Metals: The Most Golden Zone To Buy

The financial markets action has been quite volatile since the election of “wild man” Trump and his team… and it could get wilder if tomorrow’s PCE inflation report shocks the market.

On the long-term weekly chart for gold, there is no significant volatility or price action of concern, but gold is not in a significant buy zone either, let alone one for silver and the miners.

Here’s a closer look at two key weekly chart oscillators; RSI (14 series) and Stochastics (14,5,5).

For gold to be defined as being in a solid “across the metals board” buy zone, it should be arriving at significant previous highs or lows on the weekly chart, and doing it with the RSI oscillator down to at least the 50 area, with Stochastics near the 20 zone.

The last time that occurred was in the $1810 area… and of course the rally from there was spectacular… most notably for supreme money gold!

Successful investing in all major markets requires substantial investor patience. That patience gets put to the test when the news changes dramatically and the daily chart action gets wild.

This is the daily close chart for gold. The $2450-$2300 buy zone of significance is clear.

It’s important for investors to have fiat cash placed with a metals dealer or broker in advance of a price sale into a zone to buy more gold. The same applies to silver and the miners.

Open orders for precise purchases can be placed with brokers and some physical metal dealers accept them too.

The news is always much more negative in a buy zone than during a phenomenal rally. If the investor fails to prepare for that change in the news ahead of time, their intestinal fortitude can falter when it actually occurs.

They get left behind, emotionally demoralized, predicting lower prices, and failing to buy… while the major banks and most citizens of China and India eagerly gobble up all the gold!

What about fundamentals like Trump’s treasury pick, and ceasefires in Gaza and Ukraine? Are these things negative for the price of gold?

Well, most global de-dollarization has been about the weaponization of the dollar and that’s unlikely to end. Also, the Chinese economy and stock market are likely to stay weak in the medium, creating additional citizen interest there in gold.

In India, the import duty has been chopped dramatically and the nation’s GDP growth is strong. The current gold price sale will be bought aggressively by millions of citizens there, who I long ago dubbed the world’s mightiest “Titans of Ton”.

Depending on what inflation is doing, falling US rates can be either a tailwind or a headwind for gold. Currently, inflation has been fading and rates look set to fall away from the neckline of a loose but large H&S top pattern.

That’s likely going to see real rates decline, which is going to make fear traders in the West buy more gold.

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

This is the long-term dollar versus gold chart. I’ve been suggesting a bear flag for the dollar could form and it might be doing so now.

If it fully forms, it would likely be completed near the key $2450-$2300 buy zone for gold.

What about the miners?

This is the GDX weekly chart. A move to $2450-$2300 for gold would be in perfect sync with handle formation on this huge C&H price pattern.

Note the Stochastics (14,5,5) oscillator action at the bottom of the chart. It’s getting closer to the oversold zone and GDX is a bit ahead of gold in that regard.

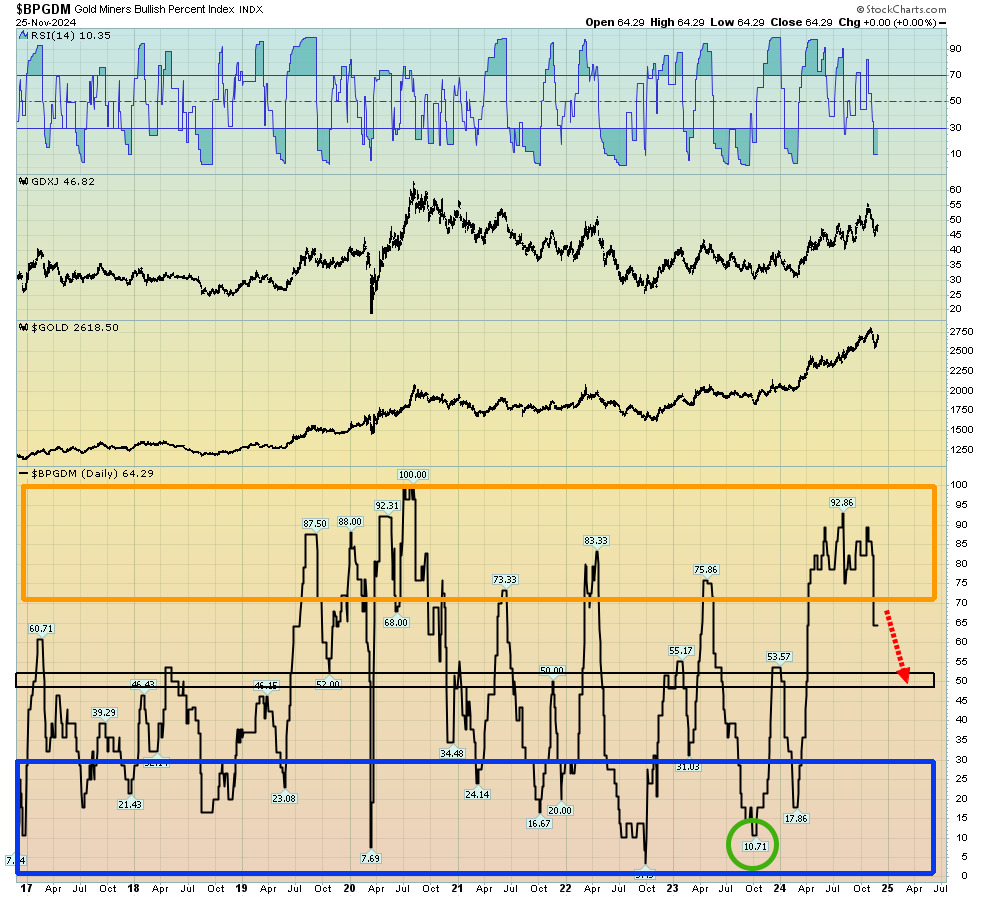

This is the BPGDM sentiment index chart. Key buy zones for the miners tend to feature sentiment indexes like the BPGDM moving down to at least the “midships” 50 area, but I prefer to see them in the sub30 area before I suggest investors buy with size.

The BPGDM has worked off its frothy overbought situation though, which is positive.

How best to sum up the current state of the metals market today? Well, from here, gold likely has the same odds of going back to the $2790 highs as it does of going down to $2450-$2300, but it’s only that key lower zone that gold stock investors of the world should be most prepared for… and eager to buy with size!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: