Gold Stocks & A War Cycle Finale

Gold finished last week strongly after the US jobs report was released. It’s soft again ahead of the key CPI and PPI inflation reports (scheduled for Thursday and Friday).

Gold is the world’s greatest asset and currency. It’s not only stood the test of time, but it’s been around for so long that it’s influenced by the biggest array of fundamental, technical, and cyclical drivers of the price.

These price drivers can flip without much warning.

Investors can get confused; just when it becomes an accepted fact that gold pays no interest (in the West), so the gold price must fall if US rates rise…

Suddenly gold soars from $1500 to $2400 and does it while interest rates surge!

Double-click to enlarge this stunning US rates versus gold chart. In the deflationary environment that existed for 40 years from 1980 to 2020, gold rose when rates fell.

When the 40year inflation cycle began in 2020, gold began rising as rates rose, like it did in the 1970s.

Because of the huge trading volume on the Western LBMA and COMEX exchanges, gold will continue to have short-term dips if US jobs and inflation reports suggest rates could rise, but the main trend will now be determined by global demand versus supply.

Sadly, America’s obsession with fiat is the main cause of the empire’s fade. Because of the widespread use of the dollar, the government still has a chance to launch a gold currency that would be embraced by the world.

China and India would become the factories of the world (and are already destined to be so) and America would become a gigantic version of Monaco. The nation’s gold holdings would skyrocket… and so would the price.

Sadly, the US government has no interest in seeing the average citizen become as rich as the average citizen in Monaco. The focus is on fiat and debt and this focus (obsession) is creating very turbulent empire transition.

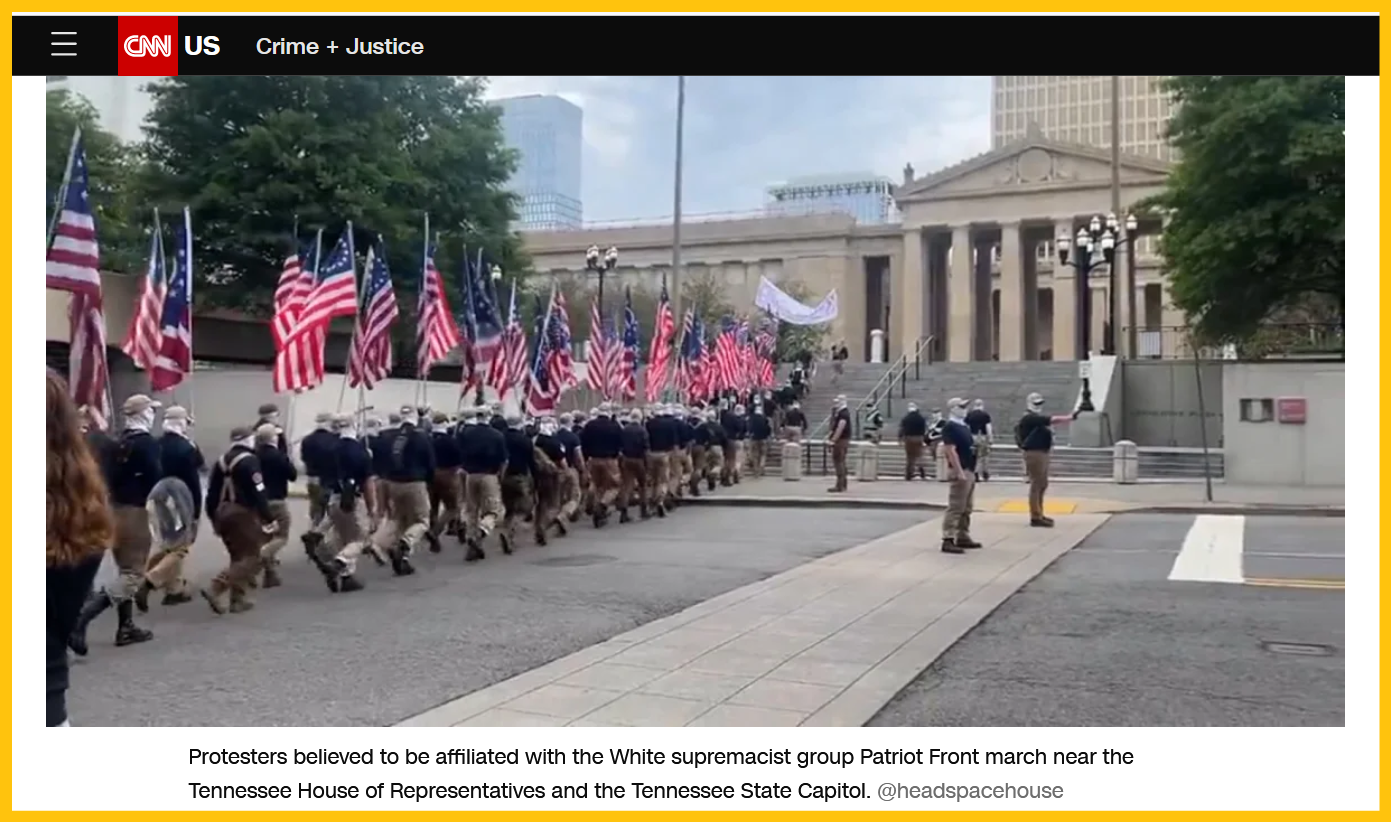

What about the 2021-2025 war cycle? Well, recent elections around the world have produced a modest reduction in government war worship, but…

In America, Trump has promised mass deportation of millions of illegal residents. He promised the same thing in 2016, but didn’t keep that promise. The issue, arguably, was logistics.

