Gold Forecast: Global Stagflation: Does It Start Right Now?

Gold is the world’s greatest money. All the other financial markets are best viewed as simple tools that can be used to get more gold.

Currently, some tools are functioning better than others. For a look at a very shaky one:

This is the US stock market chart. There’s bear wedge action on the Dow and Aug 1-Oct 31 crash season is in play.

This is the copper chart. I’m comfortable with commodity-oriented exposure in the stock market… and copper is rising from significant $4 support.

The COPX copper stocks ETF is bouncing from $38 support at the same time as copper rebounds from $4.

For investors who have no copper stock exposure, now could be an ideal time to consider a grub stake buy.

Gold and the stock market have been moving together for quite some time, but I’ve urged investors to watch for a decoupling event… and it could have just occurred.

Oil has been slipping due to global growth concerns but the 2021-2025 war cycle is still a cyclical force to reckon with… and Iran-Israel tension is suddenly in play.

Surging oil is going to ring the stagflation alarm bell and that’s more bad news for stock market investors who have just lived through the incineration of their ridiculously overleveraged yen carry trade.

For a look at the daily oil price chart:

There’s a double bottom pattern in play. A move over the neckline at $84.52 would usher in the $96 target price.

If the rally fails, it’s going to be because global growth is falling so fast that even threats of a major mid-East war can’t keep the price up. It’s almost all bad news for the stock market, and good news for gold!

This is the short-term gold chart. There’s a loose rectangle in play and the target is about $2600.

This is a spectacular long-term chart. The bull flag breakout suggests the target is… $2800!

Today’s PPI inflation report and tomorrow’s CPI could create some short-term pullback in the gold price, but all major fundamental, cyclical, and technical traffic lights for this mighty metal are green.

The India duty cut (from 15% to 6%) is one of many such green lights, and it’s a far bigger game-changer for the gold market than most Western investors understand. I’m projecting it ultimately adds around 50 tons a month of fresh and consistent demand.

Rates?

Double-click to enlarge this horrifying US rates chart. A huge H&S top is in play and the neckline has broken.

Rates could be headed for the 3.2% mark, or even to 2.5%, and if that happens while oil rips to $96, the dollar could look like the remains of a rag doll, beat on by gold.

What about the miners?

This is the key GDX chart. There’s a broadening channel in play (bullish) and now there’s an important Stochastics (14,7,7 series) buy signal.

At my GU Swinger trading newsletter we are long both NUGT and the SHNY triple-leveraged gold bullion ETN from near the recent low… and looking good! If there is a swoon in the miners, our stoplosses have us protected. My swing trade newsletter offers great value at $269/3mths and I have a special $249/4mths special offer this week. Click this link or send me an email if you want the offer, and I’ll get you onboard! Thank-you.

While I think the H&S top scenario fails and the bulls prevail, navigating stock market crash season can be tricky and unnerving, especially for overallocated-to-miners gold bugs.

Put option “fire insurance” can help investors manage any crash season concerns. I suggest looking at October/November expiry GDX $32 and $34 strike price options. It’s cheap portfolio insurance that works incredibly well if there’s a crash.

Regardless, the gold stock bulls have the edge over the bears, and the edge is large. For example, individual senior miners are currently reporting blow-out earnings and incredibly low AISC (mining cost) numbers.

This is the BPGDM gold stocks sentiment chart. Note the green circles. Overbought situations can stay overbought and there are many examples throughout history of that occurring. A big one could be just getting started with the miners.

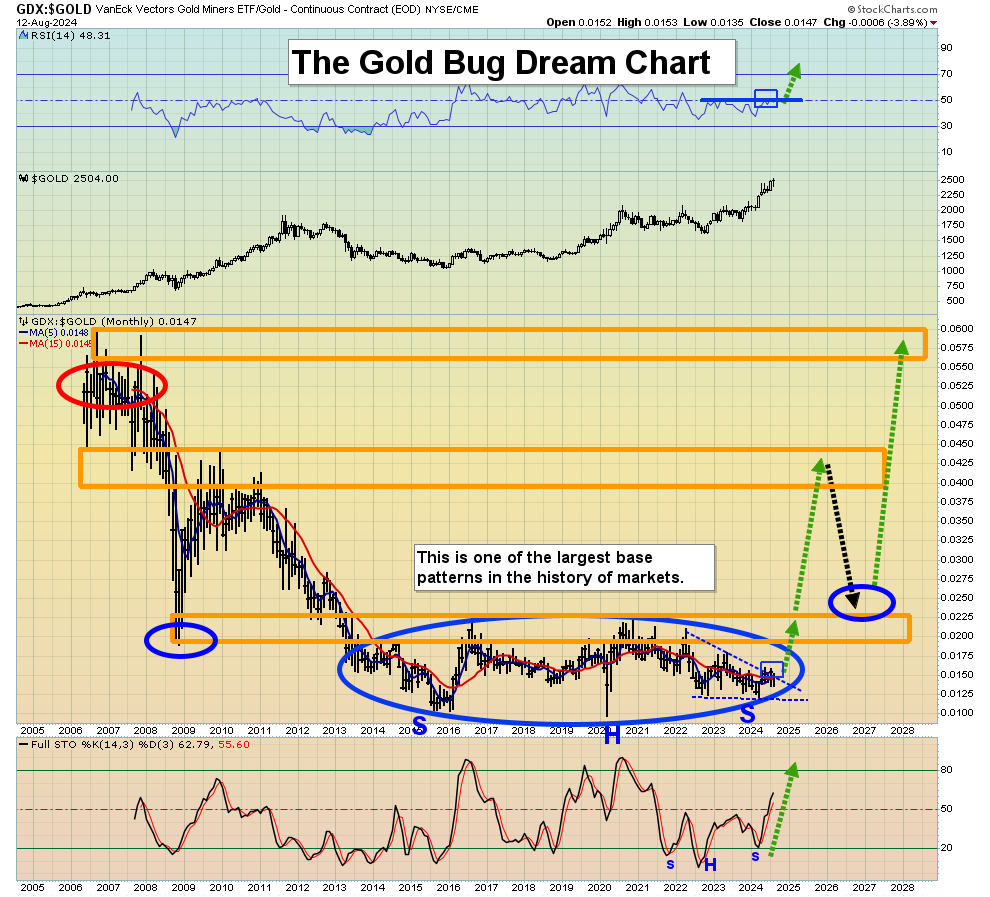

This is the stunning GDX versus gold chart. Mainstream money managers have recently tried to use “sector rotation” to move out of failing sectors and into those offering value… but that strategy has failed and here’s why:

The only sector offering what a hardcore investor would call serious value is the gold stocks… and it’s the only sector that can provide stellar performance in an era of stagflation. The PPI and CPI reports won’t show that inflation yet, but I’ll dare to suggest that most money managers will soon be ready to board a gold stocks jet!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: