The West – A Vicious Cycle Of Self-Destruction

“The first panacea of a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permeant ruin. But both are the refuge of political and economic opportunists.”

Ernest Hemingway

As the West is standing on the edge of the precipice, there are only unpalatable outcomes.

At best the world is facing a hyperinflationary depression later followed by deflationary depression.

But sadly there is today much more at stake as the West is frenetically escalating the sound of war drums against Russia’s invasion in Ukraine.

THE WEST HAS NO DESIRE FOR PEACE

As the global economy reaches the point of collapse, countries get the leaders they deserve. There is today no leader or statesman in the West who can stand up to Putin in order to negotiate peace. Biden sadly neither has the vigour, nor the ability to play any significant role in solving the conflict. Also, he has the neocons pressurising him to attack and defeat Russia. And Biden’s rhetoric against Putin is certainly not conducive to peace, with words like war criminal and genocide. Biden mustn’t forget that just in the Vietnam war, the North Vietnamese and Viet Cong are estimated to have lost one million soldiers and two million civilians. Unprovoked wars are of course always senseless whoever starts them.

Technically the US did not start a war against Russia. But Russia will of course argue that the US backed 2014 Maidan revolution, ousting the elected President Yanukovych, was a direct threat against Russia. The 1988 NATO map below and the likely one today, if Finland and Sweden join, is clearly a very uncomfortable situation for Russia.

President Zelensky is doing all he can to involve the rest of the world militarily by demanding more money and more weapons from the West, rather than putting his efforts into peace negotiations. Ukraine can of course never win the war against Russia alone. And dragging in the US and NATO can only lead to a war of incalculable consequences and potentially a WWIII which could be nuclear.

And in the West, not a single leader is making a serious peace attempt. From Biden to Johnson, Macron and Scholz, we only hear talk of more weapons and more money for Ukraine. This is terribly tragic and a sign of totally incompetent leadership in the West.

Trump had many weaknesses, but he would not have hesitated to initiate peace talks with Putin.

WEAK EUROPEAN LEADERS

So the US and the West has no ability or desire to achieve peace. And Boris Johnson has welcomed the war as a diversion from his domestic “Partygate” political pressures and therefore has taken an aggressive position against Russia rather than finding a peaceful solution.

Macron is an opportunist who stands with one foot in each camp by being chummy with Putin and at the same time condemning him.

And Scholz, the German chancellor is in an impossible position caused by Merkel’s poor management of Germany’s energy position. The three remaining German nuclear power stations will be closed down and fossil fuels are politically unacceptable. Nearly 60% of German gas imports come from Russia. German industry would not survive without Russian gas. So Scholz wants to have his cake and eat it, sanctioning Russia on the one hand and simultaneously spending billions of Euros buying their energy and other natural resources including food.

Quite a precarious position for Germany to be totally dependent economically on its war enemy. At the same time, this is good for the world as Germany has a vested interest to achieve peace.

But we must remember that only a minority of countries are backing the actions of the US and Europe. Africa, South America, most of Asia are not taking sides and continuing to trade with Russia and these regions represent around 85% of world population.

So the vast majority of the world has no desire for war with Russia but their voice is seldom heard in the Western dominated media.

As Western leaders continue their war mongering, we must remind ourselves of Winston Churchill’s words:

“Never, never, never believe any war will be smooth and easy, or that anyone who embarks on the strange voyage can measure the tides and hurricanes he will encounter. The statesman who yields to war fever must realise that once the signal is given, he is no longer the master of policy but the slave of unforeseeable and uncontrollable events.” -Winston Churchill

So Messrs Biden, Johnson, Scholz and Macron should take note that they could soon, in the words of Churchill, be “the slaves of unforeseeable and uncontrollable events”.

Russia is clearly determined to take back what they consider historically belongs to them, which is the Donbas region in the east and southern Ukraine, including Odessa, which gives them full access to the Black Sea.

Being totally surrounded by NATO countries, especially if Finland and Sweden join, is clearly another “irritation” for Russia but since these countries have never been part of the Russian empire, it has less significance.

END OF A MONETARY ERA & A NEW ONE EMERGING

Politics and money cannot be separated and the geopolitical situation that has now arisen will act as a perfect catalyst to the end of the monetary era since the creation of the Fed in 1913.

But what we must remember is that it is primarily the Western controlled monetary system (including Japan) which will come to an end.

America’s and the EU’s final desperate attempt to save their broken system by sanctions on world trade will eventually fail as the Western economies gradually decay in an economic and social breakdown brought about by a quagmire of currency collapse, deficits, debts and history’s most epic of asset bubbles.

The Phoenix emerging will clearly be the East, led by China with Russia as an important partner. China is, population wise, the biggest country in the world and will soon be the biggest country in GDP terms. With total US assistance in the form of know-how and technology China has built up a strategic and advanced manufacturing base with dominance in many sectors.

For example, 18% of all US imports come from China including 35% of all computers and electronics. Chinese sellers represent 40% of all top brands on Amazon and 75% of all new sellers.

The US and the rest of the world criticise Germany for being dependent on Russian energy, but the US folly of shifting much of its manufacturing to China certainly qualifies for joint first prize in commercial and strategic idiocy.

Since gold is the ultimate money and the only money that has survived in history, it will have a very important role in coming years as the fiat currency system collapses.