If he’s elected again with the logistics problem somewhat solved, is this time different, and if so, what kind of mayhem on the streets of America is likely?

Tens of millions of “stakeholders” are involved, because many of the illegal residents have started families and businesses with legal ones.

Given that most adults in America are armed, and given the eerie similarity of 2024 to 1864, gold bugs of the world need to be as open to a “big bang” ending to the 2021-2025 war cycle as to the fade that is indicated by other elections around the globe. The mayhem could create a parabolic move in the price of gold!

A daily focus on the big picture (fundamental, cyclical, and technical) is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

What about the miners? Well, the bizarre conundrum continues… the conundrum of technical sentiment indexes showing investor sentiment in the greed zone, while the average mine stock bug is in a state of nonchalance at best, and severe demoralization at worst.

This is the key BPGDM investor sentiment chart. I’m reminded of the year 1994, when retail investors began investing in the stock market because interest rates had fallen under 7%.

Sentiment indicators became overbought then, but investors weren’t greedy. It wasn’t until 1998-1999 that rampant greed developed… and the market crashed.

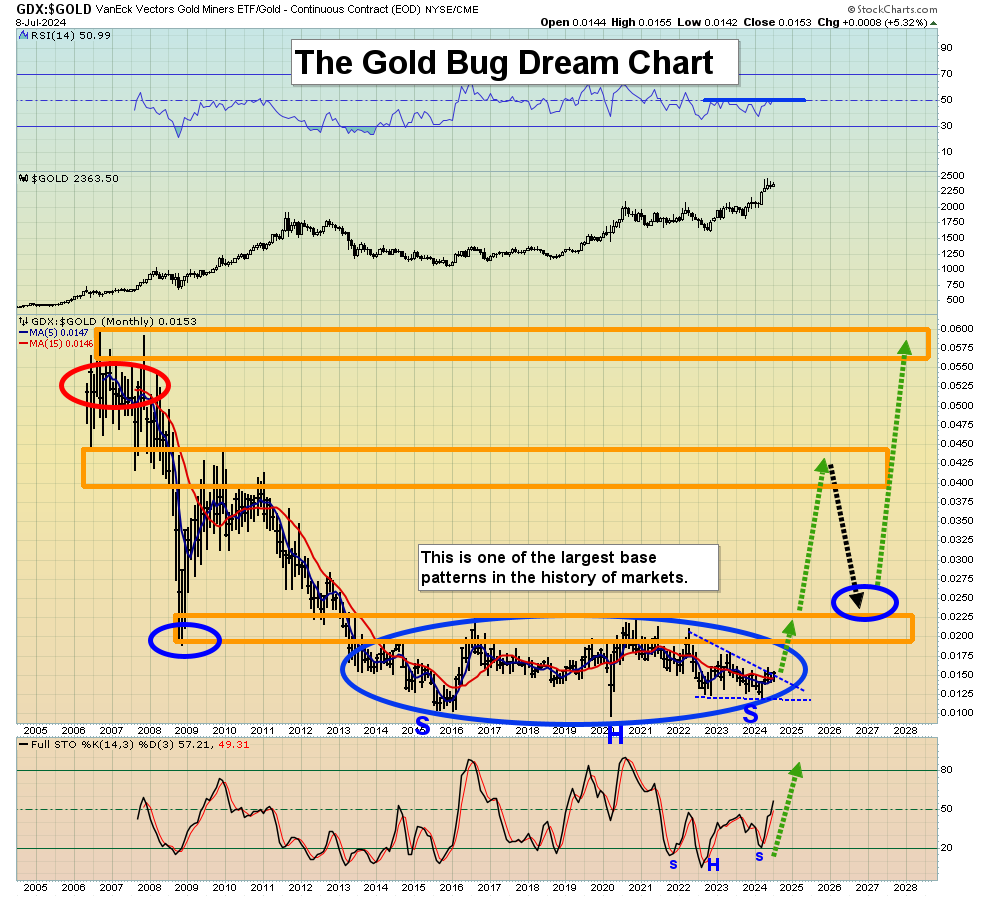

This is the “gold bug conundrum” chart. When the maverick GDX ETF was launched in 2006, gold bullion was around $600/oz. Investors raced to buy the miners, with the goal of outperforming gold.

What transpired was one of the most bizarre events in the history of the gold market; gold stocks melted against gold… while gold surged from $600 to $2400! After plunging, gold stocks became locked in a de facto gulag. This is why sentiment indexes like the BPGDM can show sentiment as technically in the greed zone, while real gold stock investor “boots on the ground” show no greed.

The good news is that gold stocks have formed one of the largest and most bullish price patterns in the history of markets, and they have done it… against gold!

For more good news:

I’ll dare to suggest that gold stocks (versus gold) are at a point in technical time that is very similar to gold in 2018. A huge inverse H&S pattern was in play in 2018, but most gold bugs ignored it. There was no excitement, and there was still none even after the big breakout over the neckline of the pattern.

Gold may be making a short-term peak in July, and that’s normal given the $600/oz super-surge in the price from the October $1800 area low. Like oil stocks have rallied many times when oil has fallen, gold stocks may stun analysts and continue to move higher, especially versus gold. As that happens, let’s hope gold stock investors show more excitement than bullion investors of 2018-2019 did and the good news is that… I’m predicting they will!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: