Interest Rates Rose, But The Result Is Bullish For The GDXJ

As expected, the Fed raised interest rates again—and Powell's dovish stance was a gift to gold miners. The USD fell, giving the GDXJ more room to rise.

Powell Strikes Again

With all eyes on Fed Chairman Jerome Powell on Jul. 27, the central bank chief took his perpetually dovish rhetoric to a new 2022 high. Moreover, while the FOMC raised interest rates by 75 basis points – which was widely expected – Powell was Mr. Friendly. He said:

“While another unusually large increase could be appropriate at our next meeting that is a decision that will depend on the data we get between now and then (...). As the stance of monetary policy tightens further, it will likely become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.”

He added:

"Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low."

Thus, while Powell reiterated comments like ‘rate hikes will continue’ and ‘we’re dedicated to achieving our 2% inflation goal,’ he continued to demonstrate his lack of inflation understanding. For example, he noted that “the public doesn’t distinguish between headline and core inflation,” and that a sustained period of supply shocks caused by bottlenecks and the pandemic “can start to undermine and work on de-anchoring inflation expectations.”

Therefore, he still assumes that inflation is mainly a supply-side phenomenon and that the Fed has to balance both sides of the equation delicately. However, while his uniformed assessment will likely be his undoing, the rhetoric is bullish for our GDXJ ETF long position.

Please see below:

To explain, the gold line above tracks the one-minute movement of the GDXJ ETF, while the red line above tracks the one-minute movement of the USD Index. If you analyze the vertical gray line, you can see that volatility struck when Powell began his press conference at 2:30 p.m. ET.

Moreover, with his dovish disposition sinking the dollar basket and uplifting the junior miners, the price action unfolded as expected. To explain, I wrote before the opening:

With Powell taking center stage today, intraday volatility may be amplified. However, with risk assets often rallying during Powell’s pressers, another re-enactment would help our long position. Moreover, if he decides to talk down the USD Index and U.S. Treasury yields, it would only brighten the GDXJ ETF’s short-term outlook. As such, while unanchored inflation should shift sentiment over the medium term, we still expect higher prices in the days ahead.

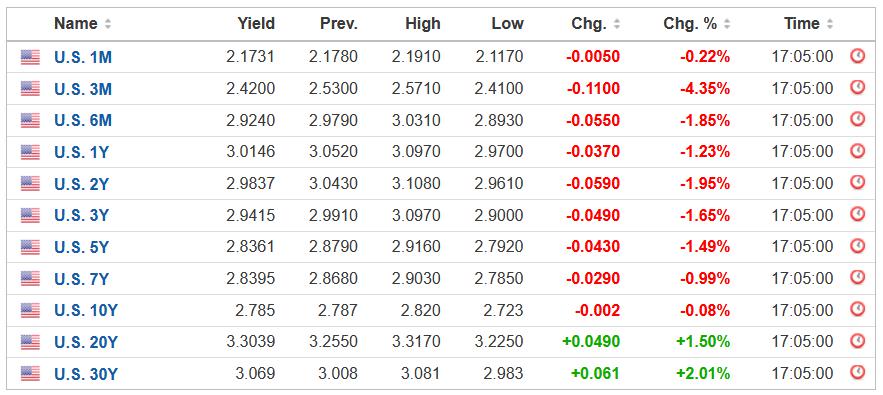

To that point, with Powell making it a trifecta and also talking down U.S. Treasury yields, the central bank chief made it his mission to loosen financial conditions.

Please see below:

Source: Investing.com

Thus, while Powell’s monetary missteps have been on display for 24+ months, he continues to repeat the same blunders. However, with the old Wall Street adage of ‘take what the market gives you’ proving prescient on Jul. 27, we don’t mind being long the GDXJ ETF and profiting from the short-term sugar high. Therefore, we expect the junior miners’ uprising to continue in the days ahead.

In contrast, with Powell’s preference for patience poised to prove extremely costly over the medium term, we’ll be careful not to overstay our welcome.

Powell’s Freight Train to Ruin

While Powell’s dovish rhetoric was met with applause on Jul. 27, his willingness to push up asset prices and loosen financial conditions is like offering needles to drug addicts. In a nutshell: he provides what they want, not what they need. Therefore, while sentiment moves markets and the current environment is bullish for the GDXJ ETF, the medium-term consequences should be dire.

For example, I’ve noted how billionaire hedge fund manager Bill Ackman aligns with our way of thinking about inflation. However, with our view in the extreme minority, the consensus sees things overwhelmingly differently. Moreover, Ackman was spot on when he wrote on Jul. 26 that “the biggest risk to the U.S. economy is not the Fed raising rates. It is inflation.”

Furthermore, while he referenced the sharp drop in U.S. Treasury yields, the drop in investment grade and high yield credit spreads, and the rise in stock prices, (add the USD Index decline, though Ackman didn’t mention that), he noted prior to the FOMC release on Jul. 27 that “financial conditions have eased materially, which has made the inflation problem worse.”

