Gold SWOT: Uganda Plans To Start Domestic Gold Purchases To Build Forex Reserves

Gold futures closed the week at $2,416.30, up $18.60 per ounce, or 0.78%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 5.73%. The S&P/TSX Venture Index came in up 1.36%. The U.S. Trade-Weighted Dollar fell 0.75%.

Strengths

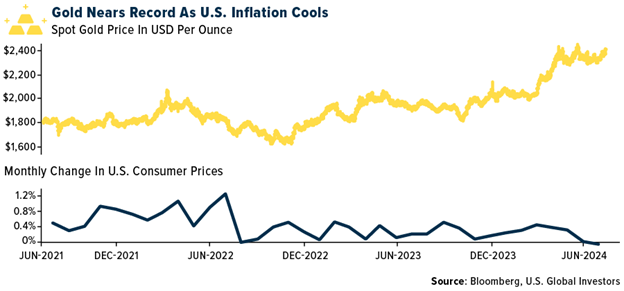

- The best performing precious metal for the week was gold, up 0.78% after lagging the other precious metals last week. Uganda announced plans to start domestic gold purchases to build foreign exchange reserves. Purchases will be executed by the Bank of Uganda directly with artisanal miners. Both the central banks of Nigeria and Zimbabwe have enacted such programs. Gold jumped above $2,400 an ounce to close in on the record price set in May, after an unexpected drop in U.S. consumer prices bolstered hopes that the Federal Reserve will soon start cutting interest rates. Gold jumped as much as 1.8% after data from the Bureau of Labor Statistics showed a 0.1% monthly decline in consumer prices, marking the first negative reading in more than four years, according to Bloomberg.

- Osisko Gold Royalties reported preliminary revenue for the second quarter that beat the average analyst estimate. Preliminary revenue is C$64.8 million, compared to an estimate of C$59 million, according to Bloomberg.

- Wesdome Gold Mines reported record quarterly production of 44,035 ounces, well above BMO’s estimate of 35,000, as for the first time both company’s mines mined meaningful tons of high-grade mineralization. After several years of development, the Kiena mine is now able to process high-grade Deep A zone mineralization.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.60%, essentially giving up the prior week’s gain. According to Goldman, over the past 12 months, the Australian gold sector has returned to cash generation over absolute production growth. However, Australian gold equities have recently broadly underperformed the Australian gold price. They expect this is at least in part driven by continued cost escalation, where over the last 5 years all-in-sustaining costs (AISCs) are up 40% on average, reducing the pass through to margin expansion.

- Endeavour Silver reported preliminary silver production for the second quarter that missed the average analyst’s estimate. Preliminary silver production was 1.31 million ounces, which was below the estimate 1.38 million, according to Bloomberg.

- Sibanye-Stillwater experienced a cyber-attack that is affecting its IT systems globally. While the investigation into the incident is ongoing, there has been limited disruption to the Group's operations globally, according to Bloomberg.

Opportunities

- Calibre Mining announced that it has received key environmental permits necessary for the development of open pit mines at the Volcan gold deposit in Nicaragua, located 5 kilometers south of the Libertad mill, according to Scotia.

- Central banks have been the most notable buyers of gold in recent years, particularly in the last three years. However, both retail and professional investors have been in liquidation mode regarding the SPDR Gold Shares ETF, a proxy for bullion, since 2020. That trend appears to have come to an end in the first half of March 2024, with 282.9 million shares outstanding. Since then, the shares outstanding have climbed to 292.2 million, with new shares being created as new money has finally started to flow back into gold.

- According to Stifel, G2 Goldfields represents the most exciting exploration-driven story they cover, with exploration success directly impacting share price performance. They highlight the discovery of 300,000 ounces of underground gold at 4.56 grams per ton already drilled at Ghanie, and they anticipate further drilling will yield similar results.

Threats

- According to Morgan Stanley, silver price-driven demand destruction may emerge. Silver jewelry demand already fell 13% in 2023, mainly driven by India. Solar demand could slow more significantly due to grid constraints, overcapacity, and poor margins. Additionally, high prices may encourage thrifting, with silver accounting for 11% of current solar module costs. Silver prices could also decline if rate cuts are implemented in response to economic weakness, which would weigh on industrial demand.

- Companies that buy metal sourced from central Africa could expose themselves to United Nations sanctions for supporting warfare in eastern Democratic Republic of Congo, according to a report by UN experts. Congo’s trade in gold, tin and tantalum—key minerals in portable electronics—is directly supporting armed groups involved in widespread human rights abuses and fueling one of the world’s deadliest conflicts, as reported by Bloomberg.

- Platinum jewelry demand is weakening. China's demand for platinum jewelry is now less than half of what it was in 2013 and declined further last year amid competition from gold, according to BMO.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of