Gold: Up, Up and Away

Politics as usual, or is it? Government declares a highly profitable company undesirable on security grounds. The government then demands that the company be sold to a former government official that assembled a buyout group to purchase the company at a knocked-down price. Russia and the oligarch buddies of Putin? No, the United States and Mr. Mnuchin, former Treasury Secretary under the Trump regime. Although many use Tik Tok, the House of Representatives passed a bill by a 352-65 vote to force the sale of China-based owned ByteDance banning the social media darling. Oh yes, Tik Tok is extremely popular with 1.7 billion users globally of which there are 170 million American users. The Chinese government has said they would block the sale, and ByteDance is suing the government on freedom of speech grounds. If it did come to a forced sale, ByteDance could block 170 million users, leaving “Swifties” out of the world’s largest social media platform. Who wins then? Politics as usual. And in this land of the free that prides itself as a bastion of free speech, a record 4,240 titles were banned last year.

And no one likes to lose. When it was discovered that certain US institutions and pension funds had significant holdings in the Chinese platform, even Mr. Trump—who had previously attempted to outlaw Tik Tok—changed his mind.

Civil Wars

Meantime the government’s transition to a greener economy, restructuring of supply chains, wars overseas and at home, tribal politics has become an aggravating factor. The fallout has isolated America. America is at war with itself. Its cultural war has spread to college campuses as the balkanization of politics becomes a new religion. Republicans now must adhere to a set of Trump’s principles and truths. Its leader even has a billion-dollar media platform called Truth Social. Democrats too cannot vary from their own set of prescribed wokenism. There doesn’t appear to be any middle ground with dogma overruling science, historic facts and even critical thinking. Not to adhere, risks excommunication (e.g. Cheney, Romney or Sanders).

And with this new era of religion, there are differing attitudes to democracy with little tolerance for others. The battles are fought on America’s airwaves, its campuses, courts and legislatures. Choices today are amplified by social media with the loudest voices dominating. Tribal politics seems to rule the day – the new religion. Civil rights are being eroded. US laws are capricious. Within weeks of taking office, President Trump reversed a raft of Obama regulations from energy to education by signing executive orders (1996 Congressional Review Act). This time Biden is scrambling to protect his agenda such as fossil fuel regulations from a similar rollback. Dark forces are gathering. Income inequities, the degeneration of political discourse, culture wars and bitter polarization have divided the country. And with more than half of the world holding elections, none are more pivotal than the United States where one candidate can’t remember and the other, can’t forget.

It's the Economy, Stupid

Today the golden days of ultralow rates are gone with the threat of deflating global real estate markets and worldwide recession. When inflation threatened double-digit levels in 2022, the Federal Reserve’s only move was to raise interest rates with borrowing costs soaring to 23-year highs from near zero, sinking Mr. Biden’s hopes for re-election. While the widely anticipated shock and awe recession did not happen, the global real estate market imploded without the support of free money, leading to a misallocation of capital.

The Fed has signaled that resilient inflation will mean US borrowing costs are likely to stay higher for longer. Expectations are that we have had enough of inflation, but inflation has not had enough of us. A host of cyclical, structural and social factors will mean inflation will remain resilient with services and wage settlements sharply higher. Commodities have picked up and gold is posting record highs on a regular basis. Capital has moved back and forth with private equity cashing in their chips. This adjustment is lasting longer than expected. Inflation not only remains resilient but threatens to move higher as the Fed and Street ignores America’s noted economist Milton Friedman’s observation that, “inflation was always a monetary phenomenon.”

While talking tough, the Fed continues to flood the system with treasury debt accommodating an out-of-control government spending for renewables, subsidies, loan forgiveness and semi-conductor manufacturing. America’s financing gap must be filled by borrowings which pushes up bond yields and inflation. On top of this, the land war in Europe has become increasingly expensive, sapping the strength of the world economies as well as emptying their arsenals, which will need to be replaced by the military-industrial complex at greater cost. The Stockholm International Peace Research Institute estimates that military spending topped $2.4 trillion last year, the most in 15 years. To foil Iran’s midnight 330 missile and drone attack on Israel, the cost alone was more than $1 billion.