He added:

“What I don’t understand is why Powell is reluctant to say that the Fed will stop inflation in its tracks by raising rates and keeping them as high as they need to be for as long as they need to be until we have durable evidence (not a few months of lower inflation) that inflation has been licked. That is what it is going to take to kill off inflation and preserve the economy and the equity markets for the long term.”

Thus, while Ackman should know that Powell always leans dovish during his press conferences, the six-to-12-month assessment should prove prescient. However, since opponents of the thesis believe that “the market is smarter,” the consensus (for some reason) opines that rampant inflation is preferable to a rate-hike-induced recession.

Please see below:

However, I warned on May 20 that investors should be careful what they wish for. I wrote:

With the consensus still fighting the hawkish realities that I warned about since 2021, the VIX is behaving as you might expect. I mean, why panic when the Fed is all bark and no bite? Therefore, everyone can relax because the Fed will turn dovish, inflation will rage, and in some alternative reality, this outcome is bullish for risk assets.

However, I’ve warned on numerous occasions that a dovish pivot would have dire long-term consequences for the U.S. economy. As such, Fed officials (should) know this, and a small short-term recession is much more attractive than a long-term hyperinflationary collapse. Yet, investors still assume that the latter option is more likely because the Fed can’t withstand falling stock prices.

However, with recency bias clouding investors’ judgment, they don’t realize that 1970s/1980s-like inflation is a completely different animal.

Thus, while the consensus follows the post-GFC ‘bad news is good news’ script and assumes that weak data will elicit a Fed pivot that solves all of the U.S.’s economic problems, the reality is that the recession train has already left the station.

As a result, the choice is between a rate-hike-induced downturn that quells inflation or a hyperinflationary malaise that leaves Americans in a worse position 12 months from now. Likewise, if investors assume that cutting rates or reigniting QE amid rampant inflation will have a positive outcome, they haven’t done their homework. As evidence, I warned on May 26 that the consensus is betting on an outcome that hasn’t materialized in 70+ years. I wrote:

With annualized inflation at [9%+], calming the price pressures with such little action is completely unrealistic. In fact, it’s never happened.

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In addition, notice how every inflation spike leads to a higher U.S. federal funds rate and then a recession (the vertical gray bars)? As such, do you really think this time is different?

What Inflation?

With Powell noting that the pace of future rate hikes will "depend on the data," his rhetoric was a green light for risk assets. However, with crude oil prices rallying sharply, most commodities took note of the dovish pushback. As such, Powell's words fueled month-over-month (MoM) inflation.

Please see below:

Source: Investing.com

Likewise, while Q2 earnings calls and presentations have been riddled with mentions of inflation and price increases, the chorus continues to sing. For example, Whirlpool – a U.S. manufacturer of home appliances like dishwashers, fridges, ovens, and laundry equipment – released its second-quarter earnings on Jul. 26. CFO James Peters said during the Q2 earnings call:

“Our raw material inflation expectations remain unchanged, and we do expect raw material inflation to peak in the second and third quarter.” However, with higher prices “fully offsetting cost inflation,” price increases of 7.25% are expected for the remainder of 2022.

Please see below:

Source: Whirlpool

In addition, I noted on Jul. 27 that Chipotle Mexican Grill was a major winner after hours due to upbeat earnings. However, with price increases the primary culprit, investors responded positively to the company’s ability to protect its profit margins. An analyst asked during the Q2 earnings call, “Why seek more pricing now?” CEO Brian Niccol responded:

“Unfortunately, a lot of things have stuck versus gone away as far as inflation. And then we’ve got some key items that have frankly continued to be inflationary. And I think Jack highlighted it right. We’ve got avocados, we’ve got dairy, tortillas, some packaging. So, unfortunately, we were hoping we’d see some of the stuff pull back. We haven’t seen that.”

Moreover, when asked about construction costs for new stores, CFO John Hartung responded:

“In terms of inflation, it’s at least in the several percent range, maybe even more than that. The deals have varied throughout the country, but definitely our investment costs this year are much higher than they have been in the past and higher than we expected them to be.”

As a result, after raising prices by ~10% in the back half of 2021, another ~4% increase is scheduled for August.

Please see below:

Source: Chipotle Mexican Grill/AlphaStreet

Thus, Powell is flying blind once again. After raising prices for 24+ months, corporations continue to amplify inflation. Moreover, it’s Powell’s responsibility to normalize the pricing pressures, and corporations will do what they have to do to preserve their margins and keep their stock prices afloat. As such, Powell drastically underestimates the task at hand.

The Bottom Line

Since Powell’s lack of foresight is a gift to our GDXJ ETF long position, we think the upward momentum still has some room to run. Moreover, with the USD Index and the U.S. 10-Year real yield falling, looser financial conditions are bullish for junior miners. However, a reversal of fortunes should occur rather sooner than later (probably not later than a week from today).

In conclusion, the PMs rallied on Jul. 27, as it was off to the races for risk assets. Moreover, with the bulls exuding confidence, higher prices remain the path of least resistance. As a result, we remain on the long side for the time being, and profitably so.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,