COMEX Search And Seizure

These are dark times for The Bullion Banks. Their Fractional Reserve and Digital Derivative Pricing Scheme is in great peril as refineries, miners, and mints all shut down in response to the coronavirus pandemic. Will these Banks be able to scrounge up enough physical metal to keep their scheme afloat through June? That remains an open question.

You may recall that we've been warning of the outrageous volume of COMEX EFPs (Exchange For Physical) for years. For the calendar years 2018 and 2019, the COMEX swapped out over 14,000 metric tonnes of contracts for alleged "physical metal" in London. And this process grew even more extreme in 2020, as the first three weeks of the month saw 290,000 COMEX gold contracts "exchanged" this way. Here's the link from the last post dedicated to this subject, written on March 10: https://www.sprottmoney.com/Blog/comex-gold-efp-us...

- For today's discussion, let's begin with a brief, simplified summary of how we got here over the past few weeks: • The Banks swap 290,000 COMEX contracts (over 900 metric tonnes) into EFPs in just the first fifteen trading days of March.

- The Fed announces QE∞ on Monday, March 23. COMEX gold price soars over $100.

- A party or parties seek actual, immediate delivery of COMEX 100-oz bars through EFP.

- COMEX must admit that it has no 100-oz bars to deliver on Tuesday, March 24.

- CME and LBMA make a joint announcement on Wednesday, March 25 that a new settlement contract will be introduced for Apr20 delivery. This contract will feature "delivery" of fractional ownership of 400-oz London bars.

In short, with an unexpected global supply squeeze, the COMEX was caught without enough deliverable gold. Through the change of rules shown above, the exchange (and CME/LBMA) have been able to scrape together enough gold to maintain the illusion of physical delivery thus far through the Apr20 delivery period. But it hasn't been easy. As you can see below, there have already been nearly 30,000 contracts delivered this month...more than 3X the average volume of Aprils past.

As the supply squeeze continues—with many mines and refineries still shut down—the COMEX should expect these delivery issues to continue in May and June. Already we're seeing total open interest of the "non-delivery month" of May20 surge—going from 1,228 contracts late last week to over 4,500 contracts on Monday, April 13. What will happen if this number surges above 10,000 in the days before deliveries begin on April 30?

And what will happen if the next "delivery month" of Jun20 sees more delivery requests than the COMEX is fielding here in April? What if there is a demand for 40,000 or 50,000 deliveries? That would be 5,000,000 ounces. From where would COMEX source the gold then?

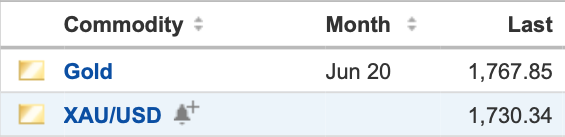

For now, an unprecedented disconnect continues to exist between the spot and front month futures price. This is indicative of tight supply and a failure of confidence in future delivery. This was the topic of last week's article. If you missed it, here's this link: https://www.sprottmoney.com/Blog/a-crisis-in-confi...

You continue to be told by System Apologists that "the gold is there, it's just in the wrong place". This is alleged to be the reason for the spread in price and the issues at COMEX. Oh, really? If that's the case, then there must be a shortage of silver, too, and it must also be "in the wrong place". The current spread shown below is more than 2% and even larger than the current spot-future spread in gold!

And these Apologists also claim that everything the CME/LBMA does is totally transparent and honest, with the moves such as fractional ownership of London bars just simply a nice new service that The Banks are providing. RRRrrriiiggghhhttt. If that was the case, then why is the CME/LBMA demanding complete secrecy from the CFTC regarding this new arrangement? Thanks to the guys at BullionStar, see the information below:

“COMEX secures secrecy agreement with CFTC under FOIA not to release details to the public of its market maker program for the new 400 oz gold futures contract hatched with LBMA, because ‘Disclosure Would Likely Cause Competitive Harm to COMEX’. Program begins tomorrow April 13. pic.twitter.com/QEuEyGz64m”

— BullionStar (@BullionStar) April 12, 2020

To make it easier, here are the screenshots attached to that tweet:

So if everything is just fine , and the delivery issue is simply being caused by gold "being in the wrong place" and the exchanges are forthright and honest brokers, THEN WHY WOULD CME/LBMA DEMAND PROTECTION FROM FREEDOM OF INFORMATION ACT (FOIA) REQUESTS?

I'll tell you why... BECAUSE IT'S ALL ONE BIG MASSIVE SCAM! The Bullion Banks have managed a just-in-time delivery scheme through increasingly mind-blowing amounts of promissory notes, delivery receipts, and unallocated accounts. For Pete's sake, the LBMA actually admitted to a total trading volume of 32,255 METRIC TONNES of gold IN MARCH ALONE! That's an annualized run rate of over 380,000 METRIC TONNES or about 135 years of global annual mine supply! WHAT?!?!

“You need to take a second. Stop what you're doing. Let this sink in. In March, the LBMA traded 1.04 Billion ounces of ‘gold’. That's 32,255 metric tonnes. In one month. That's an annualized run rate of 387,060 METRIC TONNES!! 138 YEARS of mine supply. LOL https://t.co/Q9TXLdqDff”

— TF Metals Report (@TFMetals) April 8, 2020

And now these Banks are finally being called upon to deliver metal against their fraudulent contracts within their fractional reserve scheme. It is abundantly clear that the scramble for physical gold (and silver) is on and if you don't hold it, you don't own it. All of this Bank and exchange scheming should prove, once and for all, that there is no transparency, fairness, and honest operation within the Bullion Bank Fractional Reserve and Digital Derivative Pricing Scheme. Instead, there are lies, cover-ups, distortions, illusions, charades, deceptions, tricks, gimmicks, counterfeits, deceit, duplicity, and frauds.

Since 2010, we've warned you that true physical demand would one day lead to an implosion of this fraudulent sham of a pricing scheme. We stand today on the threshold of this event. While it may still take weeks/months to follow the collapse to its inevitable conclusion, it should be clear to even the most skeptical that our analysis of the situation has always been accurate. TRUTH will always win, and lies will always unravel. ALWAYS and without exception. Sometimes this process takes years and decades to play out, but the end comes just the same. And here we are.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.You may copy, link to or quote from the above for your use only, provided that proper attribution to the source and author is given and you do not modify the content. Click Here to read our Article Syndication Policy.

*********