THE WEST’S VICIOUS CYCLE OF SELF-DESTRUCTION

Empires normally suffer a drawn-out and painful death. The fall of the US and the West has certainly been long, starting over half a century ago. But the fake prosperity has benefitted a small elite and lumbered the masses with colossal debts.

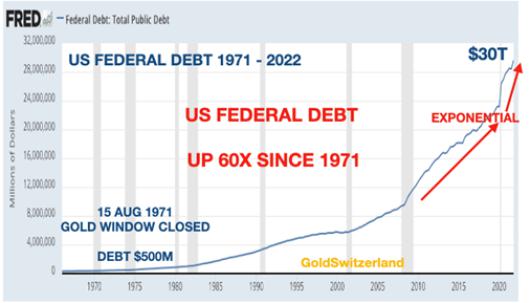

In 1971, US debt was $1.7 trillion and 50 years later it is $90 trillion, a mere 53x increase.

As the finale of the debt and currency collapse approaches, the desperation rises exponentially. Consequently, increasing amounts of money need to be created and wars initiated to justify the debt explosion, all in a vicious cycle of self-destruction.

For over half a century, the US has destroyed its currency and initiated unprovoked military actions in numerous countries – virtually all of them unsuccessful.

Yes, the US has certainly experienced a temporary false prosperity. But that could only be achieved with deficits, debt and printing fake money.

The massive cost of the failed Vietnam war led to Nixon closing the gold window in 1971.

As Nixon said at the time, “the strength of the currency is based on the strength of the economy”!

Hmmm, half a century later that currency has lost 98% in real terms (GOLD) and the Federal Debt has grown 75 fold from $400 billion to $30 trillion. It took 22 years , from 1971 to 1993 for the debt to expand by $15 trillion. Just in the last 2 years the debt is up by the same amount of $15 trillion.

It is amazing, as Hemingway said, how quickly “political and economic opportunists” can destroy both the economy and the currency.

So there we have it. The US dollar is a totally failed currency reflecting the bankrupt state of the US economy. As I have pointed out numerous times, the US has increased the federal debt every year since 1930, with the exception of four single years.

As most currencies have been linked to the dollar since WWII, either through Bretton Woods or through the petrodollar, they have all been dragged down into the swamp with the dollar.

Having started my working life a couple of years before the ominous date of 15 August 1971 (closing of the gold window) I have had the best seat to observe the collapse of a currency system and the sad but inevitable occurrence of war.

Intellectually it is a fascinating experience to watch incompetent and desperate leaders who have totally failed to manage both their economy and currency.

But even without a world war, the effects of the collapse of the West will have devastating effects on humanity for a very long time.

GOLD HAS OUTPERFORMED ALL ASSET CLASSES IN THE 2000s

Since the 1999 low of $250, gold is up 8X in dollar terms. But more importantly, the Dow Jones has lost 60% against gold during the same period (dividends are excluded).

In this century, gold has been one of the best performing asset classes and still nobody owns it with less than 0.5% of financial assets being invested in gold. Since January 2000 gold is up 7X.

It is fascinating that in spite of this stellar performance, gold has been totally ignored by the investment world.

But that is all about to change.

The current fake monetary system based on $300 trillion of global debt, plus worthless paper assets in the form of derivatives to the extent of around $2 quadrillion, will over coming years collapse under its own worthless weight.

Future observers and historians will write many books on a system of smoke and mirrors with fake money, fake paper and grossly overvalued assets, all creating the most colossal asset bubble in history.

Obviously China and Russia will be the kernel of the future world economy with the combination of the globally dominant manufacturing base of China and the world’s greatest natural resource reserves of Russia amounting to a massive $75 trillion.

China and Russia are also the world’s largest producers of gold and probably have gold reserves far in excess of their reported figures which could amount to well in excess of 20,000 tonnes. On the other hand, a major part of the reported US gold reserves of 8,000 tonnes has probably been sold or leased against worthless paper gold claims.

So it is obvious that over coming years as the Western dollar based currency system collapses, it will be replaced by commodity backed currencies with the Yuan and the Ruble as two important pillars, both backed by gold.

Anyone who hasn’t bought physical gold yet, which is 99.5% of investors, can still buy it incredibly cheaply but not for very long.

MARKETS

Since we focus on wealth preservation and in particular physical precious metals, we are neither concerned with paper assets nor with short term moves. But since 99% of financial investments are in paper assets with a short horizon, these investors should really be concerned with protecting their fake paper wealth.

As I have tweeted recently, stocks are about to start a devastating fall and are not the right place to be. But sadly most investors will believe in yet another miracle with the Fed and other central banks saving them.

These investors will be very sorry as the biggest wealth transfer in history is now starting.

Gold will soon resume its strong uptrend and will be extremely important as wealth preservation insurance to protect against the coming economic and geopolitical storms.

The consequence of the stock market crashing and gold surging can be seen in the Dow/Gold ratio below.

In 1980 this ratio was 1 to 1 at Dow 850 and Gold $850. This ratio is likely to, at a minimum, reach the trend line on the chart which is 0.5.

This means that the Dow (and other stock markets) will fall at least 75% against gold from current levels.

What that involves in price we can only speculate about. It could be Dow 10,000 and Gold $20,000. Or it could be Dow 5,000 and Gold $10,000. In my view, the ratio will be a lot lower than 0.5.

*************

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and