So what happened to that widely predicted recession? The International Monetary Fund (IMF) now reports that rather than a recession, the US economy will grow at double the rate of its G7 peers at 2.7 percent, due to the strength of consumer and historically high levels of government spending. This is an economic boom. Growth has outperformed expectations. China, which is supposedly fighting a downswing will grow by 5%, emphasizing investment rather than consumption. Simply the feedstock of this exceptional growth is inflation, and the feedstock of inflation is government deficit spending.

The subprime financial crisis of 2008, Trump's tax cuts, the 2020 pandemic, and the ensuing Washington expenditures led to a massive increase in public debt, which reached an all-time high of 130% of GDP. With the election coming up, Biden’s billions continue to stoke demand and his “guns and butter” spending is expected to boost the federal deficit over $2 trillion or 8% of GDP, more than four times the 2% average for other advanced economies and average between 1947 and 2019. When rates were near zero, the costs were minimal but today with rates “higher for longer,” the bill is made worse by growing entitlement, welfare and mandatory costs. Today the sheer amount of America’s interest bill exceeds what they spend on defense. While the increase was once financed by foreigners, China’s absence has forced the Fed to pile on more debt on its balance sheet which at $7.4 trillion is 80% larger than in early 1980s.

America's banks still control a sizable portion of US debt, even a year after the dangerous and deadly banking collapses on both sides of the Atlantic. As interest rates rise, their paper losses, which are already at half a trillion dollars, rise. Regardless of how the presidential election turns out, rates will remain higher for longer due to persistent inflation, a leveraged economy, and the expanding deficits. Crucially in this era of tribal politics and congressional dysfunction, neither Mr. Biden nor Mr. Trump cares, happily running up huge deficits, kicking the debt can down the road since there is no appetite to rein in spending. Meantime the rest of the developed world is heading in the other direction. Both politicians have fully embraced the mad goal of giving the population what they want, stoking demand in an economy that has plenty. However, history shows that guns and butter are not forever. America’s debt is on an unsustainable path which leaves taxpayers to eventually foot the bill. Thus, the combination of monetization of debt, resurgent inflation and unlimited spending means that within this debt laden landscape, a flight from the dollar could easily occur and as this burden grows, the day of reckoning draws nearer.

The Politicization of Climate Change

hus, it should come as no surprise that politics dominates Mr. Biden's foreign and domestic agenda. Historically America has railed against developing countries using massive subsidies and other measures. Now the shoe is on the other foot from the provocative blocking of Nippon’s bid to containing China’s climate tech dominance. Mr. Biden is playing catch up in this cold war, politicizing everything from economics, to climate change and trade issues in an overstretch of national security. With the geopolitical battlegrounds, the subsidization of heavy state backed EVs, clean power sectors and emerging technologies such as artificial intelligence, tariffs and sanctions are the weapons of wars. Tariffs are also inflationary. Markets are no longer allowed to operate freely, instead central control, tariffs and curbing the free flow of capital have been implemented. This politicization has damaged investor confidence, increases inflation, and raises the possibility of a Great Depression-style scenario in the United States.

In a tit-for-tat subsidy race, Mr. Biden’s signature Inflation Reduction Act heavily subsidized green industry and battery manufacturing. The billions of taxpayers’ money spent on subsidies such as the misnamed Inflation Reduction Act and the Chips Act are in actuality a protectionist nationalistic scheme disguised as an industrial policy that transfers money from government to consumers, in a massive job creation package, rather than helping in decarbonization or the reduction of inflation.

