Gold's Price Experiences Minor Decrease

LONDON (December 18) As of Monday, the price of gold has seen a modest decline, with the troy ounce currently valued at $2022.00 USD, maintaining stability.

Previously, gold exhibited a lateral trading pattern but ultimately ended the week with a slight uptick in its value.

The ongoing speculation about a potential decrease in interest rates in 2024 remains a pivotal factor in sustaining high gold prices. Should the Federal Reserve maintain a cautious approach, it is likely that gold will continue to hover around its current value.

Furthermore, upcoming U.S. GDP data is of significant interest. If early-year data does not indicate robust economic growth in the U.S., it could serve as a catalyst for a shift in gold prices.

The XAU/USD H4 chart reveals that gold's price has recently completed a downward movement to $1973.00, followed by a corrective rise to $2047.85, resulting in a consolidation phase below this level. However, the market has since broken out of this range, descending further. Currently, a downward trend towards $2006.66 is in progress, and if this level is breached, a further decline to the primary target of $1950.00 could occur. The MACD indicator supports this outlook, with its signal line above zero and a clear downward trajectory.

Gold price analysis today

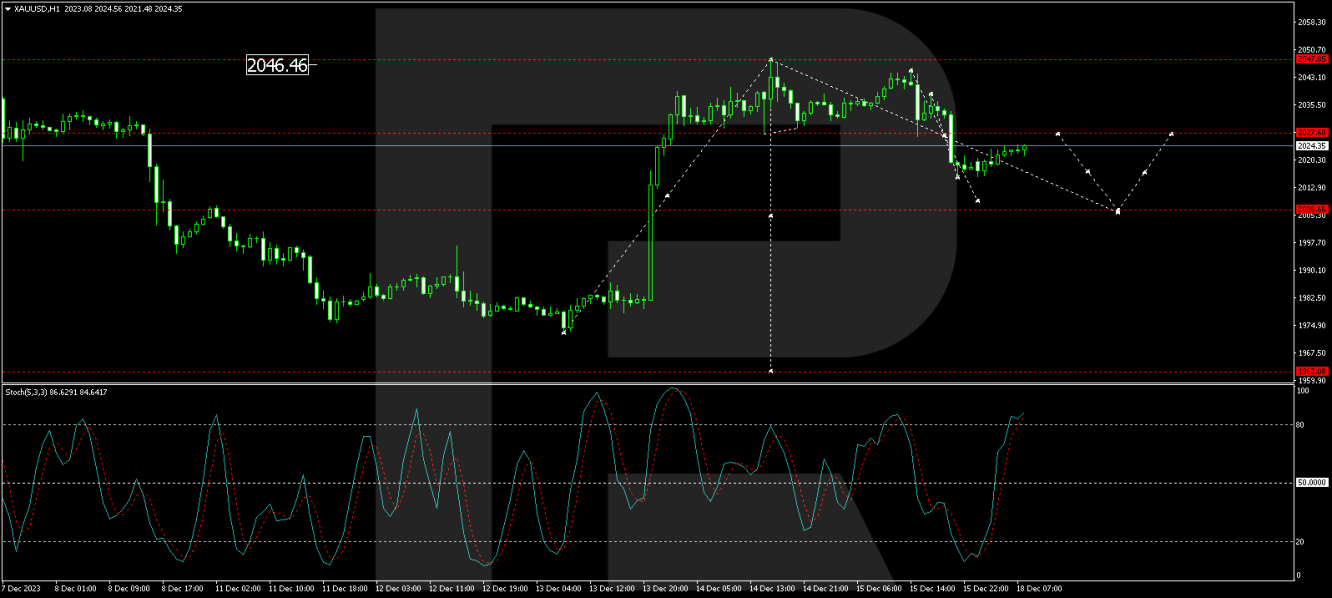

On the XAU/USD H1 chart, the formation of a downward wave heading towards $2009.00 is observable. Upon reaching this level, a corrective increase to $2027.60 may occur, followed by a subsequent decline towards $2006.66. From this point, the trend could extend down to $1950.00. This technical scenario is corroborated by the Stochastic oscillator, which shows its signal line below 80 and is directed sharply downwards towards 20.

Investing.com