Gold SWOT: Goldman Sachs Raised Its Year-End Target For Gold To $3,100 An Ounce

Strengths

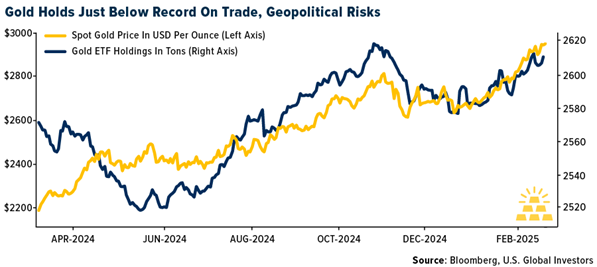

- The best performing precious metal for the week was gold, up 1.66%. Gold held near a new all-time high due to tariff threats and geopolitical tension. The metal's price was little changed near $2,935 an ounce after hitting a fresh record high of $2,947.01. Goldman Sachs raised its year-end target for gold to $3,100 an ounce, citing central bank buying, and predicted it could reach $3,300 if economic policy uncertainty persists.

- Torex's fourth quarter financial results were broadly better than BMO and consensus estimates, with earnings per share (EPS) of $0.81 beating BMO at $0.46. AISC of $1,112 per ounce and operating cashflow of $123 million represent modest beats compared to expectations. The first production from Media Luna was reiterated by end of March, and with free cash flow expected to turn substantially positive in mid-2025.

- According to Scotia, Wheaton Precious Metals reported GEO production of 633,000 ounces versus its estimate of 592,000 ounces driven by stronger performance from Salobo and Constancia (higher grades). Sales came in at 532,000 versus the expectation of 527,000. Wheaton guided 2024 GEO production of 550-620k; 2024 actual production exceeded the upper end of its guidance range.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.15%. According to JP Morgan, Anglo Platinum’s FY’24 EBITDA is 18% below its estimate, which corresponds to $1.1 billion PGM EBITDA at Anglo American for a 13% miss versus Bloomberg consensus $1.3 billion.

- Petra announced first-half 2025 financial results that indicated further reduction in costs, reports BMO, as the company continues to position itself for the diamond market weakness. However, Petra breached its loan covenants and has been granted a temporary waiver. Lenders are expected to re-engage with Petra following another round of planned restructuring. Richard Duffy has resigned as CEO - Vivek Gadodia and Juan Kemp have been appointed joint interim CEOs.

- According to Canaccord, Hecla’s fourth quarter production was weaker than anticipated, and financials generally missed estimates. 2025 guidance was also weak, with lower silver production, higher AISC, and total capex guidance that was 71% above its forecast.

Opportunities

- UBS is bullish on gold, as expectations for U.S. rate cuts are pushed out and is driven by continued: 1) official sector buying, 2) haven buying, 3) lack of positioning and 4) ongoing liquidity issues. Gold mining companies’ results to date have highlighted beats on returns, which UBS expects to continue to ramp up on the increased cash generation, before investment options run out and the inevitable M&A cycle ensues.

- Endeavour Silver's high-grade silver and gold discoveries at its Bolañitos Mine in Mexico reinforce its ability to replace reserves, expand resources, and extend mine life, with recent drill results showing notable silver-equivalent grades up to 4,839 gpt AgEq.

- Gold and gold miners stand to benefit from gold’s scarcity and stability compared to the seemingly unlimited number of cryptocurrency projects, reinforcing its role as a safe-haven asset while Bitcoin faces increased competition and speculative volatility.

Threats

- Uganda deployed more forces to eastern Democratic Republic of Congo, highlighting the growing risk of a widening conflict in the unrest-prone, mineral-rich region. Troops have been sent to Bunia — a town close to Lake Albert, which straddles the border between the two nations — to “control the escalating ethnic tensions in the region,” according to Bloomberg.

- FVI shares still trade like a silver company, even though it has completed its transition into a West African producer with its key assets now in Burkina Faso and Cote d’Ivoire. Looking ahead, the company will only generate 3% of its revenue from silver in 2025, down from 50% just five years ago. In CIBC’s opinion, it is a matter of ‘when’ and not ‘if’ the market catches up to the fundamental changes at the company.

- The latest survey of U.S. consumers shows that long-term inflation expectations rose to the highest level in nearly 30 years, with a consensus annual rate of 3.5% over the next 10 years. Consumer sentiment also dropped below consensus expectations and more than half the participants expect the unemployment rate to rise over the coming year, Bloomberg reports.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of