The problem is that protectionism has spread like Covid with the US imposing rounds and rounds of tariffs and now quadrupling the tariff on Chinese EVs to 100% to protect their domestic industries, although Chinese EVs are not even on the streets of America. Chinese car parts already face a 25% levy. And despite that Chinese imports make up less than 2%, Biden has out-trumped Trump by sharply raising tariffs on solar cells, lithium batteries and chips, raising the risk that the Chinese government will retaliate and impose tariffs on American-made vehicles such as the huge Mercedes plant in Tuscaloosa, Alabama (where two-thirds of annual production is exported mainly to China). Paradoxically, Chinese automakers are collaborating with European, Japanese, and Korean automakers to gain access to China-produced autonomous driving technologies. China has even allowed Tesla to conduct robotaxis tests with its autonomous drive. The politicization of national security and the demonization of Chinese technology will exacerbate the cost of climate change and introduce yet another inflationary factor, with ramification at home and abroad.

China’s headstart in greening their economy and energy security has allowed them to dominate green technology. China’s production of solar panels will reach 1,100 gigawatts by the end of this year, three times more than demand, according to the International Energy Agency. Consequently, the West is fearful that the cheaper imports will undermine their domestic industries which are heavily subsidized. It is a red herring. In the Seventies, Japanese automakers offered well-made cars which included many of the expensive options that were eventually included in offerings by American automakers. Then the Japanese carmakers set up factories in the United States to produce cars for the domestic American market. The Europeans followed with BMWs and Audis and then the Koreans. American carmakers prospered too. And for more than a quarter of a century, American consumers have been voting with their dollars by purchasing Asian-made TVs, fridges, and iPhones and once again politicians are fearful that a flood of low-priced imports will threaten domestic jobs and thus have subsidized Americans to buy inferior products. No wonder the car lots are full of EVs. The cost of everything is being pushed up in a misguided move to greater self-sufficiency. As an example, despite spending hundreds of billions to get Americans to buy EVs with subsidies and tax credits, 84% of the cars sold in America are powered by combustion engines. The challenge is greater given that the US is home to half the coal plants in the G7 with over 200 coal plants. In an election year, politics out-trumps climate change. Truth is, without subsidies the economics don’t work.

That’s What Friends Are For

Without a doubt the world is a spider’s web of territorial jostling, with the Israeli/Gaza war and the escalation of the Ukraine /Russia war crossing multiple red lines further isolating America. Tensions have escalated amid Washington and Beijing's deteriorating geopolitical relations as both have turned to trade and investment restrictions to safeguard domestic interests, complicating the global environment. Nonetheless, despite escalating tariffs, the US was China’s third largest trade partner in the first quarter. Mr. Biden is trying to limit Chinese involvement in the South China Sea enlisting support of important regional allies, Japan and the Philippines to counter China’s growing military power. Washington also is weighing the expansion of Aukus, the security pact signed by US, UK and Australia to include Japan, although Australia has yet to receive its previously ordered nuclear submarines. Ironically, the US's previous withdrawal from the Trans-Pacific trade treaty limits their cooperation in their attempts to forge an Indo-Pacific axis to confront China's maritime ambitions.

And taking a page from America’s Marshall Plan that followed the Second World War to rebuild Europe, China has dominated Asia as it turned to manufacturing, and trade pacts as part of its $1 trillion Belt and Road Initiative (BRI) which binds other nations through China-led alliances. China is also a huge market as well as a major production base for everything from chips to cars. Through currency exchange lines, loans, and payments from Argentina to Pakistan to Africa, the Chinese have made use of their financial might. However, further dividing the two is America’s usage of protectionism including the hundreds of sanctions and trade embargos to cripple Russia’s economy or Iran and its proxies, which instead has caused the balkanization of the world which has evolved into competing multi-polar blocs from the unipolar world of the past.

