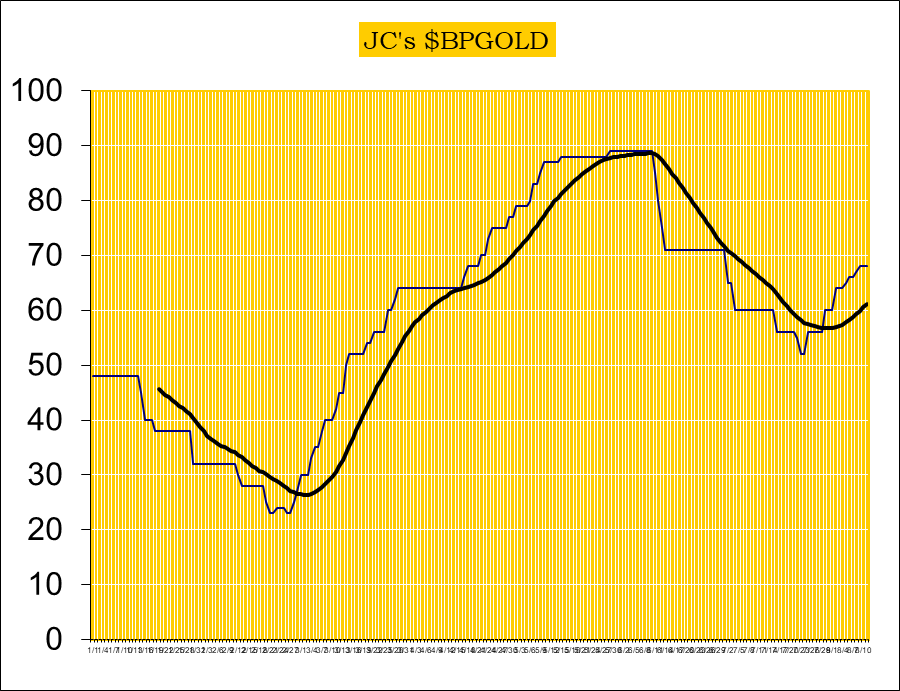

Gold Price Exclusive Update Shows Sector Cycle Has Flattened Out

To public readers of our updates, our cycle indicator is one of the most effective timing tool for traders and investors. It is not perfect, because periodically the market can be more volatile and can result in short term whipsaws. But overall, the cycle indicator provides us with a clear direction how we should be speculating.

Investors

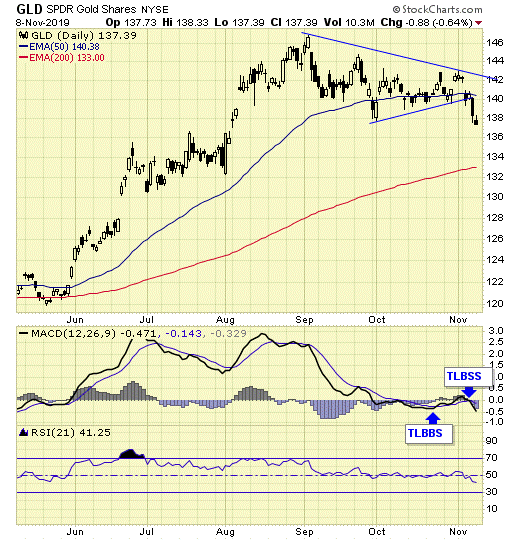

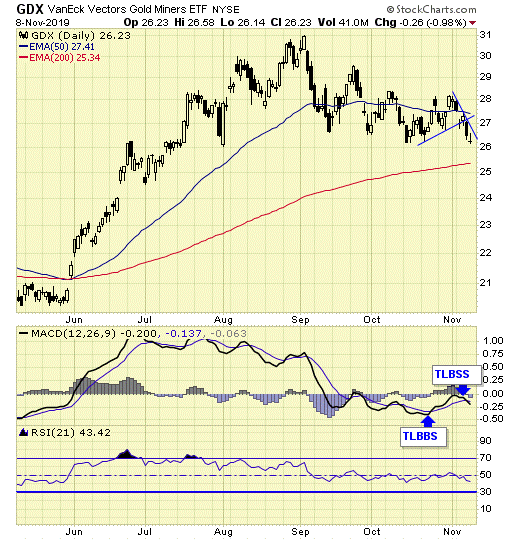

During a major buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200ema.

During a major sell signal, investors should be hedged or in cash.

Traders

Simply cost average in at cycle bottoms when prices are at or near the daily 200ema; and cost average out at cycle tops when prices are above the daily 50ema.

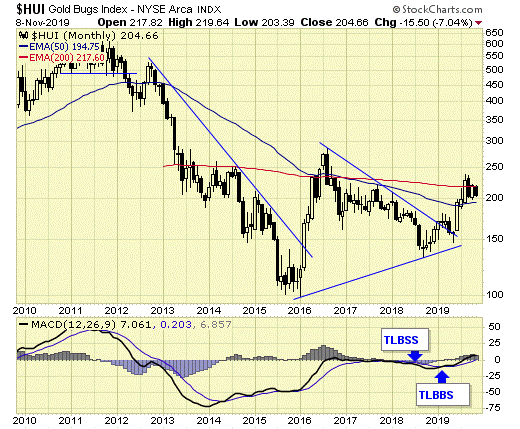

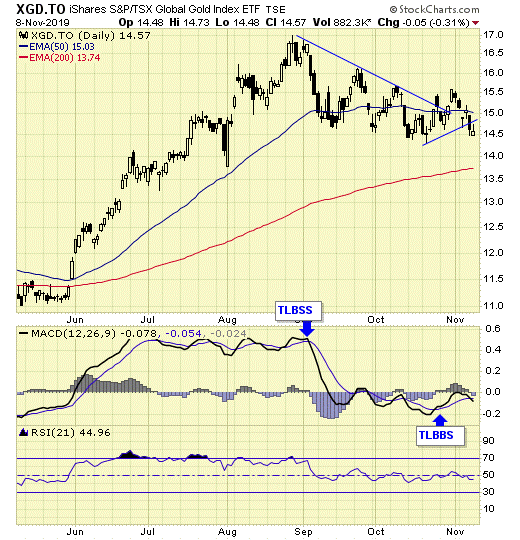

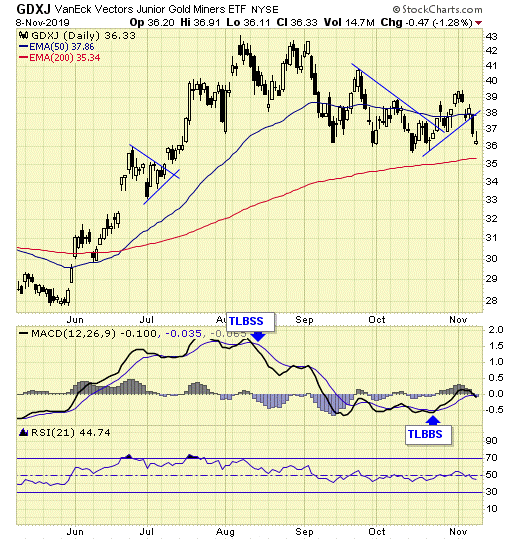

Gold sector is on major buy signal.

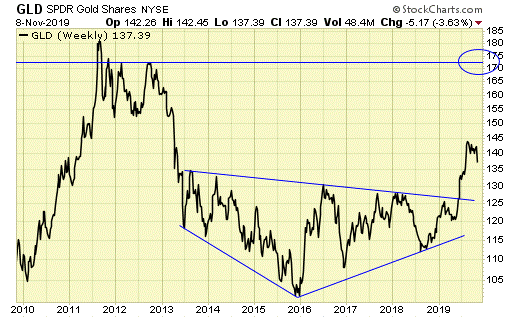

GLD is on short-term sell signal.

GDX is on short-term sell signal.

Analysis

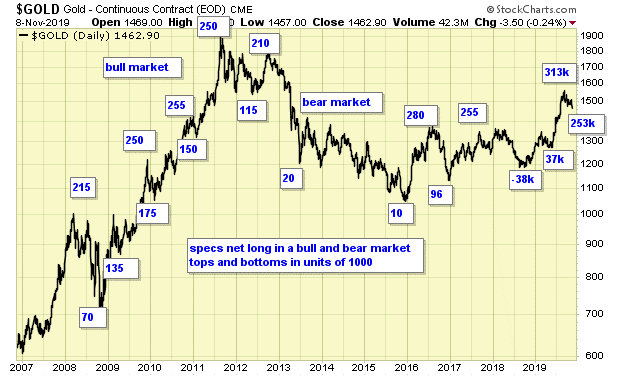

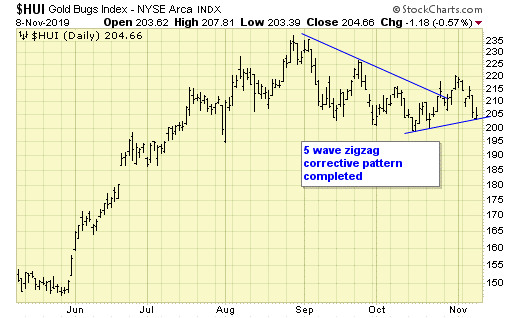

Speculation dropped sharply this week and will show up in next week’s data.

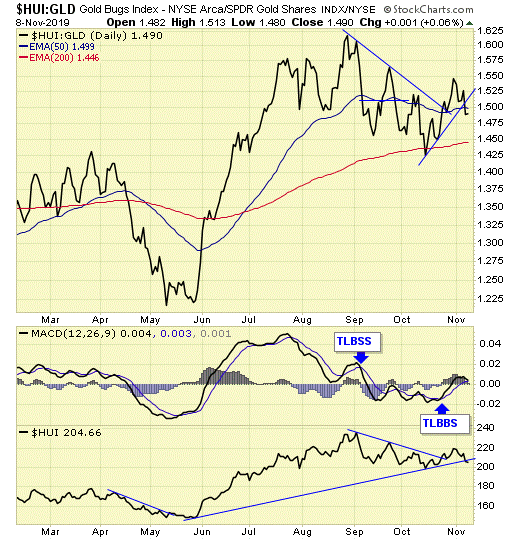

Our ratio between gold and gold stocks in on a text book perfect buy signal.

The breakout remains valid as long as prices hold above the Oct low.

Stay focused on the big picture.

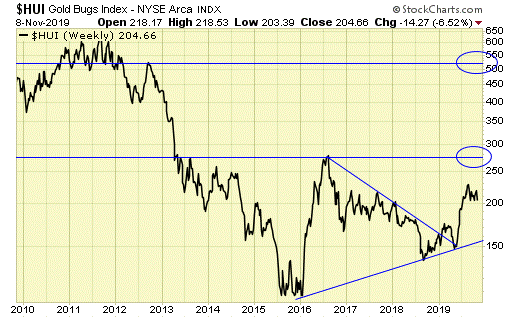

Potential upside of 30% until major resistance on gold stocks as represented by $HUI.

Summary

Long-term – on major buy signal.

Short-term – on mixed signals.

Gold sector cycle is up.

We are holding long term positions.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

We also provide coverage to the major indexes and oil sector.