$ 1 Million Gold Price & Exchange Controls

It was always inevitable that the GOLD price would reach $ 1 million!

So, now we are there.

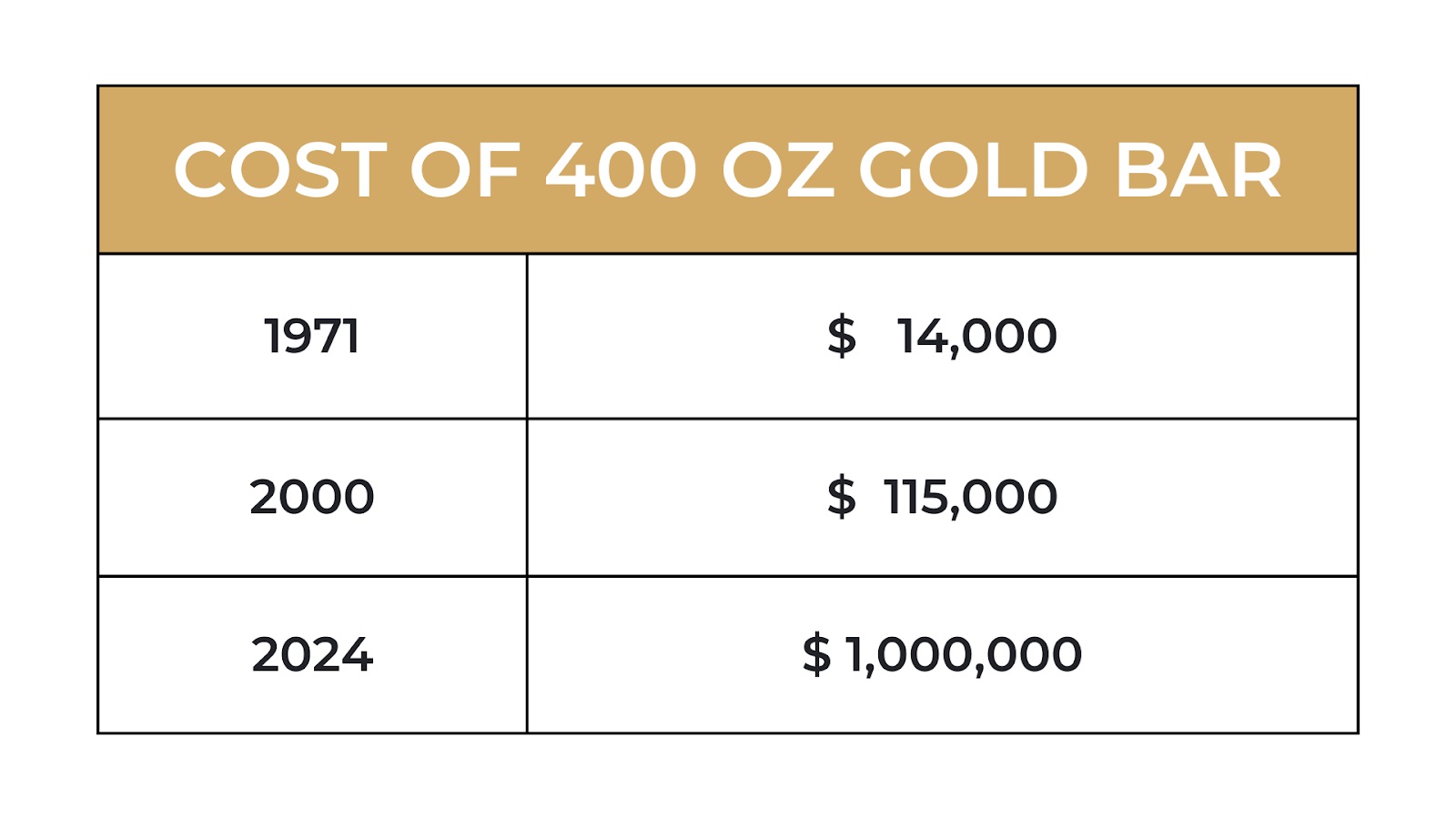

The price for a 400-ounce gold bar has now reached $ 1 million.

It reached $ 1 million on August 16, 2024 – 53 years and 1 day after the US (Nixon) permanently said farewell to the dollar as a store of value by closing the Gold Window.