For instance, China is the biggest oil importer in the world. As part of a de-dollarization effort to bolster their respective local economies and currencies, the BRICS (Brazil, Russia, India, China, and South Africa) made cheap purchases of oil in April, which caused Russian oil earnings to double. This dangerous balkanization and devolution into a multi-polar order dates back when Balkan nations separated from the Ottoman empire after post World War I. Already China consumes 30% of Russian crude oil using renminbi or gold instead of dollars, giving Beijing leverage over Moscow. India too is among Russia’s largest customers. Russia’s economy is very much alive thanks to war expenditures and ironically, the United States continues to purchase Russian energy, uranium, and other metals. Simply, US-China decoupling has become an election issue. Consequently, the possibility of a financial war arising from the sanctions is increased by the weaponization of the western dollar payment system.

Then, in the land of the free, in a pre-election effort Mr. Biden surprised one of its closest allies, Japan, by intervening at the behest of the United Steelworkers to block Nippon Steel’s $15 billion bid for US Steel to protect American jobs and national security. Although the sale of US Steel was good enough for America-based Cleveland Cliffs (the only US bidder but at a lower price), the deal had the support of the United States Workers Union whose support could tip the balance in swing states. Importantly, the deal requires a review by the Committee on Foreign Investment in the United States (CFIUS) and not a nod from the President, although its chair is Janet Yellen, Biden’s Treasury Secretary. Shareholders? Japan is supposed to be at the heart of America’s China policy, but it seems they were run over by the freight train of protectionist state activism, the American way. China and America are locked in a long-term battle for global influence – both will need all the friends they can get.

Shades of the Great Depression

Big government has set unrealistic goals such as dictates from the Environment Protection Agency (EPA) imposing an adoption faster than engineering and economics allowed and an unrealistic 64% share target for EVs by 2027. Yet the heavy dose of subsidies, tariffs and tax credits were found to be not enough because government dictates did not guarantee more buyers. Car companies have also balked, particularly with their car lots choking with unsold EVs. Governments are not the market. The EV losses in Detroit lays bare the folly of this bet. There is also the risk of backfiring as retaliatory moves by China and the West’s reliance on critical technologies are vital pillars to halt climate change that can squeeze both industry and consumers. Spending billions or piling on more tariffs has done little to fix the paltry recharging infrastructure, boost their electric grid or even secure the critical minerals and processing needed for the goal of self-sufficiency. And no matter how much money Europe and America spend trying to catch up, China’s clean energy dominance will last for the foreseeable future. Not surprisingly, America’s EV revolution is running out of power.

Politicians don’t seem to get it. Competition is not about subsidies, tariffs or wars that have already been lost. Worrisome is that there are eerie parallels with the Thirties, marked by protectionist trade policies, nationalism and currency manipulation when the Smoot-Hawley Tariff Act raised US tariffs on 20,000 imported goods, which triggered “beggar thy neighbour” protectionism that helped lead to the Great Depression. Today we have developed tariff wars with the president and the president-in-waiting threatening to raise taxes on Chinese imports, notwithstanding that earlier a trade war with China ended badly for both sides. Not surprisingly, Secretary of State Yellen’s visit to Beijing for another round of talks failed to ease tensions between the two superpowers since the last summit turned into a lecture session by both sides. With US relations at the lowest point since the countries established ties in 1979, Secretary of State Blinken sought to stabilize the deteriorating relationship despite Yellen’s earlier description that relations are on a “stronger footing.” Little concrete or common agreement resulted from those meetings since the Biden administration portrays China as an economic and geopolitical threat, demonizing everything Chinese. In actuality, both sides just agreed to disagree, avoiding for now, Greek historian’s Thucydides’ Trap.

Central Banks Help Gold’s Rebound

Despite the issues of resilient inflation, fiscal profligacy and growing reality of rising debt, the dollar remains strong as US and European rates diverge. Today US inflation once thought “transitory” is much more resilient and likely to stay “higher for longer”. The war on inflation is already lost. Services, wage settlements and increased government spending will ensure inflation stays high in a repeat of the 1970s Great Inflation era. In the inflationary Seventies, the dollar had to be revalued as high inflation and string of deficits forced America to devalue the dollar. In 1985, a string of deficits similarly forced another coordinated multi-lateral revaluation of the dollar with the Paris Accord. Like 1971 and 1985, there is renewed pressure to revalue the dollar, as countries intervene to support their currencies amid growing geopolitical risks, protectionism and America’s foreign entanglements.

