Gold & Oil Are at the Tipping Point

Gold and oil traders have been on edge for the past few weeks wondering if prices will drop or rally from this correction/pause in prices. You will see in the charts below that gold and oil are at points where they could go either way very quickly. The are currently balancing at key technical points and we will wait for the tipping point.

Gold Analysis

The bullish percent index for gold mining stocks helps point out how bullish the gold sector is. Currently gold stocks look to be strong. This chart shows that we are near a possible wave top and could see lower prices in the near future. The Problem with this indicator is that it can hold these high levels for extended periods of time and gold could just keep moving higher and higher.

So now what? Which way is the gold sector going?

Well Indicators are very helpful for pointing out trends and possible pivot points; I do not believe you can trade with them alone. In my opinion trading the price action of gold and gold stocks is the way to do it. Until we get a bounce or breakout with a low risk setup its best not to do anything.

Gold Stock Trading

Gold stocks are currently trading near support. This week we should see a substantial move higher or lower. Only time will tell.

Gold Price Trading

Gold has been consolidating for about 6 weeks and has formed two patterns. One is a head and shoulder reversal pattern and has broken its neck line already. The other is a simple A-B-C correction which is what I have drawn on the chart.

Why did I only show the A-B-C correction? Both patterns are simple to see so I only high lighted one pattern which puts enough noise on the chart, I am all about keeping it simple.

I am favoring the long side currently for gold. Don't get me wrong I am not bias in my trading, I am more than happy to go short at any time, but for this report I want to stick with the Trend Is Your Friend mentality.

Gold is currently trending up and after rallies we get pauses or consolidations as traders take profits and new traders start to accumulate long positions.

- Gold miners Bullish Percent index is a bullish.

- Simple A-B-C consolidation pattern.

- Gold is currently trading at support from the December wave top.

- Gold is currently trading at the 200 Moving average which can act support.

- Gold stocks are holding more value than the price of gold (bullish for gold).

- Stochastic indicator is bottoming and starting to hook up for positive momentum.

Technically Trading Gold

Trading gold can be a very frustrating experience. I will admit it's been much harder than normal, and the past 6 months with volatility levels through the roof it's difficult for getting low risk setups in both gold and gold stocks.

Knowing when to pull the trigger is the most difficult part of trading and that is why you must have a strategy in place which will minimize your risk per trade and your money is working for you when the odds are on your side. I use a very simple trading model which only generates 10-30 trades per year in gold. I believe you do not need to trade every week to make a living from the markets.

If you would like to receive my free weekly trading reports please visit my website: www.GoldAndOilGuy.com

Crude Oil Traders Be Ready!

Energy traders have been watching this slow rounded bottom reversal forming for months in the energy sector and crude oil prices. I have pointed it out many times and even posted some buy signals for USO and Crude Oil a while back. Oil is now testing a key resistance level and a breakout here could really send oil prices gushing higher towards the $70 per barrel level.

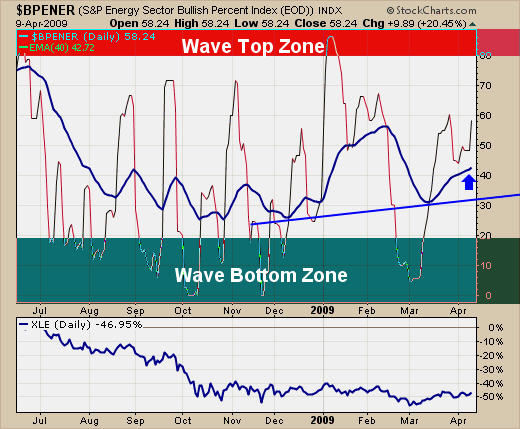

Energy Bullish Percent Index

Energy stocks have been bottoming for about 5 months so most investors should be trading at about the breakeven point here if they have been holding their positions. The BP chart below is showing some bullish momentum as more energy stocks are on point and figure buy signals now. This is a very bullish looking chart.

Crude Oil Traders

Not many times a trader gets to see the amount of volatility we have seen in the recent months with crude oil. It really is an eye opening experience and can provides huge profit potential if one is to focus on trading this commodity.

This multi month cup and handle pattern is very exciting to see. Not only is this one of the most powerful bullish patterns but its in oil which I think is safe to say has almost every trader and investor watching around the world. If we get a breakout here I expect to see prices sky rocket higher toward the $70 level.

Oil Traders Be Ready

Trading oil does carry a lot more risk than a lot of other investment vehicles but the profit potential in oil looks great. We may see prices pause at this key resistance level as a lot of traders will be taking profits and or shorting oil here.

But if oil does breakout, then this could be the trade that sets you for the year. Those of you who went long on my buy signal at the end of February are sitting with a nice profit and praying for a big pop in oil prices.

Those of you who are not long energy yet will have to decide what your risk level is. Entering on a breakout will carry 10-20% downside risk. Or you could wait for a breakout and correction to buy in. As usual I will wait for another low risk setup and provide it to my members when the time is right.

Some funds to trade would be XLE - Energy Stocks Fund, USO - Texas Oil Fund, XEG.TO - Canadian Energy Stocks Fund