Let’s just recap what has happened to the cost of a 400 oz gold bar since 1971:

So, has the value of gold gone up 71x since 1971? (71x$14,000=$1M)

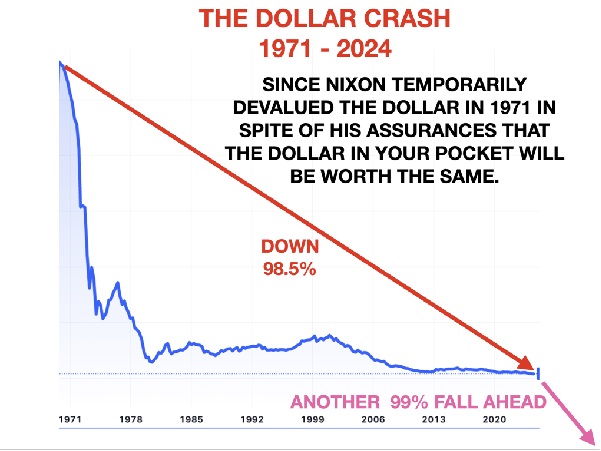

No, of course not. The dollar has collapsed by 98.5%.

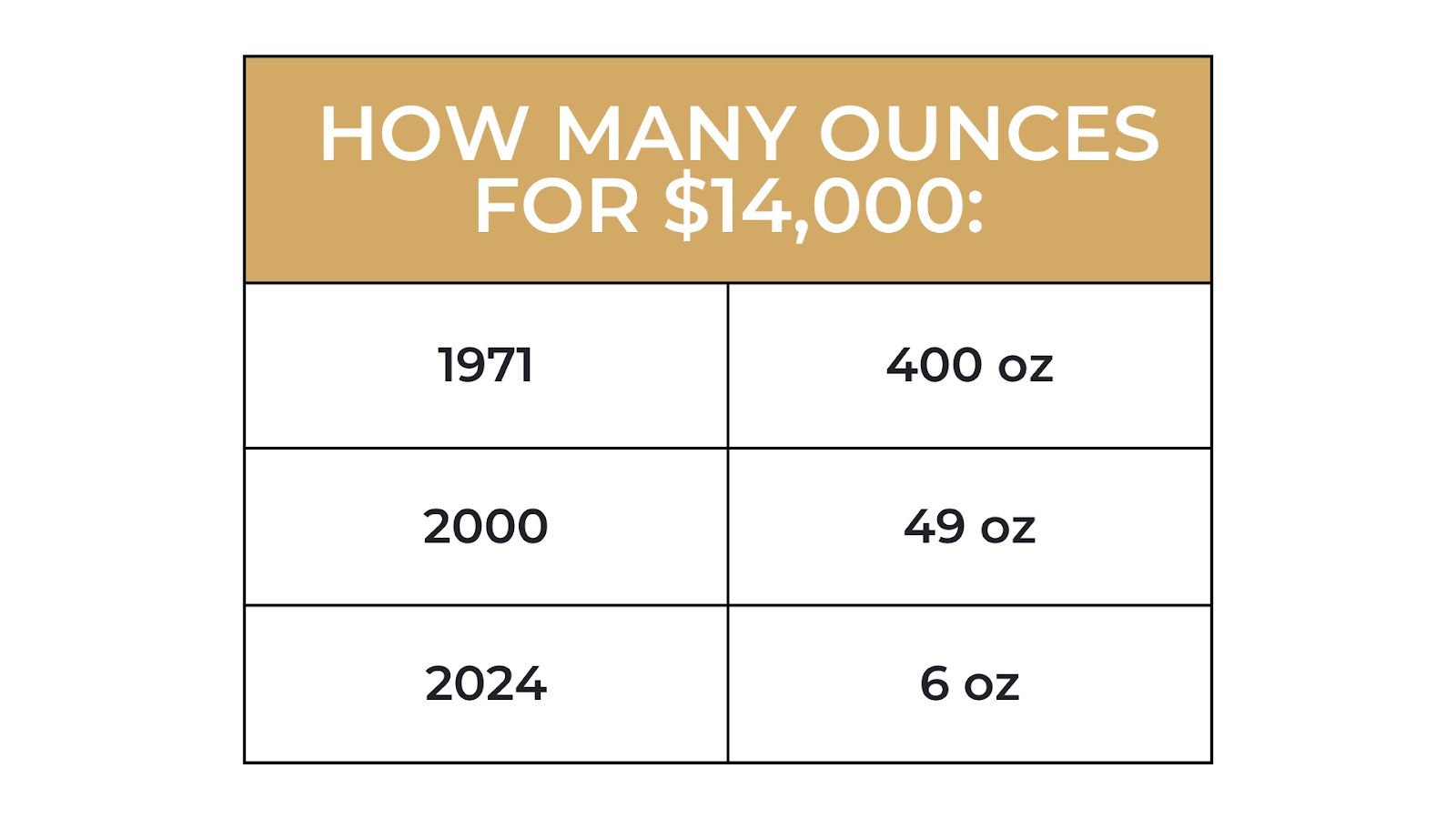

Or, if we look at it differently:

That is a loss of purchasing power of 98.5% over the 53 years between 1971 and 2024.