Today’s most potent threat is global warming. Yet both Biden and Trump are locked in a tariff bidding war that will make it worse. Beyond the dollar, the belief that imbalances could be fixed with tariffs will invite a tit-for-tat retaliation which could lead to a disastrous global financial war. Further, a return of Donald Trump’s Fortress America capital controls would fail and erode confidence in the dollar which underpins America’s already stretched financial system. The dollar is the weakiest link. Gold will be a good thing to have in the interim.

China’s diversification moves gives them more options which could further affect its huge holdings of US Treasury bonds at a critical time since America needs others like China to help finance its whopping national debt at $34 trillion that is bigger than the combined economies of China, Germany, Japan, India and the UK. China’s de-dollarization moves are joined by the BRICS+ who have also purchased gold, diversifying their assets from dollar denominated debt, including repatriating their gold reserves from the United States, signaling a more fractious world order.

Gold Shock and Au

Gold’s rise was predictable, or was it? While wars, inflation and Trumpism were dominant for the past few years, gold was stagnant while markets were raging. The recent rally was counter intuitive, as the US dollar was also strong. That changed. What happened?

More than anything, gold’s push through $2,400/oz was due to rising US debt which caused money to flow into gold for defensive purposes. Since March, gold has been up $500 an ounce, setting numerous all-time highs as the monetization of debt became an instrument of public policy. Americans can carry a lot of debt, but as the burden grows, the sustainability of their monetary and fiscal policies leaves little margin for error. Gold production peaked in 2019 at 3,300 tonnes and output has declined with miners’ all-in costs moving up from $1,000/oz to over $1,400/oz. Noteworthy is that the dollar index (DXY) has jumped 5% due to its perceived safety amid the conflicts, but gold has done even better.

On the demand side, billions flowed into physical gold as the central banks purchased gold in record numbers totaling 1,034 tonnes or almost one third of mine production prompted by the freezing of Russian assets and layers of sanctions which undermined faith in the international financial system. Seeking to diversify from the US dollar, other big gold purchasers were Russia, Poland, Türkiye and India.

For China, Gold Is the New Critical Mineral

China bought gold in record amounts, purchasing 735 tonnes last year, up 23% over a year ago, and became the fifth largest holder, purchasing gold for 18 months in a row. In contrast, China's holdings of US Treasuries fell more than $400 billion to a 14-year low of $775 billion, down from $1.1 trillion in 2021. Gold now makes up around 4% of China's reserves, up from 2.9% in 2019. As Chinese citizens surpass their Western counterparts in their influence on the bullion market, the Shanghai Gold Exchange has emerged as the largest physical dealer in the world in the meantime. The first quarter saw a 6% increase in the amount of gold consumed by Chinese consumers, who imported 367 metric tonnes in the first two months of this year—a 51% increase over the previous year.

We believe fiscal, monetary and geopolitical uncertainties have driven investors into gold as an alternative currency, or the classic store of value. Gold is in limited supply in contrast to the fiat dollars which are in unlimited supplies or cryptocurrency which could be made or seized with a click. Gold is universally fungible and finite. Gold can be bought and sold in US dollars and thus is an alternative to fiat money for both central banks and investors, particularly since gold is also outside the Western based system. The Saudis are selling oil for yuan, and China has grown to be their biggest consumer. This signals a fundamental shift in power from the West to the East, with the petroyuan taking the place of the petrodollar. Dollars are being utilized less and less as bullion gains a greater percentage of the reserves held by central banks worldwide. For China, gold is the new critical mineral. We continue to believe gold will reach $3,000/oz within 18 months.

