons

Strengths

-

The best performing metal this week was silver, up 2.03 percent. Gold came in second place, up 1 percent. Inflows into ETFs backed by gold have hit 1,000 metric tons since holdings bottomed in early 2016. Bloomberg data shows that total known ETF holdings rose to 2,424.9 tons on Wednesday, which is the highest since 2013. Goldman Sachs predicts that the price of the yellow metal will climb to $1,600 an ounce over the next six months.

-

Gold prices were up sharply on Friday morning after China announced retaliatory tariffs on $75 billion in American goods. The escalating trade war creates geopolitical uncertainty, which often translates to greater demand for safe haven assets like gold and bonds. On Thursday, gold saw a small bounce when U.S. PMI data for August declined to 49.9, below the level that separates growth from contraction.

-

Veteran investor and founder of Mobius Capital Partners LLP, Mark Mobius, gave gold a big endorsement on Bloomberg TV this week. Mobius said “I think you have to be buying at any level” and that “gold’s long-term prospect is up, up and up” due to rising money supply. Another believer of the yellow metal? A Sandler Capital Management hedge fund that is known as one of the top performers this year, reports Kitco News. The fund has $2.1 billion in assets and just made gold its top holding by increasing its investment in the SPDR Gold Trust by 180 percent.

Strengths

-

The worst performing metal this week was palladium, which was still up 0.88 percent. Higher gold prices and a bad monsoon season are weighing on the gold demand outlook in India, the world’s second largest consumer, ahead of festival season when buying usually peaks. Bloomberg reports that demand for jewelry grew 9 percent in the January to June period, but high taxes, record prices and slowing economic growth are likely to counteract.

-

Kitco News reports that Wells Fargo is cautioning investors from buying too much gold. According to a note by John LaForge, head of real asset strategy, gold is one of the best assets to own in times of economic uncertainty, but that most investors don’t understand it and could buy too much as prices hover around $1,500. Wells Fargo sees gold ending the year around $1,400 to $1,500 as the economy stabilizes.

-

BN Americas reports that production from the 10 biggest gold miners in Mexico fell in the second quarter due to declining reserves, technical challenges and lower grades. The top 10 miners produced 675,450 ounces of gold in the second quarter, compared to 709,385 ounces in the same period last year.

Opportunities

-

Russian President Vladimir Putin signed a law removing the 20 percent value-added tax (VAT) on investments in gold and other precious metals, reports Kitco News. Russian newspaper Izvestia predicts that demand for precious metals in the next five years could surge 50 tonnes a year – an increase of 15 times current levels. The Russian central bank continues to be a big buyer of bullion, purchasing 300,000 ounces in July.

-

A Texas woman visiting Arkansas’s Crater of Diamond State Park found a 3.72 carat yellow diamond this week. The park reports that this is the largest registered diamond found since March 2017 and the largest yellow diamond found since 2013. The 37-acre park is one of the only places in the world that visitors can search for real diamonds.

-

Dan Oliver, founder of Myrmikan Capital, told The Street in an interview this week that “there’s a lot of pressure into gold, and we’ve just barely begun this cycle.” Oliver noted that once gold broke above $1,350 an ounce, institutional investors began to pay more attention, including Ray Dalio. Oliver added that breaching that level was the first step for gold to climb to $3,000.

Threats

-

Growing trade tensions and global economic uncertainty continue to rile markets. In a speech at Jackson Hole Friday morning, Federal Reserve Chairman Jerome Powell said “the global growth outlook has been deteriorating since the middle of last year. Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States.”

-

A special feature in CNN this week highlighted how “bloody” gold continues to support the troubled Venezuelan government and economy. General Manuel Crisopher Figuera, the former head of Venezuela’s intelligence service, told CNN that “just like the blood diamonds [in Africa], the gold that is being extracted from Venezuela, outside of any protocol, is bloody gold.” The nation has the world’s largest oil reserves and some gold reserves of its own. The feature describes how workers face treacherous conditions to mine gold for the government without regulations or safety concerns. President Maduro has been able to sell some of its gold reserves in recent months that had pushed global prices down.

Georgette Boele, senior FX and precious metals strategist at ABN AMRO, expects silver prices to decline in the near term and further deterioration in global growth and trade, reports FX Street. “If the global economy and global trade slow further (we don’t expect a recession), this will weigh on silver demand and the outlook for silver prices. In addition, we expect profit taking in gold prices and this should also drag silver prices lower.”

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of