Gold And Silver Had A Bad Week But So What?

Precious metals investors can’t look back at this week’s declines in gold and silver and not be a little upset. But it’s important to keep in mind that nothing happened this week that reversed the decade long bullish trends for gold and silver. So, keep in mind that for over a decade gold and silver have gone up for a reason; the mismanagement of the world’s monetary system by the global central banks. That plus all financial assets today have huge counter-party risk thanks to the fraud plagued OTC derivatives market, whose notional value is in the hundreds of trillions. Physical gold and silver have no counter-party risks for their owners, and this makes them especially attractive to forward thinking investors. This lack of counterparty risk also makes the old monetary metals objects of ridicule by the global financial industry, who market fraudulent “financial assets” by the trillions of dollars, euros and other currencies.

Are there any indications that central bankers have seen the error of their ways at the end of this week? Good grief no! The Bank of Japan has reaffirmed its commitment to destroy the yen as an economic asset, and the ECB is scheming to confiscate Cypress’s “excess gold reserves”. Our Doctor Bernanke is no monetary slouch either. Look at the post credit crisis Federal Reserve’s balance sheet in the chart below. Since 2008 the supply of newly created digital dollars has exploded. If US Currency in Circulation (CinC / Green Plot) lags behind the growth in digital dollars (Blue and Red Plots), it is most likely because the Earth doesn’t grow enough cotton to supply both the world’s textile mills and the US Treasury’s need for high-grade cotton based paper for its paper money production. That’s a scary thought that just might be true!

If the price of gold and silver have been correcting since 2011, it’s because after over four decades since the US closed its gold window, where foreign central banks could exchange their excess paper dollars for US government gold, the world at large has forgotten that once there was a linkage between the supply of dollars and the price of gold. This is true today, gold has been decoupled from the concept of money in the minds of most people. But remember that in the past few years, foreign central banks have once again seen value increasing their holdings of gold as a monetary asset, and have voiced concerns over the management of the worlds’ “reserve currency”; the US dollar. China and India are buying huge amounts of gold, as is Russia and other eastern central banks. The European Central Bank is looking at increasing its gold horde too. It has snatched Cypress’s “excess gold reserves” as part of its bailout package.

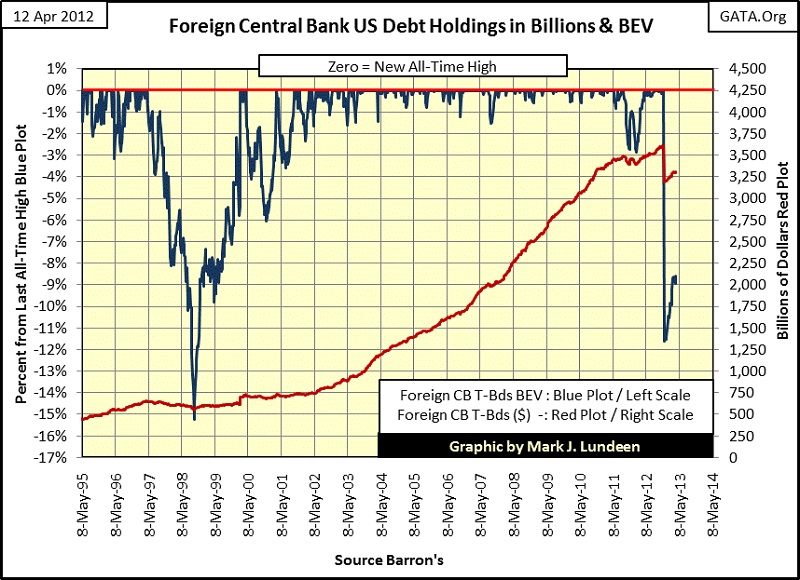

Currently, US Treasury bonds are the mainstay reserve asset for central bank “monetary policy”, but with the United States refusing to conduct its fiscal policy in a responsible manner, the ever rising US National Debt must be causing great concern for the future value of Uncle Sam’s IOUs. One week last November, the holdings of foreign CBs US treasuries dropped by 11.63%. We haven’t seen anything like that since the “Asian Contagion” of 1998. But the 1998 sell off was widely reported on in the financial media, but strangely last November’s 11% one week decline was not. This was a reduction of $420 billion dollars in the foreign central bank holdings of US Treasury bonds. How much of this money was used to purchase gold?

Back when Alan Greenspan could move the markets by mumbling total economic nonsense, it seemed to make sense to have America deindustrialize, and ship its manufacturing capacity overseas. The world would make what America wanted to purchase in exchange for digital dollars and AAA-rated US Treasury debt. How else could China have industrialized in just a few decades after Mao’s death? If Washington hadn’t burdened American manufacturers with unreasonable environmental, and other self-destructive regulations and a tax system that made domestic manufacturing unprofitable, former third-world countries, like China, would never have achieved the current world class manufacturing base they now have, and the American middle-class would not now be in dire straits for lack of viable employment opportunities. Obama’s healthcare law is just the latest of many legislated burdens on American industry the Democratic party has inflicted on the economy, and the Republican party will refuse to free business of.

