Beware Of Markets Full Of Fool's Gold

Fool’s Gold comes in many guises, whether it is in fake paper money, Ponzi investment schemes, fake and manipulated gold derivatives, Bitcoin or just fake gold discoveries in Uganda, all of which are discussed in this article.

‘The tendency of an inconvertible paper money is to create fictitious wealth, bubbles, which by their bursting, produce inconvenience.’ – Lord Liverpool 1810 (UK Prime Minister 1812-27)

The elegant and understated courtesy of the English is well known. “Inconvenience” is for an early 19th century aristocrat what a modern Englishman today would call “bloody mess.“

Confucius described this trait already 2,500 years ago:

“The noble-minded are calm and steady. Little people are forever fussing and fretting.” – Confucius

As we know from history, paper money doesn’t just cause an inconvenience, as Lord Liverpool said, but a collapse of the monetary system and of the economy involved.

In today’s decadent and morally bankrupt world, leaders tend to be “fussing and fretting little people” who frantically “create fictitious money and wealth”. This is why, as we enter the final stage of this era, we will see more sackings of leaders (Boris Johnson), assassinations (Abe) and escapes (Gotabaya Rajapaksa, Sri Lanka President).

Social unrest and civil wars will sadly be commonplace too.

The combination of weak leaders and fake money is a fitting end to a major economic cycle. It actually couldn’t end in any other way.

But the world has of course not yet seen the end of the current era, which started with private bankers taking control of the US monetary system in 1913.

Some of us believe we have a good idea how this will all end, but only future historians and other observers will tell us the exact course of events.

The Austrian economist Ludwig von Mises gave us a very likely outcome of how the financial system will end:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

IMPOSSIBLE FOR CENTRAL BANKERS TO TURN OFF THE MONEY SPIGGOTS

Von Mises first alternative of a voluntary abandonment is of course totally unacceptable to current governments and central bankers. Don’t believe for one moment that Powell or Lagarde would contemplate turning off the tap that has kept them and their money forging friends in power for decades.

Yes, they will make gestures like the Fed is now attempting with QT (quantitative tightening). So the balance sheet of the Fed has come down $70 billion since mid March – BIG DEAL!

That’s a 0,7% reduction in 3 1/2 months for a balance sheet that has grown by 240% or $5.3 trillion since end of August 2019. In 2006 the Fed balance sheet was $900 billion and today it is $9 trillion, a mere 10-fold increase.

Let’s just remind ourselves that the current problems in the world did not start with Covid in early 2020, but with irreparable damage to the financial system which central banks couldn’t conceal beyond August 2019.

The beginning of the end of this 100+ year financial era was the Great Financial Crisis -GFC- which started in 2006.

As I have illustrated in many articles, the cast producing this damage to the financial system changes, but their actions are all the same. Through the privately owned Fed, they are all working for their own “charitable” purpose of personal gain and control for the private bankers.

AFTER US THE FLOOD

After Us The Flood is what Louis XV mistress Madame de Pompadour told the French King after they lost a critical battle against Prussia in the 18th century. That event was the beginning of the downfall of France and the French Revolution.

AFTER US THE FLOOD – Après Nous Le Déluge

Since 2006, the balance sheets of the major central banks (Swiss National Bank, Bank of China, Bank of Japan, ECB, Fed) have grown exponentially from under $5 trillion to $36 trillion – a 7-fold increase!

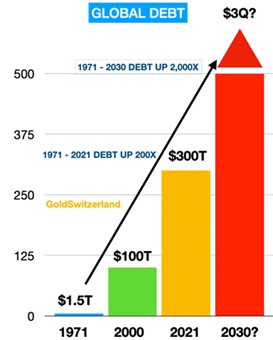

GLOBAL DEBT UP 200X SINCE 1971 AND GOING TO 2,000X

But we must remember that irresponsible debt creating central banks are only part of the problem. The real money printers are the commercial banks. So if we look at total global debt, it has grown from $100 trillion in 2000 to $300 trillion today. In 2006 (not shown) total global debt was $120 trillion.

As the graph below shows, total global debt including derivatives and unfunded liabilities is over $3 quadrillion. When the financial system crashes, these derivatives will prove worthless as counterparties fail and the central banks will print $2-3 quadrillion in a futile attempt to save the banks and the system.

Sensible historic comparisons are no longer possible since the debt creation folly of the last 50 years is totally unprecedented in history.

In 1971, when Nixon closed the gold window, global debt was $1.5T.

After 50 years of irresponsible monetary policies debt has grown 200X. When we reach a total debt of $3 quadrillion in the next 5 to 10 years, with the assistance of the derivative collapse, the increase will be 2,000X since 1971.

I can hear some people calling this sensational scaremongering. But I am sure that these people would have said the same about the 200X debt expansion since 1971.

THE COMING EXPONENTIAL MOVE WILL BE TERMINAL

Also, it is important to understand how exponential moves happen. I explained this in an article from 2017 called “Only Contrarians Will Survive”

In that article I illustrated that exponential moves really move exponentially and that they are terminal:

“Imagine a football stadium which is filled with water. Every minute one drop is added. The number of drops doubles every minute. Thus it goes from 1 to 2, 4, 8 16 etc. So how long would it take to fill the entire stadium? One day, one month or a year? No it would be a lot quicker and only take 50 minutes! That in itself is hard to understand but even more interestingly, how full is the stadium after 45 minutes? Most people would guess 75-90%. Totally wrong. After 45 minutes the stadium is only 7% full! In the final 5 minutes the stadium goes from 7% full to 100% full.”

