Silver Forecast: If You Held A Short Position in Silver, You Hit the Bull's-Eye

In short, practically everything that I wrote in Monday’s analysis remains up-to-date. The profit-take levels in silver were hit, so those of you who chose to hold a short position in silver have likely reaped nice profits yesterday. Congratulations!

I previously commented on silver in the following way:

The white metal moved lower, and its intraday low was just 2 cents above our profit-take price.

Since gold is likely to move lower, and the general stock market is likely to move lower, I’m moving the downside target lower – slightly above the 50% Fibonacci retracement level based on the entire 2020-2021 decline. That’s the next strong support that’s below the 2021 lows, and that would more or less correspond to the size of the above-mentioned short-term decline in gold (at least that seems realistic to me).

The downside target that I featured was $21.23 (for silver futures, which some might choose to call a form of “paper silver”, by the way), and it was reached yesterday – the intraday low was $21.16. The downside targets for related ETFs were reached too. Will silver soar immediately? This might or might not be the case, as the general stock market might decline some more in the near future. Since silver (and mining stocks) are quite correlated with the former, they could move even lower.

Still, it doesn’t mean that it’s worthwhile to stay in position at all times. Since silver moved so close to its 50% Fibonacci retracement level yesterday, it could be a situation where the downside is very limited and the upside (for the short term) is bigger. For now, I’m not suggesting going long (to profit not only on the decline but also on the rebound), but this might change very soon.

Please note that despite all the “peak silver”, “silver is manipulated so it has to rally”, and “silver shortage” theories, the white metal is now much lower than it was when it got really popular – in early 2021. Don’t get me wrong: I think that the silver price will move into the three digits, but I would like to emphasize that just because something is likely to happen eventually doesn’t mean that it has to happen right away.

Silver’s purchasing power can decline before soaring, and that’s exactly what it's been doing for more than a year now. It doesn’t seem that the medium-term decline in silver is already over.

In yesterday’s analysis, I wrote the following about the stock market:

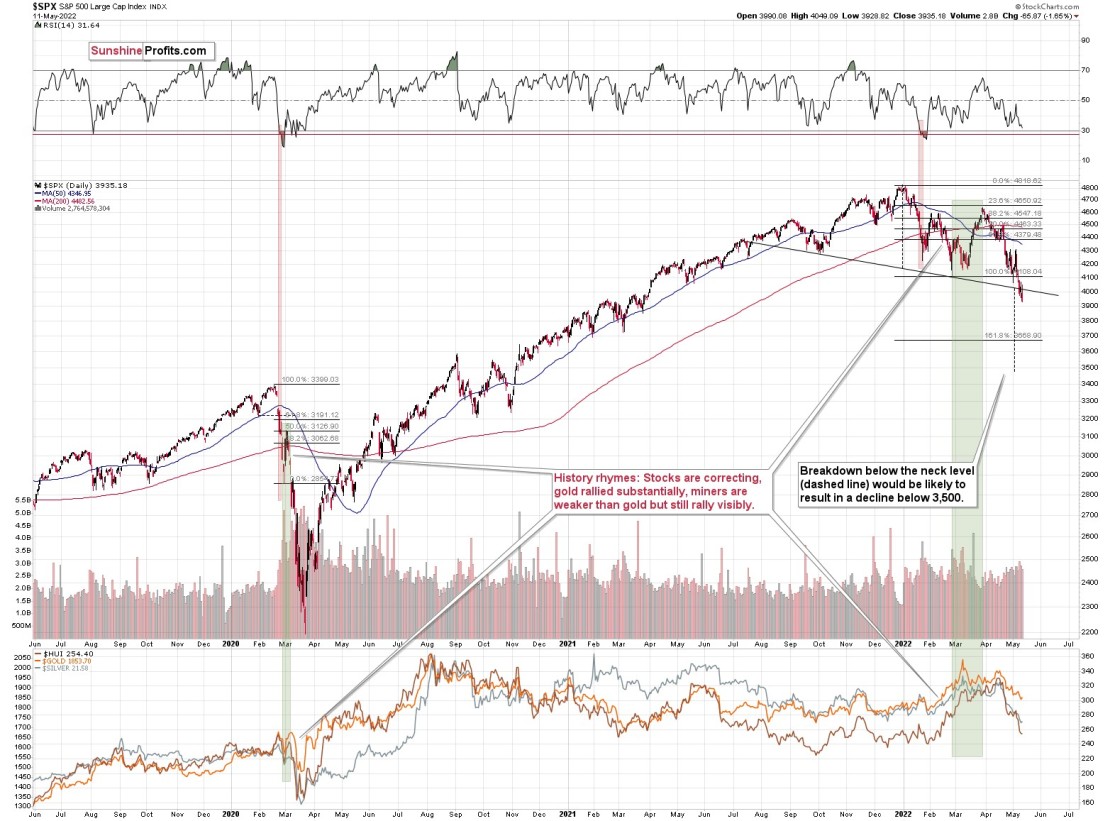

Speaking of the general stock market, it moved slightly higher yesterday (in terms of closing prices), but the move was not significant enough to invalidate the breakdown below the neck level of the head-and-shoulders formation. Therefore, the breakdown is now almost confirmed, and the situation is already more bearish than it was yesterday.

At the moment of writing these words, stocks are once again trying to rally, but so far the rally is not as big as yesterday’s pre-market rally that was just erased. Thus, I doubt that stocks will be able to avoid falling in the near term.

The S&P 500 is currently confirming a breakdown below its head and shoulders pattern. Once confirmed (just one more close below the neck level is required), the formation will be complete, and the next target will be below 3,500. So, yes, I expect the S&P 500 to decline below its 2021 lows in the near future.

Despite yesterday’s attempt to move higher, stocks closed the day below the neck level of the head and shoulders pattern for the third consecutive day. The bearish H&S pattern was confirmed, just as I expected.

The implications are bearish and while the target based on this formation is slightly below 3,500, it wouldn’t surprise me to see a rebound from about 3,800 – that’s where the 38.2% Fibonacci retracement is located. I previously wrote about it in the following way:

Is there any nearby support level that would be strong enough to stop this short-term decline? Yes: it’s the 38.2% Fibonacci retracement level based on the 2020-2022 rally.

Back in 2020, the very first decline erased 50% of the preceding rally, but back then the market was much more volatile than it is right now, so it’s understandable.

If we see a decline to the 38.2% Fibonacci retracement and then a comeback to the previously broken neck level of the head and shoulders pattern, it would fit practically everything that I wrote above and in the previous days / weeks.

It would trigger another immediate-term decline in silver and mining stocks in the near term that would be followed by a (quite likely tradable) rebound.

So, it seems that the general stock market is quite close to its near-term target area, but not yet at it – another move lower appears likely.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,