Recommendations

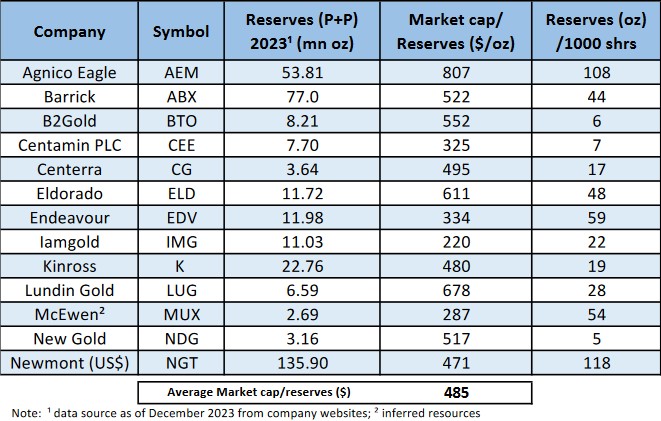

The first quarter was a strong quarter for the gold miners with bullion up 15%. Margins expanded and the industry was a cash flow machine. Not all glistened however as gold stocks have lagged the gold price because mining gold has become increasingly expensive with all-in-costs (AISC) increasing to $1,400/oz up from $1,000/oz. In addition, the gold mining industry has had difficulty replacing reserves, reaching “peak gold” in 2019 whilst demand grew led by the central banks. Nonetheless, the group is undervalued on multiple fundamentals (market cap/reserves, earnings, cash flow and balance sheets) particularly against the overvalued S&P 500. The pipeline of new projects is thin and with the lack of new mines under development and few gold discoveries, exploration budgets have been slashed making it cheaper for companies to join the M&A game of musical chairs, but there are few empty chairs. The industry agrees from Newmont’s $19 billion takeover of Newcrest to G Mining Ventures (GMIN) paying $825 million for Reunion Gold’s Oko west deposit in Guyana, despite Reunion has yet to publish a feasibility study.

In the interim, the acquisition of ounces on Bay Street is a cheaper option given the long lead times in building a mine which can take up to 10 years from first discovery to first gold pour. Capital requirements today are huge with projects requiring time-consuming permits and half a billion or billions to build. We calculate the market cap per reserves in the ground at less than $500/oz thus it is cheaper to buy than explore. The problem? There are few candidates around.

We continue to like the senior producers like Barrick, and Agnico-Eagle. Developers are the next group, bringing on mines over the next couple years like B2Gold, Endeavour Mining, McEwen Mining and Eldorado. There are many explorers that are very cheap. But instead, we have focused on those players with advanced PEAs or FS which are likely to get financed in this current bull market. Potential M&A players, like Centamin and Lundin Gold, are also attractively priced.

Agnico-Eagle Mines Ltd.

Canadian producer Agnico Eagle reported a strong quarter producing 880,000 ounces of gold with strong performances from Canada Malartic, Nunavut and Macassa. Agnico's two flagship assets Malartic and Detour performed well with cash costs of $900/oz and AISC $1,200/oz. Importantly operating free cash flow increased by 50 percent to a record $396 million for the quarter due to higher gold prices and improved margins. Agnico has a stellar balance sheet with a new $2 billion revolver and only $800 million of debt coming due over the next 15 months. Agnico is expanding the Canadian Malartic complex with the underground Odyssey operations, a prelude to East Gouldie which could come on stream in 2026. At Detour Lake, they set a quarterly record and expect mill throughput to top 28 Mtpa by yearend as the company focuses on the western extension where there are better grades. Gold production is unchanged at 3.1 million ounces. And we like that Agnico Eagle boosted reserves by 10% to 54 million ounces. Buy.

Barrick Gold Corp.

