Here's What's Going on With Gold & Silver

Gold fell 2.42% today in continuation of last week’s price action. Gold is experiencing a normal pullback after its whopping 50% rise this year. I'm not worried one bit. I'm now watching $2,600 in COMEX futures and the uptrend line as key support levels. Ideally, I’d like to see a bounce from here.

After a breakout attempt on October 18th, silver got slammed back below the key $32 to $33 technical zone. I’m annoyed and frustrated by what may well be manipulation. If it is, regulators simply don’t care and turn a blind eye to it.

Despite that, silver is still in a confirmed uptrend and up nearly 40% this year. I'm waiting for another breakout attempt. For now, we just have to wait a bit longer.

I can see a lot of discouragement, frustration, and boredom taking hold within the precious metals community once again, and I want to urge everyone to keep the faith.

After gold and silver’s 50% rise in the past year, a pullback is normal and not the end of the world. Gold is ultimately heading to $5,000, $10,000, $15,000+, while I expect silver to hit several hundred dollars per ounce as global debt and the money supply continue their inexorable rise.

The stark reality is that Trump isn't going to save the world. Even if he could theoretically "save" the U.S. (which I don’t foresee happening), he has zero influence on overly-indebted Europe, Japan, China, Canada, Australia, etc.

We all need to accept that pullbacks are a natural part of this long-term gold and silver bull market and the unraveling of the unsustainable Keynesian monetary experiment.

The key is to stay calm and not overreact when these inevitable dips happen. Every epic bull market or asset has experienced pullbacks—Tesla, Amazon, Bitcoin, the Nasdaq 100, and even U.S. housing prices. They all consolidate and regroup periodically, and precious metals are no different.

This consolidation is actually positive; it’s a chance to accumulate more physical gold and silver while prices remain steady. Few of us are fully prepared for the balloon to go up just yet, so take advantage of these gold and silver “sales.”

As you can see, the S&P 500 has experienced several significant pullbacks during this ongoing bull market, yet it has rebounded each time, now achieving an impressive 809% gain:

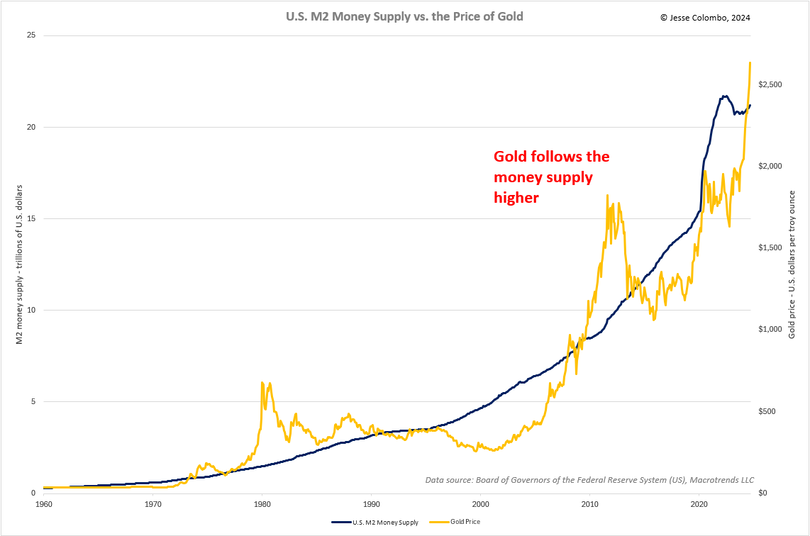

One factor that virtually guarantees that gold and silver will continue to rise over the long run is the non-stop surge of the U.S. and global money supply, which is what fuels inflation.

No president in modern history has ever addressed this elephant in the room, nor do I expect Trump to. The best bet is to expect this trend to continue during Trump’s term and beyond.

In conclusion, while gold and silver are experiencing a temporary pullback, history shows that all major bull markets have corrections along the way—and they often emerge stronger.

Just as the S&P 500, Bitcoin, Apple, and Nvidia have recovered from significant downturns to reach new highs, precious metals are also consolidating before their next upward movement.

The relentless expansion of the U.S. money supply and rising global debt remain fundamental forces driving the gold and silver long-term uptrend. Now is the time to remain calm and take advantage of this consolidation phase to accumulate more physical gold and silver.

Rather than being discouraged by adverse short-term price movements, let’s focus on the bigger picture: a powerful uptrend that points to substantial gains for gold and silver in the years ahead.

********