So for the same reason, debt is likely to grow exponentially in the next 5-10 years, as the world experiences hyperinflation. But we must also remember that as commodities such as food and energy plus many raw materials like precious metals go up exponentially, all the bubble assets (stocks, bonds and property) will implode in real terms. See my recent article “Concurrent Deflation and Hyperinflation Will Ravage The World”

We could of course blame Nixon for the debt disaster that the world is now in. But that would be too simple. Governments have throughout history interfered with the laws of nature and the simple law of supply and demand.

As clueless central bankers (and before that governments) interfere in the natural ebb and flood waves of the economy, these natural cycle movements become extreme tops and bottoms. These excessive moves lead to speculative asset and credit bubbles (inflation/hyperinflation) followed by a deflationary collapse or implosion just as von Mises said (see quote above).

As I explain above, it is totally natural that the end of major cycles creates exponential moves, as we have experienced in this century in both debt and assets such as stock and property.

But what few people realise is that the frantic money printing and debt creation which has taken place in this century indicate the end of a 100 year old monetary era.

The next few years will be like the final 5 Stadium minutes when the debt goes up exponentially by say 14X (the Stadium going from 7% to 100% full) before it all collapses.

CRYPTOS – FOOL’S GOLD

These final moves also lead to the creation of instruments that become “fool’s gold”.

In my view, cryptocurrencies are a form of fool’s gold. Cryptos might have been a wonderful speculative investment for a few investors, but many who entered late have experienced losses of 70 to 90% so far.

As far as I am concerned, and the investors we advise, cryptos have nothing to do with wealth preservation and will certainly never replace gold. Bitcoin is a binary investment that might go to $1 million but it could just as well go to ZERO, so obviously not a good risk.

“Blockchain is a fraud” – Brazilian professor

A Brazilian Professor of computer science, Jorge Stolfi, tweeted in May this year:

“Every computer scientist should be able to see that cryptocurrencies are totally dysfunctional payment systems and that “blockchain technology” (including “smart contracts”) is a technological fraud.”

Stolfi explains how he and 1,500 specialists, including Harvard lecturers and Google’s principal Cloud engineer, delivered a critical letter to the US congress, warning about crypto currencies.

He explains in an interview why cryptos are a pyramid scheme similar to Madoff.

Stolfi: “These pyramid schemes collapse when there are no more fools to fool.”

He also says that Bitcoin won’t exist in 20 years. He calls blockchain a technological fraud that can never be used as a payment system, due to its snail processing speed compared to Visa for example.

El Salvador and Fool’s Gold

El Salvador clearly believed in Fool’s Gold as they announced last year that they would be the first country to accept Bitcoin as legal tender. They were also going to fund the project by issuing $1 billion in bonds secured with Bitcoin. That project is obviously delayed after BTC fall of 2/3. Bitcoin City would be built and would have no taxes except VAT. And now it seems the City would have no revenues either after the BTC losses.

Sounds like Shangri-la turned to hell to me. Sadly for them, they have lost more on their BTC purchases than the country can afford to lose and their debt is now JUNK.

All the Bitcoiners who hailed El Salvador as the future model of money and went there on Pilgrimages are now very quiet.

Well, Ponzi schemes always collapse without fail and it seems that this might be the destiny of Bitcoin and other Cryptos. Most of them are down 70% or more on their way to oblivion.

We will certainly stick to physical gold!

Fool’s Gold in Uganda

So Uganda has officially declared that they have discovered 31 million tonnes of gold ore deposits, which is expected to produce 320,000 tonnes of refined gold!

Let’s remind ourselves that all the gold ever mined in history is around 190,000 tonnes. So this find would treble the gold in the world.

Sounds to me like another Fool’s Gold story. Uganda is quite notorious for corruption and fraud. They clearly hope to borrow major amounts of money based on this so-called find, which is in no way properly proven or documented.

Or maybe this comes from the Bitcoin crowd. They are of course elated by this “fake” gold discovery since it makes BTC much more unique with a limit of 21 million coins issued.

Or could the Ugandan government have confused tonnes with ounces?

STOCK MARKETS FOOL’S GOLD – COLLAPSE IMMINENT

Current asset markets and especially stocks have also turned into fool’s gold. Investors now believe that stocks can only go up and that the Fed and other central banks will be there to save them indefinitely. How shocked these investors will soon be!

As I often say, forecasting markets is a mug’s game and that is why we prefer to focus on risk. And as I outlined in my last article, (“The Implosion Will Be Fast, Hold Onto your Seats”) risk is now extreme, both fundamentally and technically.

Most stock markets in the world are already down 20-30% in 2022. What few investors realise at this stage is that the fall we have seen so far is not just a normal correction but the beginning of a long-term secular bear market with dramatic falls to come.

Technically it looks like the next major fall is imminent. So protecting risk by being out of stocks is strongly advisable.

Precious metals are in a small correction of a major long term bull market which is the inevitable collapse of the currency system. Gold might come down initially with stocks by $100 or so but the next major move of gold up will be both substantial and long term.

Remember that physical precious metals must be owned, not as a speculative investment, but as the best form of wealth preservation you can hold.

Courtesy of GoldSwitzerland.com

********

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and