However in the age of Bernanke, the benefits of accepting digital dollars and stockpiling US Treasury debt in return for manufacturing merchandise for the United States is beginning to become unacceptable to America’s trading partners. Currently, there is a growing trend where international trade is being conducted without the use of the American “reserve currency.” This trend has profound implications for the US dollar, and the price of gold and silver, as taken to its logical conclusion means that the world will no longer have an economic reason to hold dollars and US Treasury debt to conduct international trade. Trillions of dollars and US Treasury bonds will one day return to the one country that must accept them – the United States. The inflationary impact on consumer prices in the US will be significant as dollars flood back into the US, and consumer goods exit American markets. Can this happen? With the entrenched political interest now in control of Washington, what is there to prevent it from happening?

The United States faces real problems today, problems that are not being addressed by Washington. Look at our Electrical Power (EP) Consumption. Its last all-time high was seen in August 2008, and has been struggling for almost five years now. Washington’s economists and statisticians may claim that we are now seeing “economic growth”, but most of their statistics are measured in dollar terms. Go back and look at the Federal Reserve’s balance sheet chart above. Doctor Bernanke has increased the supply of dollars in the economy by over 200% in a vain effort to “stimulate” the economy. It’s actually shocking how little impact Bernanke’s quantitative easings have had on American economic demand for kilowatts.

When interest rates and bond yields once again rise to levels last seen in 2008, I expect to see demand for EP to break below its lows of 2009, and for the same reason; an interest-rate derivatives disaster that will disrupt the banking system ability to function. Absolutely nothing has changed since 2008. Washington is once again attempting to inflate a bubble in the real estate market as a means to “stimulate” the economy. It’s just a matter of time before we see another and larger credit crisis.

All and all, the reasons for owning gold and silver have never been stronger. The problem with the old monetary metals is that governments around the world currently don’t want to see precious metals prices increase as they over issue their fiat currencies. So, they look the other way as their banking systems use the world’s futures markets to flood the gold and silver paper markets with promises to deliver gold and silver that doesn’t exist to suppress metal prices. But this scheme can only work as long as the physical market can deliver real metal at artificial low prices. The West’s central banks have kept this scam going for well over a decade, but how much longer can they continue it? For as long as their gold reserves last I suspect.

Here’s an ugly chart! Clearly the “policy makers” are hoping to begin a selling panic in the gold pits. But the price of gold has been in a downtrend since August 2011. I doubt the gold bulls are shocked by this now old trick by the big NY and London banks. The buyers who like to purchase real gold by the ton, like Eastern central banks must be hoping for more of the same next week. No matter, even if the paper traders in the gold market can force another huge sell off, gold and silver’s current correction is getting very stale. I expect the price of gold in 2013 will become the thirteenth up year in a row. But even if I’m wrong, it changes nothing in a world whose “monetary policy” is controlled by incompetent bankers, academics and politicians.

Gold’s Bear’s Eye View chart is probable the best chart to see the damaged done to the price of gold since its last all-time high of August 2011. From the beginning of the bull market in gold in 2001, we’ve seen worse declines. Also note that if we compare our current bull market to the 1969-80 bull market in gold, our current bull market in gold has been a real pussy cat of a bull market when it comes to volatility and deep corrections. Look at the 2008 credit-crisis correction, gold declined only 29% when the Dow Jones saw a 53% decline. The truth is that since 2001, gold and silver bullion have been superior investments to blue-chip stocks for those investing for the long term, though this is a point never presented to the public at large by the financial media.

In silver’s BEV chart below, we see how silver is the more volatile of the two monetary metals, but actually silver has been more profitable than gold since their bull markets began over a decade ago. This has also been true since their credit crisis bottoms in October 2008. Silver’s D correction (the credit crisis) looks pretty bad, but it was only 4% points deeper than the Dow’s 53% correction, and then silver went on to new BEV Zeros in 2010, three years before the Dow Jones did. I can’t argue that correction E hasn’t been deep in both time and valuation, but it is only a correction in a continuing bull market; a time when one can accumulate silver at cheaper prices.

Silver still has a good way to go before it breaks below its decline of October 2008. It would have to fall to $20.80 to see a similar 57% decline. The question is can the big NY banks sell enough paper silver to make that happen? Sure they can, but what happens if someone should ask for actual delivery to settle their contracts with J.P. Morgan? Morgan is a bank, not a silver miner. It doesn’t have sufficient silver of its own to settle their massive short position that currently is counted in the hundreds of millions of ounces.

Normally this isn’t a problem, as most future contracts are settled in dollars. But it seems to me that we are currently living in historic times that to our great misfortune will be remembered for many generations to come. Wall Street and Washington have pushed things right up to the edge of the abyss. Something really bad is going to happen and it will start with an unexpected event that is off most people’s radar. Seeing J.P. Morgan defaulting on their naked short position could very well be the trigger to another economic crisis. But if not that, it will be something else will come along and knock this house of cards down in the financial markets.

One thing for sure is that many eastern central banks are now moving into gold, and away from the US dollar and US bonds for very good reasons. Knowing that is probably the best investment tip one could take in 2013.

Mark J. Lundeen