Gold SWOT: Central Bank Gold Inflows Totaled 2,575 Tons Over The Past Five Years

Strengths

- The best-performing precious metal for the year was gold, dazzling the world with a 21.41% premium afforded in 2024. Central banks, led by a gold-hungry China and joined by India and Turkey, unleashed a buying spree, adding over 1,000 tons to their reserves—a historic move to shield against inflation, currency risks, and global turmoil. India’s cultural reverence for gold, paired with booming GDP growth, turbocharged demand, while investors flocked to gold amid Federal Reserve rate cuts and escalating geopolitical tensions.

- According to Bank of America, central bank gold inflows totaled 2,575 tons over the past five years, with the largest buyers being China (+412 tons, a 22% increase in holdings), Türkiye (+359 tons or +141%), Poland (+299 tons, or +232%), India (+280 tons, or +47%) and Russia (+223 tons, or +11%).

- Silver is living up to its promise as the Fed interest rate-cutting narrative gains greater traction. The cheaper precious metal is outperforming gold by a comfortable margin. Right now, it is on pace to close out another quarterly climb in what would be the longest winning run since 2011, according to Bloomberg.

Weaknesses

- The worst-performing precious metal for the year was palladium, decreasing 20.8%. Palladium endured a crushing 2024, with prices plunging below $1,000 an ounce as weakened demand collided with a Russian supply glut. The rise of electric vehicles, which don’t require palladium for catalytic converters, and automakers substituting platinum, further eroded its once-dominant role. With oversupply persisting and job losses hitting mining companies like Sibanye-Stillwater, palladium’s decline cemented its status as the worst-performing precious metal of the year.

- According to Bank of America, production was widely disappointed with nine of 12 gold companies reporting guidance below Bloomberg consensus expectations. On unit costs, similarly, nine companies of 12 reported guidance that was higher versus Bloomberg consensus expectations. Total capex was better, with only four of 12 companies reporting higher capex than consensus. On conference calls, cost inflation remained very topical with most companies noting that they are still seeing cost inflationary pressures in certain areas (such as labor) while easing fuel costs has provided some offset.

- Shares of Victoria Gold Corp. plunged the most on record after suspending operations at its flagship mine in Canada’s Yukon, reports Bloomberg, following a heap leach failure. Its stock fell as much as 87% to $1 a share, its lowest since December 2002, in Toronto, after the Canadian bullion producer disclosed the incident at its Eagle Gold Mine.

Opportunities

- Silver has caught up and outperformed gold by 10% since mid-February, yet still at a gold/silver ratio over 80:1 and above the 10-year average. The 2020 ratio peak at 65:1 would equate to a silver price of over $37/ounce today, implying silver has room to move higher versus gold at current levels, according to RBC.

- For two years, J.P. Morgan strategists have urged investors to buy gold, and for two years they have been right. The bank predicted a triple crown, saying gold is once again the top commodity to buy. “Gold still looks well situated to hedge the elevated levels of uncertainty around the macro landscape heading into the initial stages of the Trump administration in 2025,” wrote a team led by Natasha Kaneva, head of JPM global commodities strategy. Gold's extended rally is reminiscent of the late 1970s, another period when inflation was a persistent problem.

- According to Canaccord, gold valuations remain attractive in their view with the senior producers trading at 0.69x NAV, up from a recent low of 0.57x but below the historical average of 0.81x and at the lower end of the 0.65-1.0x range. According to RBC, junior gold valuations have started to move higher along with metal prices, but they remain depressed despite historical levels and prior peaks. They continue to see significant value in the group at spot metal prices and strong potential for re-rating versus producers on increased appetite for new projects with better economics at higher prices. Costs have capped upside as well as a weak merger and acquisition (M&A) market.

Threats

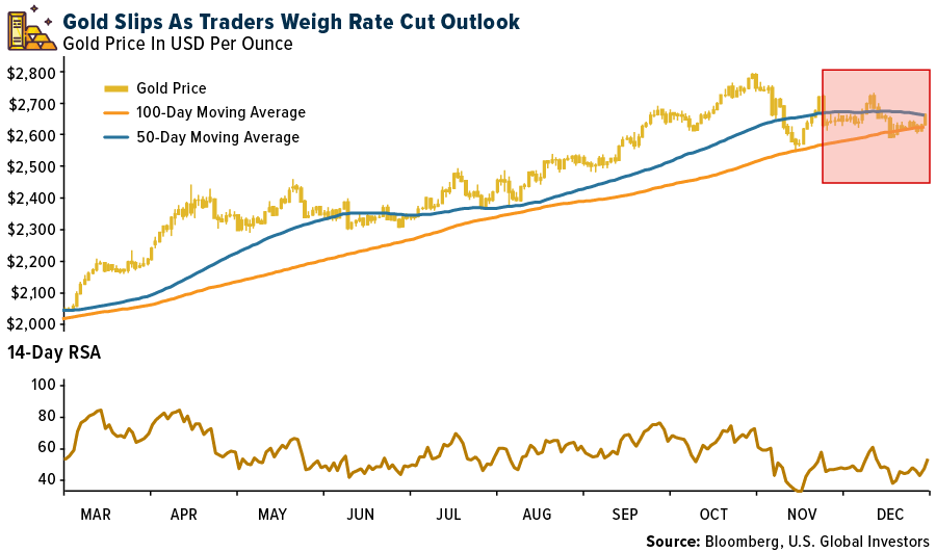

- Gold’s year-end outlook faces risks from a resurgent dollar, challenging the seasonal tailwinds that typically support the metal this time of the year. The precious metal typically sees its highest returns in December and January, with average gains of 2.4% and 3.5%, respectively, over the past 10 years.

- There has been a sharp decline in new gold deposit discoveries over the past few decades. Between 1990-1999, gold discoveries averaged 18 annually. This number fell in the 2000s to 12 discoveries annually, and then further declined to just four in the 2010s. Between 2020 and 2023, there have only been five major discoveries despite an increase in exploration spending, according to Bank of America.

- According to Scotia, the return on invested capital (ROIC) for the mining sector is 7%, on the lower end of most industries. ROIC varies among sectors, from the technology sector at the higher end (15%) to metals & mining (7%) towards the lower end. Overall, gold companies are generally in line with the ROIC seen in the mining sector.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of