The world’s second largest producer, Barrick Gold reported a mixed quarter producing 940,000 ounces, but operating cash flows remained strong at $760 million. Production was temporarily impacted by a new ore conveyer problem at Pueblo Viejo (PV) in Dominican Republic. Now resolved, Pueblo Viejo's expansion will ensure sustained gold production at about 800,000 ounces for at least 20 years. Porgera was restarted in Papua New Guinea and the mine will eventually produce about 700,000 ounces annually. At all important Nevada Gold Mines JV, the company is focusing on numerous brownfield targets with existing infrastructure in place including Turquoise Ridge and Fourmile. The ramp up of Goldrush would add growth ounces to the joint venture. Barrick also focused on the Lumwana copper Super Pit expansion in Zambia where a feasibility study is expected by the end of this year which would potentially double output by 2028. At the world’s largest undeveloped copper-gold deposit, $7 billion Reko Diq in Pakistan, Barrick is negotiating with Saudi Arabia as a partner that would help mitigate geographic risk. With 13 million ounces of gold reserves, Reko Diq’s feasibility study should be completed by yearend with first production in 2028. Barrick has a solid balance sheet with $3.9 billion of cash against $4.7 billion of debt. We like Barrick for its long-term growth potential, array of Tier I assets and the fact that Barrick has increased its reserves for three consecutive years. Buy.

B2Gold Corp.

B2Gold produced 225,000 ounces at an all-in cost of $1,345/oz. Production was in line, although flagship Fekola produced 120,000 ounces. Cash flow was $48 million from B2Gold’s three operating mines with Back River coming in stream next year. B2Gold reported that the Back River Goose project will be delayed by one quarter to Q2 2025 and thus a drop of 100,000 ounces. B2Gold has spent almost $900 million so far and Back River is a company builder. B2Gold has a strong cash position sufficient to complete Back River. The shares have been weaker because of concern about the 2023 mining code in Mali which is holding up the exploitation license. But the company and others expect that the new government will not pluck the golden goose (Barrick’s Loulo-Gounkoto is also in Mali). B2Gold consistently boosts reserves, has a strong pipeline and Back River will be a major producer. We like the shares here.

Eldorado Gold Corp.

Eldorado produced 117,000 ounces from Kışladağ, Efemçukuru in Türkiye and Lamaque in Québec and is on track to produce more than 525,000 ounces at $1,300/oz all in cost. Production is expected to improve due to better grades from Efemçukuru and Lamaque. Eldorado spent $53 million of expected $375-$425 million expenditures to complete the Skouries Mine copper/gold mine in Greece which is 73 percent complete. First production is expected Q3 2025. Eldorado's other Greek mine Olympias produced almost 19,000 ounces and should produce between 75,000 to 85,000 ounces of gold this year. Eldorado has total liquidity of $628 million, including $515 million of cash. We like Eldorado for Skouries’ long-term potential, a potential company builder.

Endeavour Mining PLC.

The largest producer in Africa, Endeavour Mining is on track to meet its guidance this year with a major contribution from the Phase 2 Sabodala-Massawa BIOX® expansion project in Eastern Senegal. Production in the first quarter was 219,000 ounces at AISC of $1,100/oz due in part to a 11-day strike at Houndé. At Endeavour’s largest mine Sabodala-Massawa, lower grades impacted the quarter but the BIOX® Expansion will boost tonnage. Endeavour’s Lafigué mine in Côte d’Ivoire is on budget and first gold is expected by the end of this quarter, producing 100,000 ounces this year and 200,000 ounces of gold annually over a 13-year mine life at AISC under $900/oz. Endeavour is spending $65 million on exploration and the company has a very low cost per ounce discovery rate. Longer-term Assafou is a big tonnage deposit with 2 g/t potential in West Africa with a resource of 4.5 million ounces. Endeavour plans to advance pre-feasibility this year. We like Endeavour’s growth profile and is among the lower cost producers relative to their peers. Buy.

IAMGOLD Corp.

