Gold Forecast: $2800 & $3300 Targets In Play

Gold is the world’s greatest cash (money). For amateurs, setting target prices is most important. Pros simply want to identify price zones where they can eagerly buy more.

I’ll lay out these key zones today, and spice it with exciting comments on silver and the mining stocks, but first I’d like investors to look at some of the “backstage lighting” currently shining brightly for gold.

The double bottom pattern on oil is failing. It’s being overwhelmed by a H&S bear continuation pattern with a $60 target.

If the Fed needs a reason to cut rates, the fading global growth showcased by oil is certainly it. In the West, most gold pays no interest and a cut (or cuts!) in rates would get these gold bugs very excited.

This is the US rates chart. The H&S top action is ominous. It suggests a dangerous black stock market swan may be in the air.

For a look at the dollar index:

The price action is decidedly bearish. A rectangle is consolidating the downtrend and within it there is H&S bear continuation action.

I asked investors to watch for a bull flag for the “fiat safe haven” yen against the dollar, and now it’s here.

That flag is itself the right shoulder of an incredibly bullish inverse H&S pattern.

The US stock market often gyrates in August before crashing in September or October. The action of US rates, oil, and the dollar all suggest this crash scenario could be in the cards in the weeks ahead.

It’s unknown what the black swan catalyst will be, but it likely involves US debt in some way.

In the East, gold jewellery demand is surging in India while demand for coins and bars is on the rise in China.

This is bright background lighting for gold, which is already the greatest actor on the global markets stage!

In the short term, there is inverse H&S action all over this gold chart. It’s outrageously bullish and…

This is the weekly chart. The bull flag target is $2800, and the massive inverse H&S patterns targets a price well above that, at $3300!

A daily focus on the big picture (fundamental, cyclical, and technical) is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

In the long-term, price targets aren’t that important but buy zones are.

Aggressive investors should prep to buy the $2480 zone. It's solid support.

Conservative players should seek $100+/oz sales in the price, and they can begin to look at $2430 as their buy zone as the price moves towards the $2530 area.

A pause is likely at $2530, but it’s probably going to be followed by a rush towards $2800.

Investors who are new to ultimate money gold should buy a grub stake now, and it’s wise to include a bit of silver and mining stocks too.

For a look at the silver price action:

This is the monthly chart. The bullish action is magnificent!

Note the bull hammer candlestick within the flag pattern. Silver may be poised to stun the naysayers and begin a rise to new all-time highs. It likely plays out over 12-24 months and that new high would bring in a lot of money managers who seek outperformance.

From the highs on this chart, gold stocks are down about 75% against gold. This is not a time to issue a top call. It’s a time to accumulate the miners, and to do it with tactical precision.

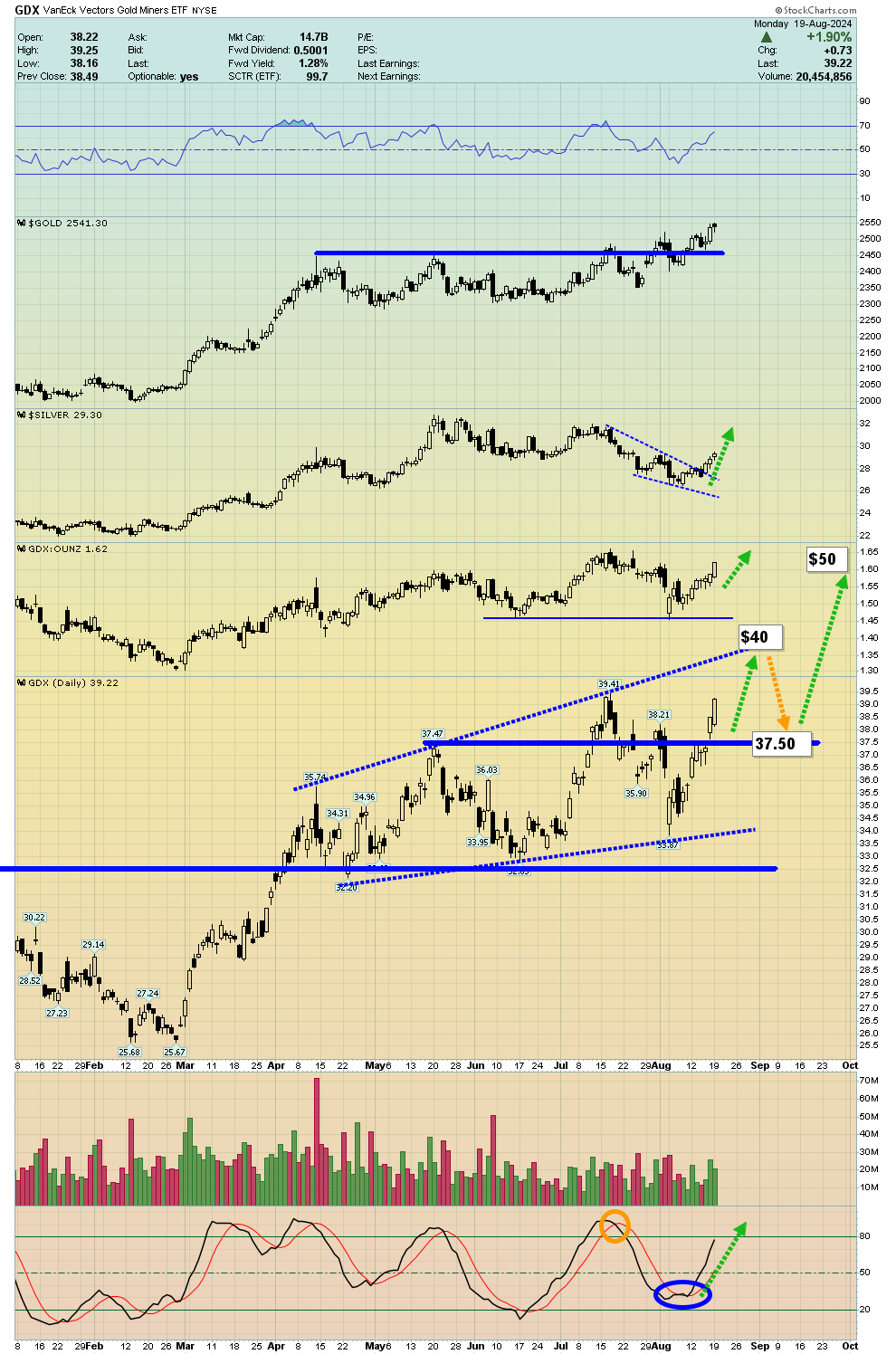

For a look at the GDX daily chart:

GDX looks to be making a beeline towards $40, which would correspond with $2530 for gold.

From there, a light pullback to the buy zone of $37.50 (and gold $2480 or $2430) is likely to occur. By late 2025, GDX should be not only at all-time highs, but it could be the most-loved ETF in the world. Many gold stock investors have waited patiently for this scenario to happen, and now their time in the limelight is here!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: