The Herd Is Even More Fearless than in 1929

Skittish about the stock market’s manic climb? Consider moving some of your savings into T-bills, which are currently yielding around 4.25%. You could do worse. Some of my friends are reluctant to take even a little money off the table because 2024 was such an incredible year for them. One is a retired lawyer who racked up a nearly $500,000 gain in Nvidia. She sold enough shares to buy a condo in Palm Beach, but her portfolio is otherwise unchanged and showing a return of about 40% for the year. She and her financial advisor are confident her portfolio will do equally well next year.

Both of my siblings had a similar experience, but they have since moved most of their nest eggs into Treasury bonds and bills. It has been an extraordinary year for them, and for millions of Baby Boomers who owned stocks, real estate or both. Who could blame them for thinking that the bull market begun in 2009 might have another year or two left in it?

On the other hand, valuations are at their highest levels ever, and a real estate downturn seems all but certain because mortgage rates are stuck at levels too high to attract first-time buyers. And few would deny the stock market is out of its mind, a beast on steroids; we all sense this in our bones. Consider the way speculators have shrugged off ominous tariff news. Trump has threatened our two biggest trading partners, Mexico and Canada, with protectionist levies that would punish U.S. auto manufacturers in particular and cause grocery prices to surge anew. The President-elect also seems hell-bent on implementing immigration restrictions that would boost hiring costs significantly.

He’s Bluffing, Right?

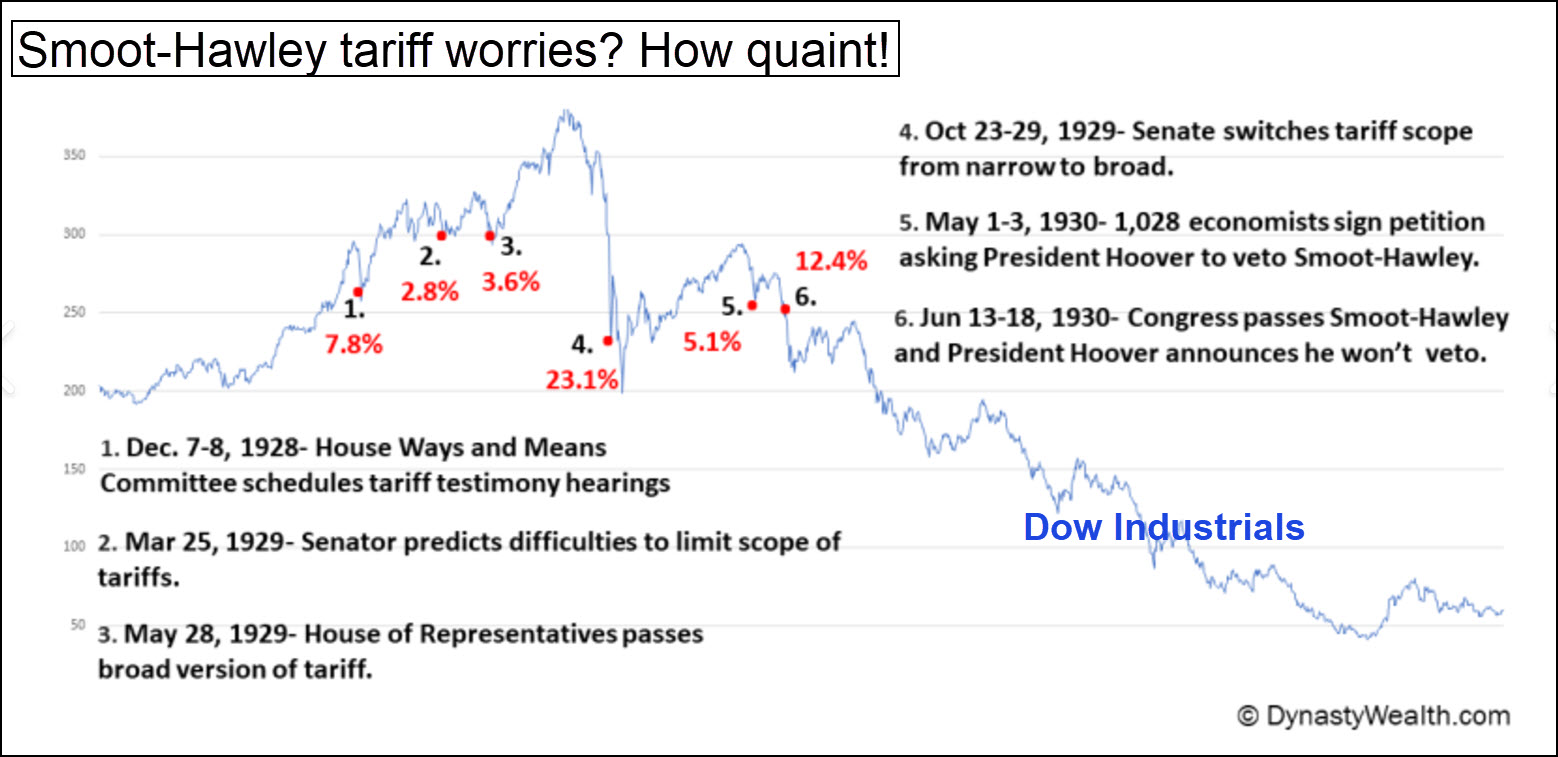

Toward the end of the Roaring Twenties, when Congress was debating passage of the Smoot-Hawley Tariff Act of 1930, investors grew increasingly obsessed with headlines concerning the bill’s odds of becoming law. When it appeared to pick up support on Capitol Hill, stocks would fall; but when the protectionists seemed to lose ground, shares would rise. This time around, facing tariff measures that make Smoot-Hawley look benign in comparison, investors remain not merely unconcerned, but giddy. Stocks rise on most days regardless of tariff news and despite the strident efforts of economists and editorialists to convince us that Trump is about to goad the world into a trade war. Investors must think he’s bluffing, and perhaps he is. If not, don’t be surprised to see the broad averages, along with Bitcoin, get nuked a few months after he takes office.

********