The "Speculative Bubble" In Gold And Silver

Just because prices have been rallying, the market generalists and their sycophant media have been pushing the idea that gold and silver are somehow in a "speculative bubble". However, even just a quick, basic review of the COMEX market internals reveals that this is nothing but lazy misinformation.

Since we're going to be talking about the CFTC-generated Commitment of Traders and Bank Participation Reports today, we must begin as we always do when these reports are cited...with a disclaimer. In the past, JPM and other bullion banks have been repeatedly fined for deliberately submitting false information for these reports. Therefore, you must always take this information with at least a few small grains of salt.

• https://www.wsj.com/articles/cftc-fines-j-p-morgan...

• https://www.cftc.gov/PressRoom/PressReleases/7347-...

With that said...

Again, the prevailing notion being put forth by the market generalists and precious metal permabears is that both gold and silver are in some sort of speculative bubble. Here's just one example. This article is from CNBC, and it cites a "strategist" at TD Bank: https://www.cnbc.com/2020/08/17/gold-markets-us-ch...

As an aside, this is the same TD Bank that Eric Sprott and I discussed in last Friday's Weekly Wrap-Up. (Link: https://www.sprottmoney.com/Blog/price-manipulation-and-a-case-for-physi...) A regular listener had written in to inform us of his troubles with TD Bank. Now that the bank has declined to give him his silver, it seems the bank may have been defrauding him by charging him monthly storage fees for unallocated metal. See below:

Poor guy. My fellow precious metals advocates always advise physical delivery for your precious metal holdings, and if the size of your position is too great, only vault your metal at trusted storage companies like Sprott Money. Any other strategy—particularly one that relies upon the trustworthiness of a Bank—is a recipe for disaster.

Anyway, back to the point of this week's post...

All of this talk about a "speculative bubble" is easily dismissed by a quick perusal of the latest CFTC data. It's so easy, in fact, that it makes me wonder whether or not those touting the "bubble" are simply promoting their own agenda.

The CFTC generates a Commitment of Traders report every Friday from data surveyed the previous Tuesday. The key to understanding these reports is historical context. One report on its own reveals nothing. However, placing the data into the context of ten years’ worth of reports reveals a lot....so let's do that.

Your most recent CoT data can be found through the CFTC's website: https://www.cftc.gov/MarketReports/CommitmentsofTr...

As of last Tuesday, the COMEX gold CoT looked like this (handy spreadsheet courtesy of Goldseek):

Those are a lot of big numbers, but let's place them into historical context:

• The Large Speculator (hedge funds, trading funds, etc.) NET long position was 224,053 contracts. Again, that seems like a lot. However, that's the smallest seen since the survey of June 18, 2019. And where was price that day? $1347.

• The Commercial (bullion banks and the few producers that still hedge) NET short position was 268,331 contracts. That's the smallest since the report surveyed June 16 of this year. Price that day? $1729.

So, is the gold CoT overstretched in a speculative bubble and due for a "wash cycle"? Not at all. Not by a long shot.

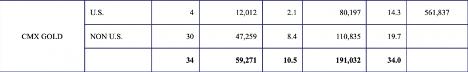

And then let's look at the latest monthly Bank Participation Report. This data, taken from the first CoT survey of each month, purports to show the summary positions of the largest U.S. and non-U.S. Banks. For the most recent report surveyed on August 4, the CFTC reported the positions of four U.S. Banks and thirty non-U.S. Banks. The totals are shown below, and you can see them yourself through this link: https://www.cftc.gov/MarketReports/BankParticipati...

All totaled, these thirty-four Banks report a NET short position of 131,761 COMEX gold contracts. Again, that sounds like a lot...but is it?

As recently as last January, this combined Bank NET position was at multi-year highs of 225,111 contracts short. The price on January 7 when the survey was taken? $1574.

In fact, this latest report actually revealed the smallest Bank NET short position since May of 2019. The price of COMEX gold from that May 7, 2019 survey date? $1283.

Hmmmm. How about that?

And before we go, we should definitely check the COMEX silver CoT, too. With price having rallied over 50% in the past month, there are cries from the rooftops about "speculative bubbles" here, too. But again, all you have to do is check the actual data and compare it to the historical data.

Here's last week's Commitment of Traders report:

Of note:

• The Large Speculators are NET long just 23,568 COMEX silver contracts. Like COMEX gold, this is also the smallest reported position since June 18, 2019. Price that day? $14.98.

• The Commercials are NET short 45,540 contracts. This is their smallest NET position since May 19, 2020. Price that day? $17.89.

• And one more...At TFMR, I track what I call the Large Spec Net Long Ratio. By dividing the total number of Large Spec longs by the total number of Large Spec shorts, I get a ratio that takes out the impact of varying levels of contract open interest over time. What I've learned is that any ratio over 4:1 is a bearish signal while any ratio under 2:1 is considered bullish. As of last Tuesday, the ratio is 1.54:1. This is the lowest since July 9, 2019. Price that day? $15.07.

So what's the point of this exercise?

While prices can fluctuate in the short-term due to myriad factors, the notion that COMEX gold and silver are due to collapse any day now because they are in a "speculative bubble" is simply not true. Anyone willing to make even a cursory review of the CFTC data can come to that conclusion. Thus, consider yourself warned the next time you see or hear a supposed "precious metals expert" attempt to tell you otherwise.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

********