Gold to NOT Rally After the Rate Cut

Market Expectations and Rate Cuts

It can, but it can also decline, and the latter is actually more likely. What a crazy idea, right? With the lower cost of money (interest rates), gold should be more attractive to investors (it pays no dividend), so its price should rally, right?

Wrong. Things are not that simple. It’s the real rates that matter to gold (also taking the expected inflation into account), and additionally, it’s a matter of what the market participants expect ahead of the move. And right now, the market already expects the Fed to lower the rates – the price moves that are supposed to happen based on those rate cuts (three cuts this year are expected), have likely already happened.

Let’s take a look at the CME FedWatch tool.

As you can see, people are not expecting cuts in July, but then they expect to see them on every regular occasion. If the Fed fails to deliver all three cuts, it would be viewed as a hawkish (potentially bearish) surprise.

- But PR, gold rallied when the rates were cut before! For example, in 2007.

That’s true, but there were also cases when gold plunged right after the rate cut, for example, in 2008. Let’s take a look at all reactions of the gold price to the first rate cuts (in the case of the rate cut series).

The red lines represent situations when gold declined after the first cut, the black line represents the situation when nothing really happened, and the green lines represent situations when gold declined after the Fed’s first rate cut.

There were more cases when gold declined after the first cut than there were when it rallied!

The 2008 case is particularly notable – after the October 2008 rate cut, gold truly plunged – and the same happened to gold stocks.

The 2020 case is also quite interesting.

We saw a quick move up and then a huge move lower – particularly in mining stocks.

By the way, do you recall how we bought that 2020 bottom about 30 minutes within it?

So, no, the rate cut does NOT have to result in a rally in gold, silver or mining stocks – it might have no implications, or it could result in declines.

To clarify – I’m not saying that gold “has to” decline on rate cut or that it’s certain that it will decline after a cut. This might happen. What I’m saying and emphasizing is that this does not have to happen – and that declines after the cut is more likely than rallies – especially when one takes the current expectations into account.

Besides, gold, silver and mining stocks have been likely to decline based on other reasons and that’s what they are doing right now.

In yesterday’s Gold Trading Alert, I wrote the following:

“The strength of the bearish implications of the weekly reversal in gold that I wrote about previously is (on its own) multiple times greater than any possible bullish implications that this daily rally might have. And gold’s weekly reversal is not the only factor pointing to lower gold prices in the coming weeks. So, all in all, nothing really changed for gold, and today’s rally is likely meaningless.”

The rally was invalidated, and the overall price action that we saw yesterday was NOT meaningless, and the results can already be seen.

Namely, due to yesterday’s intraday reversal, the very short-term outlook deteriorated, and gold already plunged in the overnight markets.

Technical Analysis and Breakdown

Most importantly, gold just moved below its rising support line. This breakdown is not yet confirmed, so it’s too early to say that the implications are very bearish, but it already serves as a good confirmation that all the techniques that I’ve been describing previously are working. The big-volume shooting star reversal that materialized at the triangle-vertex-based reversal point, the weekly shooting star reversal and many more.

I previously asked you to buckle up, and if you haven’t prepared for the ride lower, this is another heads-up.

Silver just plunged as well. As it became clear to everyone (you knew in advance) that silver is not able to hold above $30 despite the second attempt to move there, people started selling.

This crystal-clear invalidation of the moves above the 2020 and 2021 highs strongly confirms that the top in silver is in (just like the top in gold most likely is).

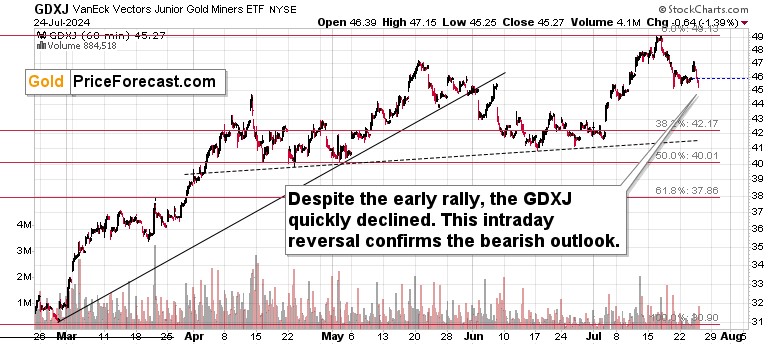

Meanwhile, the GDXJ also reversed and declined by over 1% despite the early rally. With bearish outlooks for gold and silver, it’s only natural to expect miners to move lower as well.

The re-test of the May highs as resistance was successful – this time, the GDXJ wasn’t able to move above this level (and the previous attempt to move above this level was invalidated) – making it even clearer that the next big move will most likely be to the downside

What does it all mean?

It means that if one has been waiting on the sidelines to see how things play out or they were waiting for more confirmations for exiting long positions or entering short positions in junior mining stocks or gold (or adding to them, or re-entering them if they got closed previously), THIS IS IT.

There are no certainties in any markets, but – in my opinion – the short-term combinations that come on top of the strong medium- and long-term indications that I’ve been describing previously create a truly superb opportunity right now.

*******

Przemyslaw Radomski,

Przemyslaw Radomski,