Just think about it: If you put $14,000 in the bank in 1971 and earned, say 4% on average, that would be $116,000 today. A far cry from the $ 1 million that the same amount invested in gold – REAL MONEY – would be worth.

So, what does closing the gold window actually mean?

It simply means that after August 15, 1971, the dollar could no longer be converted to gold by any investor, private or sovereign.

FOLLY OF THE WEST

Before we look at the fatal consequences, let’s just look at the Folly of the West.

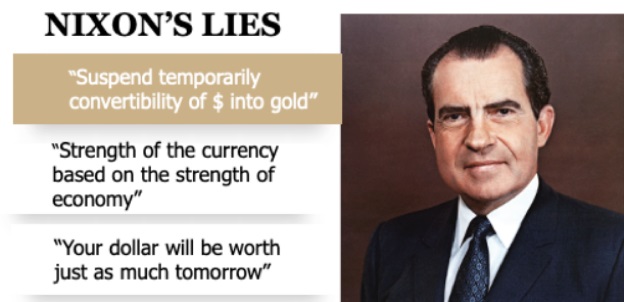

First, we see the West’s prediction of the consequences as interpreted by Nixon on 15 August 1971:

WISDOM OF THE EAST

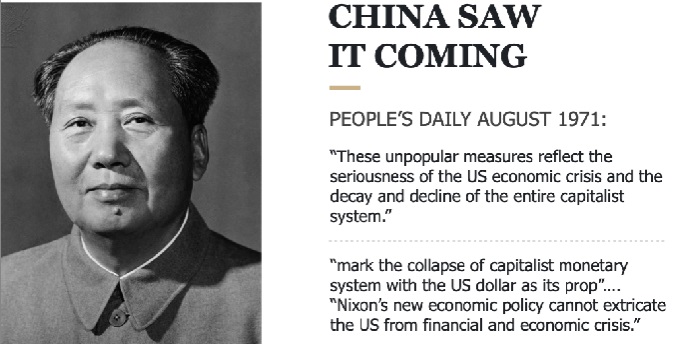

And below follows the Wisdom of the East (Mao) as written by the official Government body, the People’s Daily:

So the US (Nixon) said, “Your dollar will be worth as much tomorrow”.

And China said, “These measures mark the collapse of the capitalist monetary system with the US dollar as its prop”.

So the West is only interested in instant gratification, issuing debt and thus buying short-term prosperity and votes, leading to “decay and decline”.

DECAY AND DECLINE OF THE WEST

So, let’s look at the “decay and decline” of the US and the West reflected perfectly in the fall of the US dollar.

Here is the performance of the dollar since August 1971:

Nixon said in 1971 that the “strength of the currency is based on the strength of the economy”.

Hmmm…

A 98.5% fall in the value of the dollar (in real terms, against gold) since 1971 can hardly be called “worth the same”.

Measuring the dollar against gold is the only correct method to determine the real purchasing power of the dollar. To measure currencies against each other serves no purpose. All that tells us is which currency will win the race to the bottom.

What will destroy the dollar and all Western currencies, will be the exponential growth of debt led by the US.