IAMGOLD produced 151,000 ounces from Essakane and Westwood and should produce 450,000 ounces this year. Essakane had a strong quarter with all in costs at $1,300/oz. At 70% owned Côté Gold capex will top $3 billion and the mine is expected to produce between 220,000 and 290,000 ounces this year. Commercial production is expected in the third quarter. We believe that the project will not only have the usual start-up risks but that it will take time to de-bottle this big bet. Sell.

Kinross Gold Corp.

Kinross produced 520,000 ounces with contributions from Tasiast, Paracutu and La Coipa at AISC below $1,000/oz. Higher grades at La Coipa and improved production from Bald Mountain helped results. At Great Bear, Kinross is targeting at long last a PEA in the second half of this year. The company has completed about 38,000 m of drilling but we are concerned that despite the armwaving, they spent billions on a mine with no feasibility study nor even a PEA, particularly since management is currently talking about an open pit and underground mine. On the other hand, Tasiast had a strong quarter producing 159,000 ounces. Looking ahead at Round Mountain, Kinross is going underground as part of their Phase X to access higher grade material. Kinross should produce 2.1 million ounces this year. Nonetheless billion-dollar Great Bear bet is too far off in the future, and we prefer other less risky bets such as B2Gold.

McEwen Mining Inc.

McEwen Mining had a good quarter with Gold Bar’s in Nevada production up 80% and San Jose in Argentina up 15%. Fox in North Ontario was disappointing due to lower tonnage and grade, but grades and production is expected to improve through the end of the year. At 48% owned McEwen Copper, the Los Azules feasibility study is expected in the first half of next year following the June PEA last year. Since then 22 rigs drilled off 69,000 meters. Since McEwen is also listed in the US, under GAAP reporting they reported a consolidated loss of $20 million of which $18 million was attributable to its 48% investment in McEwen which was valued at $800 million in the last financing by Stellantis and Rio Tinto. The loss temporarily hurt the shares but provides a purchase opportunity for this developer. Buy.

New Gold Inc.

New Gold produced almost 71,000 ounces of gold and 13.3 million pounds of copper. Rainy River in Ontario produced almost 53,000 ounces due to higher stripping. New Afton in BC produced 18,000 ounces and increased copper output from the C zone is expected in the second half. Results were negatively impacted by the Rainy River gold stream obligation. We were disappointed that New Gold repurchased part of the New Afton Teachers’ partnership option for $255 million of cash in exchange for 26.1% interest, increasing New Gold’s cash flow exposure to 80%. Long term debt was $396 million, so the $150 million bought deal funded the buyback. New Gold should produce 320,000 ounces at AISC of $1,400/oz. We prefer B2Gold here.

Newmont Corp.

Newmont produced lower ounces this year but is on track to meet guidance. Newmont produced 1.7 million ounces of gold at AISC of $1,439/oz in the quarter. Newmont took another half billion-dollar writedown on the potential sell-off of six mines over the next year, a legacy from the Newcrest and Goldcorp acquisitions (Akyem, CC&V, Éléonore, Porcupine, Musselwhite and Telfer as well as Havieron and Coffee). Of note, the carrying value of those assets is almost $5.7 billion but Newmont only expects to net $2 billion so further writedowns are likely. Although the assets are expected to generate active interest, investors are likely to be disappointed with the results because of the quality of the assets. Pamour for example has huge reclamation liabilities and Telfer is unlikely to receive much interest from Australia. Newmont’s growth profile is modest considering that they spent $19.2 billion on the Newcrest acquisition with only Tanami Expansion and maybe Cerro Negro on the horizon. Meantime with the Yanacocha sulphides project delayed, Newmont’s water treatment plant is estimated at a whopping $400 million. On a positive note, Newmont has a solid balance sheet. Nonetheless we prefer Barrick for its superior quality of assets and expectation that Newmont has a number of other “bad news” shoes to drop. Sell.

John R. Ing

*********