Easy Fixes for Social Security and Fair Taxes to End Deficits for Good

The bottom line is we need to pay for everything as we go and stop deficit spending, and there are only two avenues for doing that—raising tax revenues and lowering expenses. The closest we came was during the Clinton years when Bill Clinton wanted to solve the debt problem by raising taxes, while Newt Gingrich said, “Not so fast. Not without equal expenditure cuts.” The two hammered out a deal under considerable pressure that greatly cut expenses and reasonably increased tax rates to find the sweet spot.

Greedy rich Republicans have long sought to sell the idea that the more you lower tax rates, the more revenue government will bring in because the incentive to invest and work becomes greater. If that were true, cut the rates to zero and get more revenue than you ever dreamed of. Of course, it isn’t exactly true in the way many believe.

There is some truth to it, and it’s defined as the Laffer Curve; but it is a bell curve, not a straight line. By lowering tax rates from a very high level, such as the roughly 75% top rate they were set at before Ronald Reagan, revenue does increase as you lower them; but that benefit starts to fall off and then reverses to where, the more you lower them, the more quickly revenue falls. The sweet spot maximized revenue, and Clinton must have come pretty close to the actual sweet spot, not the theoretic one laid out by Laffer because revenue definitely rose with Clinton’s tax increases.

That still wouldn’t have balanced the budget if Republicans had not won hard-fought expense cuts. Between the two forces, we achieved, on one level of measuring, something never seen in my lifetime—a balanced budget. I say “on one level” because, of course, there continued to be many “off-budget” items, such as war expenses that weren’t in the picture. However, just balancing the main picture was a massive improvement that was allowing us to actually pay down government debt.

You can actually see that in this Fed graph of total US public debt:

That flat spot where debt stopped rising is a direct result of those tax changes and spending cuts. In fact, within that flat spot is actually a slight dip in debt just before George Bush blew it out to the water with his eponymous tax cuts that gave us, at that time, the steepest rise ever in government debt. I was outraged as soon as he announced his cherry check that would be coming to me for $4,000 in tax savings. I said, “For the first time in my life, I’m living in a country that is responsibly no longer raising any debt to pay for its expenses and is even paying it down and little, and George Bush is now going to destroy that forever just to give most of us a little tax candy but give his rich cronies huge tax savings.

As you can plainly see, the years of flat government debt ended immediately and debt soared by historic standards all the way until George Bush delivered us into the worst recession in my lifetime—the worst since the Great Depression. So much for all that debt spending being worthwhile because of the great economy it was supposed to deliver!

Once the Great Recession hit, government debt went completely out of control forever. That steeper elevator ramp up in debt also started under George Bush in his final year, and even the first year of massive government debt spending under Obama was approved in that final Bush year and simply carried out on its approved schedule during Obama’s first year.

Once we got on that path set by Bush, we continued up that steep ramp all the way through Trump’s term until the massive reboot that happened in Trump’s final year that sent government debt straight up like a rocket. It has gone completely out of control ever since, and it delivered us massive inflation to cut the value of your paycheck every month forever.

How to fix it

Fixing the problem is not hard. Go back to the higher taxes of the Clinton years that Bush wiped out and that Trump made even worse in terms of deficit spending, and go back to the much tighter budget during those simultaneous Gingrich years that Republicans deserve credit for, and stop giving tax candy to the babies who want to pretend you can just cut taxes forever and never have out-of-control debts or raise spending forever and never suffer the consequences that have already started to arrive from out-of-control debt. Stop playing pretend and own up to reality and live it! Suck it up, Baby!

In making the fix, I would do something much like Kamala Harris is proposing, but even simpler. I would completely eliminate the special capital-gains rate that got started in the Reagan years with the fake promise that it would trickle down from the rich to the poor. It NEVER trickled! It did not result in more factories being built to create more higher paying jobs. Why would you got to the enormous effort to build a factory so you could make money the hard way by earning it at very high risk of a new endeavor, only to pay higher taxes on all that you earned the hard way, when you could just make money the easy way by investing it in stocks and sitting on your investments and pay lower taxes under capital gains tax laws?

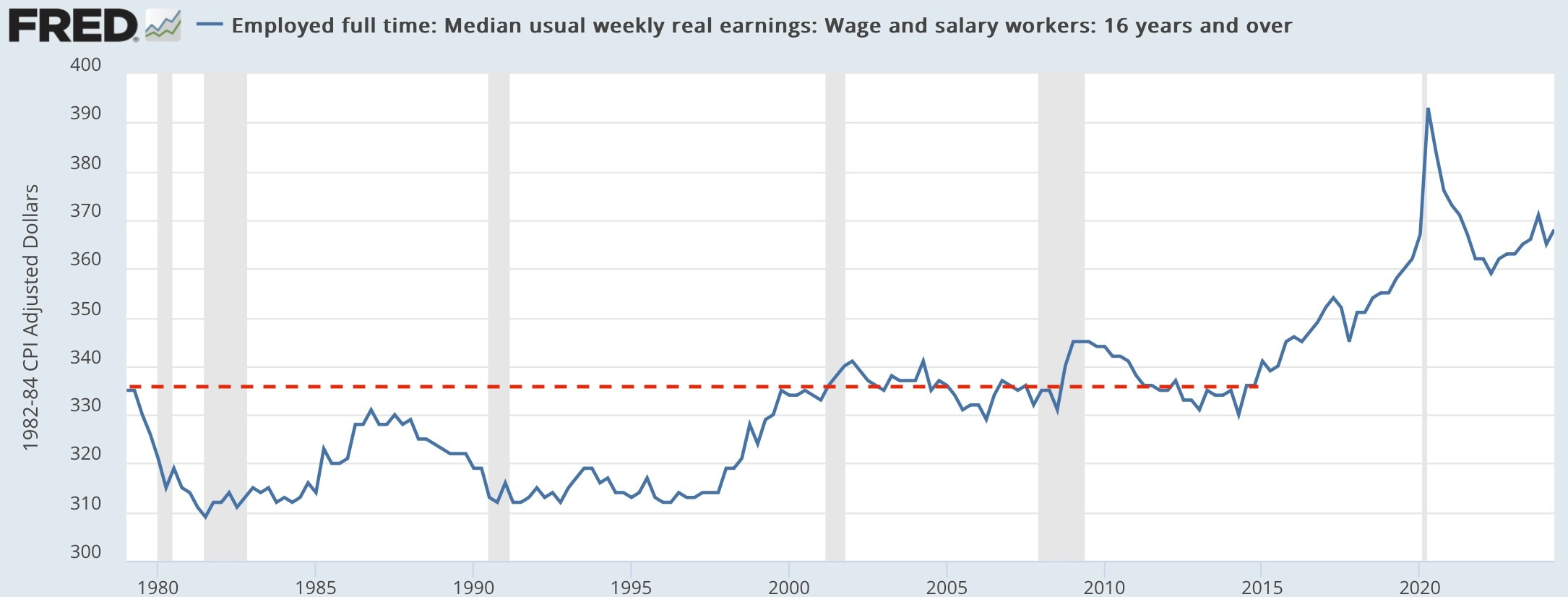

So, that is the only thing that ever happened. The money got endlessly re-invested in circles of finance that pushed up huge mountains of wealth for the very rich who bought football teams and works of art and other items taxed lower as capital gains, including stocks; and they became very wealthy; but here is what happened to the working man’s wages during all that time.

You can see that, adjusted for inflation, wages went down for two decades after “trickle-down economics” went into play; and, in fact, they did not rise and stay above where they had been just before the start of “trickle-down economics” until 35 years later! Income of the wealthy, however, went up astronomically—especially the top 1%.

So, why are average, conservative workers so bent on preserving the incomes of the wealthy from tax erosion while all the tax erosion has continued down in their tier of the economy? Ask yourself why you want the rich to have a LOWER tax rate on their capital gains than you pay on your regular income when you have to work so much harder for that income? Is it based on a fantasy that someday you’ll be in the top 10%, and you want to make sure the government can’t take any of that away from you when your ship finally comes in?

Is it based on a Republican lie that you’d be taxing the rich unfairly? Some Republicans love to point out that the rich already pay 80% of the taxes. They say that in order to convince you the rich are already paying way more than their fair share in taxes, bearing the load for the rest of us. What they don’t tell you is a truth many people would never guess because it is a truth so obscene: the rich pay 80% of the taxes because they make over 90% of all the income! If they were only paying their equal share, they should be paying 90% of the taxes! So, why give them a special break on capital gains when it doesn’t ever trickle down? It’s a lie and was a lie from the day it was told. Time to ditch the lie and any politician who tells it. It never trickled down! It never will!

The same is true for Social Security. Why do you want to protect 90% or more of a rich person’s income from Social Security (FICA or self-employment tax) when, for most readers here, none of your income is shielded from that tax? Is it due to a fantasy that someday you’ll live among that upper crust and you sure don’t want to have any of you income taxed away when you finally get there? Dream on. Live in reality.

The lie told, usually by Republicans, on this one is that it would be unfair to gouge the rich and tax them more to save Social Security. Who’s talking about taxing them MORE? It’s the same old lie! I’m asking why don’t we tax them the same amount we tax you? Why don’t you demand that? What’s wrong with an equitable tax system that stops shielding 90% or more of the income of the wealthy from SS taxes, but doesn’t shield any of yours? Remove the income cap. Why should they pay less in SS taxes by far than you do on money that is more easily made by just investing and sitting on the investment?

You could end the deficits, pay down the debt and make Social Security absolutely robust with better benefit payments for all by just ending those special tax shelters that enormously benefit the rich and only the rich. Moreover, the rich would still enjoy the huge tax benefit of deferment on capital-gains tax if you don’t tax those gains until the capital is sold or traded and the gain or loss is finally realized. That money can build for years just like a 401K without tax loss. Isn’t that benefit enough? Why give them a special huge tax break on top of that deferment advantage?

So, what I’m arguing for is a truly equitable tax system that stops giving massive charity to the richest of the rich—that taxes them the same as the rest of us on all of their income as the rest of us have to pay on all of ours. I’m, of course, also arguing for huge spending cuts, especially on giveaways to foreign nations that hate us anyway and on military adventures around the world, of which we’ve started too many. I’m arguing that we start paying for all the charity we intend to give as we go and that we pay for the military as we go, too. Stop pretending to be either charitable or strong by using your kids or grandkids money to pay for it all.

We do that, and we fix the system. One last simple fix I’d love to see is to end complicated income tax and replace it with a simple sales tax on the end user (not a value-added tax applied all along the chain). Vastly less complicated and harder to cheat on.

Why not just finally be fair?

Finally, don’t be fooled by Trump into thinking that tariffs are taxes other countries pay to us. All tariffs, import and export, are paid by American citizens. They typically get added to the price of imports that you have to pay at the store. If we’re lucky on export tariffs, the American exporter is able to raise his own prices enough to cover the tariff he pays and then those tariffs do get paid in higher prices by people outside the country; but, in reality, that doesn’t happen much because the businesses and consumers in the other country refuse to pay the higher prices and say they’ll just buy their products from countries that are not jacking up prices. We saw that during the Trump tariffs when other nations just refused to buy our more expensive beef under export tariffs and bought their beef from South America.

*********