US ROAD TO PERDITION

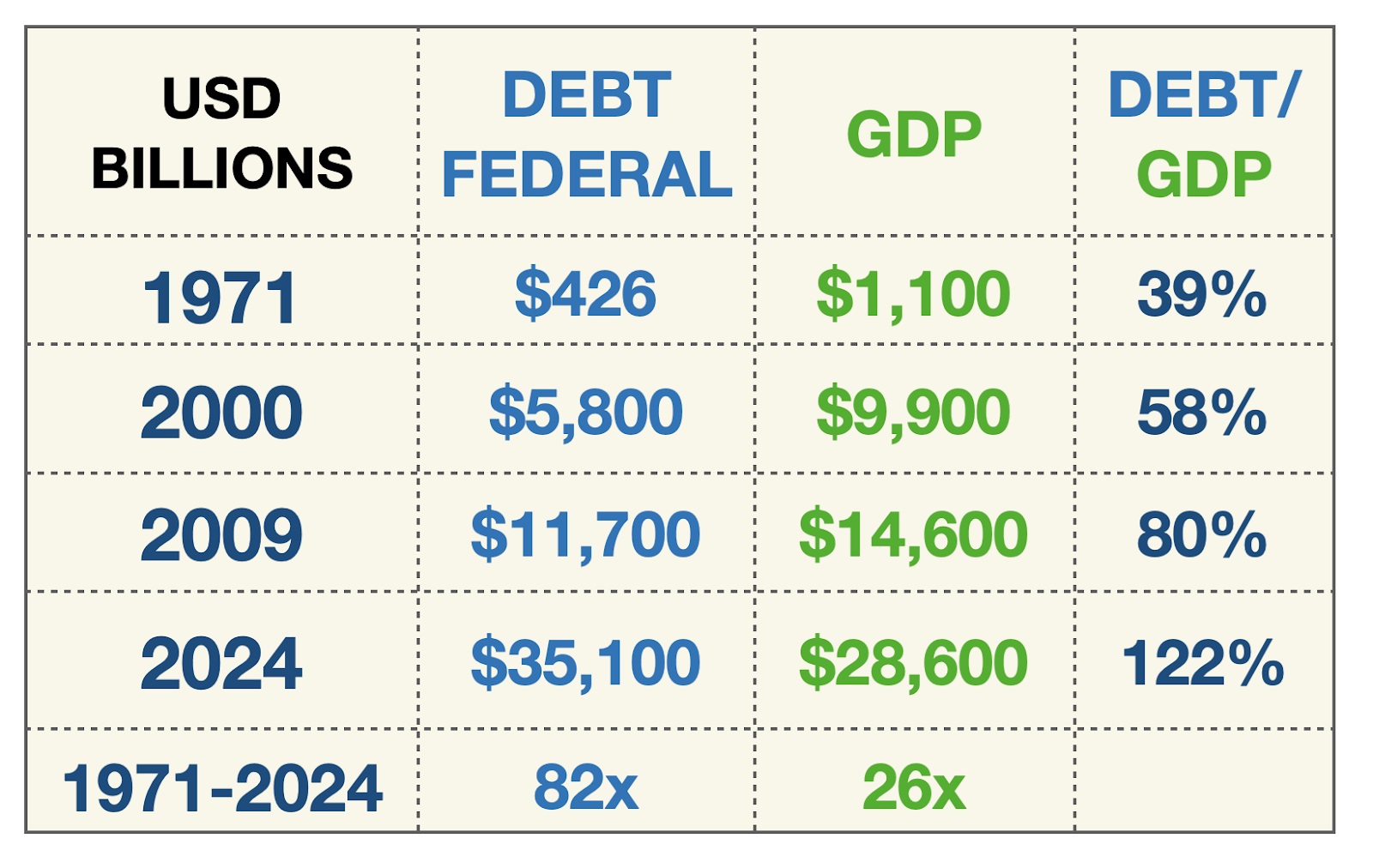

The table below shows the inevitable road to perdition that the US dollar’s is now on:

With debt up 82x since Nixon closed the gold window in 1971 and GDP only up 26x, it is not difficult to see that the US engine is running on empty.

Just look at the super-exponential phase of debt since 2009, the year that the Great Financial Crisis was supposed to have ended. Since 2009, US debt has trebled, while GDP has only doubled.

But it has, of course, not ended at all.

More and more debt is required to create growth. Consequently, since 1971, US debt to GDP has gone from 39% to 122%.

Over 90% of Debt to GDP is considered junk, and 122% is Banana Republic territory.

But it won’t stop there.

A pure statistical extrapolation of the debt trend tells us that by 2036, the debt will be $100 trillion.

I have explained many times how fast the exponents’ phase of a dot crisis and currency collapse develops: “THE REAL MOVE IN GOLD & SILVER IS YET TO START”

The conclusion is simple.

The US government, together with all Western governments, are destroying the fabric of society by constantly spending more than they earn. Even the word “earn” is deceitful.

Governments don’t earn anything. They will just wilfully levy taxes and other charges against the people without their consent. After decades of suffering from high taxes, people are entirely “socialised” and expect the government to pay for everything.

Do the people of the US and Europe want to send $100s of billions to Ukraine? Do they want to pay similar amounts for the immigrants, many of whom get preferential treatment when it comes to housing, social security, hospital treatments, etc?

Well, nobody knows what the people want since they are never asked. But I doubt they would approve this spending if they had a say.

WHERE IS THE MONEY COMING FROM?

Nor does anyone ask where all this money is coming from. It definitely hasn’t been earned by the government.

The government doesn’t even have the money it is paying out. It just creates money out of thin air and creates ever-increasing deficits that lead to exponentially growing debts.

The people are pacified since they believe that the government is paying. Nobody understands that all this debt is owed by the people.

CONSEQUENCES

But they can, of course, never afford to repay it in taxes and other levies. Nobody understands that the consequences will be the value of money dropping catastrophically, poverty, famine, shortages of many items, homelessness, social unrest and probably war.

And once a country reaches that stage, the government is powerless. They are bankrupt and have no funds to assist anyone. The risk of anarchy is high since the government will have few tools to maintain law and order.

So, how can we predict such a dark period? It requires no predictive powers but just a study of history. Please read “THE DARK YEARS ARE HERE II”, a 2018 update of my 2009 article. It was even more important today than it was in 2018.

Just take the US government’s mismanagement of the country’s finances as the inevitable journey to serfdom. With a handful of exceptional years, the US has increased the Federal debt since the early 1930s. Even during the so-called “Clinton surplus years”, the debt went up. So, the surpluses were fake.

AN ILLUSORY FANTASY GAME

As current growth is derived from creating debt with ZERO intrinsic value, the growth is only illusory.

The world will soon understand that it is all a fantasy game, with trillions of unreal assets created by even more trillions and quadrillions of debt (including derivatives) made out of thin air.

In the next few years, the world will realise that debt has zero value since neither sovereigns, corporations, or individuals can repay their debt or even afford the interest.

Remember that the official global debt is around $350 trillion plus a big part of the derivative time bomb which could be into the quadrillions. Much of that will transition to debt.

As the debt implodes, so will all the bubble asset values.

The billionaires will lose all or most of their zeros (of their wealth), and so will the trillion-dollar companies.

The wealth transfer will be shocking. The wealthy have the most to lose. Some have been clever and are debt-free. But most are leveraged and will lose everything.

Everyone will suffer, rich or poor. However, the poor and ordinary people have the most to lose with no reserves, no safety net, and a bankrupt government that can’t help them.

The few who have understood that future prosperity comes from natural resources will obviously be in a better position. Technology will also be a growth area, but it is currently overvalued, as it was in the 1990s.

The asset-rich BRICS countries will be major beneficiaries, whilst the debt-infested West will experience the end of a major era. These are all major shifts that will evolve over decades and even centuries.

But the beginning could be very rapid and most probably violent for the whole world, West and East…

So many factors come into play.

Economic decline, financial collapse, wars, political and social unrest, poverty, food shortages, as well as mass migration led to major cultural shifts.

So how can we be so confident that all this will take place?

Well, that is what history tells us with great certainty. History never lies, and it never fails us as lying politicians do, without exception, for their political survival.

But history doesn’t tell us when, of course. So, the exact timing is always unknown.

We also know that the world has never experienced a global debt bubble of such magnitude.

So, the timing is almost irrelevant.

It’s important to understand that the risk is now higher globally than at any point in history.

DOLLAR, GOLD AND EXCHANGE CONTROLS

As I have outlined in this article, a continued and steep dollar decline in the coming years is a virtual certainty.

As there has been no gold window to close since 1971, the US government is almost certain to implement foreign exchange controls as the dollar falls. I wouldn’t be surprised if it comes relatively soon, but the timing is irrelevant. The risk is here today and now is the time to prepare for it.

Thus, for Americans, it would be an advantage to have funds or assets outside of the US as soon as possible. Physical gold and silver are clearly the best assets to hold as they also protect against the dollar debasement.

Switzerland and Singapore are obvious places to hold gold. Switzerland has a strong currency and a very sound economy. Exchange controls would be unlikely here.

What is extremely important is not to hold your precious metals through a US company or other entity, which the US government can order to return the gold or silver from a foreign vault to the US.

Instead, hold your metals through a Swiss or Singaporean company that has no US links.

MOST PEOPLE CAN AFFORD SOME GOLD OR SILVER

For anyone who has savings, big or small, putting them into physical precious metals can make the difference between survival and misery.

Most people can afford to buy a few silver coins every month, and many can afford one or more small gold bars or coins.

With the acceleration of the dollar’s (and other currencies) debasement and shift in Central Bank reserves out of dollars into gold, the revaluation of gold in coming years will be by multiples. As I keep on saying, the real move in the gold and silver hasn’t started yet.

But above all, a harmonious and close circle of family members and friends is crucial to survive the difficult times ahead.

Courtesy of VonGreyerz.gold

********

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and