Economic World War II Is On!

(Due to the massively important and numerous events that swept the news on Tuesday, this editorial wound up becoming the kind of deep look normally reserved for Deeper Dives, so this week’s Deeper Dive is coming early because that is what it turned out to be. It was too important to wait, and that is why I’m making it available to everyone, except the headlines section reserved for paying subscribers, because everyone needs to understand how earth-changing the events of the day were. What has happened today, if no one quickly backs down, may change the globe significantly for years or even decades to come.)

At its worst level, the Dow fell 840 points today. It tried to recover, but courage failed it again into the close, leaving the Dow down 670 points at the end of the day for a total two-day plunge of 1300 points. Today’s wild action put the S&P 500 in the red for the year and left the Dow flat on the ground for the year. In fact, the S&P is now lower than where it was on Election Day, hours before Trump was elected. Today’s plunges were definitively pinned to Trump’s start of actual (versus the earlier feigned) tariff wars with various nations.

Yet, the market’s action is nothing compared to what really happened.

The battle is engaged

Canada lived up to its word this morning and immediately retaliated, as anyone would expect it to, with the matching 25% across-the board tariffs it had promised if Trump followed through on his threats. In counter-response, Trump immediately retaliated against the retaliation tariffs, as he said he would, by ordering the doubling of the US tariff on all Canadian goods, except oil, which will get a lower 10% tariff. That means a 50% tariff will exist on all goods from Canada.

Prime Minister Justin Trudeau laid it on the line:

"I want to speak first directly to the American people ... your government has chosen to do this to you," Trudeau said. He laid out how profoundly the ensuing trade war would hurt the American economy — noting markets are down and inflation could rise.

"Your government has chosen to put American jobs at risk at the thousands of workplaces that succeed because of materials from Canada, or because of consumers in Canada, or both," he added.

"They have chosen to raise costs for American consumers on everyday essential items like groceries and gas, on major purchases like cars and homes and everything in between," Trudeau said….

He dismissed Trump's claims that U.S. tariffs were necessary to ensure border security and prevent fentanyl from coming to the U.S. He noted that drug flow and illegal border crossings occur between Canada and the U.S. are incredibly low [less than 1% of the fentanyl that comes into America]….

Trudeau told reports [sic.] Trump wants to "see a total collapse of the Canadian economy, because that will make it easier to annex us," referring to Trump's desire to make Canada the U.S.' 51st state.

In summary, he said, “This is a very dumb thing to do”:

Generations of cooperation with Canada have been ended for now unless Trump backs down. Trudeau’s statements that this is going to be hard on Canada, telling his citizens to prepare for the worst, is strong evidence that Trudeau is not about to back down on a war he didn’t start that includes a battle for acquisition of his nation to put it under Trump’s rule.

Given the additional stories below about provinces in Canada retaliating by cancelling American contracts and about a rapidly widening movement among Canadian citizens to boo Americans and their national anthem at additional kinds of sporting events, I think Trudeau will have enough Canadian support to take that stand. No doubt, the one thing that cemented that resolve among Canadian citizens and their leader was Trump’s claim that he intends to take over Canada, abolishing its government by folding the entire nation into the US government as a 51st state. That is the kind of stuff I’m calling ham-fisted and self-destructive to any of Trump’s better aims.

(And, while this article comes down hard on the news of today because of the very negative impacts already pouring out of the news regarding tariffs, I hope tomorrow to focus on the best parts of Trump’s speech before congress and some of the really good things I think he is doing.)

This stuff is beyond insane. Taking over Canada is all-out imperialism on Trump’s part, and he is incredibly naive if he didn’t realize this would galvanize Canadian citizens into fighting back against his tariffs. By picking wars everywhere and offending everyone, even citizens of other countries who hear about a US takeover of their country by the US president, he empowers his enemies in the fight against his tariffs. Not smart timing. Prove you actually have made America great again for a few years before you even talk about annexing Canada, and then you might find, at least, a few Canadians who think joining the USA could be an improvement for them. Might.

China, today, also lived up to its threat to impose an additional 15% retaliatory tariff on US goods now that Trump has increased US tariffs against China by 10%. Its new tariffs will kick in on March 10. China has already shown it does not back down to tariff pressure. We are still in the original tariff war with China that Trump promised us would be easy to win—“So easy, just you wait and see.” Obviously, that was another Trump baldfaced campaign lie 8+ years ago. About six years after imposing tariffs on China, the war not only continues unabated but greatly intensified TODAY. So much for “easy.” So, China is not going to back down and has stated today,

The duties will “hurt” U.S.-China trade relations and China urges the U.S. to withdraw them, the ministry said in Chinese, translated by CNBC.

With today’s additional 10% tariff, the US tariffs on China’s products are now set at 20%. However, with the retaliatory tariffs announced today by China and then Trump’s promise of retaliation against the retaliatory tariffs, the final US tariff on Chinese goods is expected to hit 33% just based on everything already promised. Note quite clearly that Trump’s threat of retaliatory tariffs if other nations imposed their own did nothing to dissuade them from their own retaliation.

Mexican President Claudia Sheinbaum said Mexico will respond with its own retaliatory tariffs and other measures that it will announce this weekend.

“It’s inconceivable that they don’t think about the damage this is going to cause to United States citizens and businesses with the increase in prices for things produced in our country,” Sheinbaum said. “Also the damage it will cause by stopping job creation in both countries. No one wins with this decision.”

So, as Gregory Mannarino puts it, the world is now at war:

The first collateral damage of the tariff wars

Given how tariffs will enormously jack up the costs of doing business, companies with clear connections to foreign goods used in their products or services saw their stocks tumble today:

Shares of companies with significant imports came under pressure. Shares of GM and Ford dropped more than 4% and nearly 3%, respectively. Chipotle, which sources about half of its avocados from Mexico, slipped 2%. Target shed 2.5% with its CEO saying prices for some produce would be going higher in the next few days because of the tariffs….

Best Buy shares fell more than 12% in early afternoon trading on Tuesday, a move lower that put the stock on pace for its worst day in nearly five years….

The decline comes on the heels of the company’s chief executive, Corie Barry, warning on an earnings call with analysts that U.S. President Donald Trump’s 25% tariff on goods from Mexico and additional 10% tariff on goods from China could lead to higher prices for consumers.

“We expect our vendors across our entire assortment will pass along some level of tariff costs to retailers, making price increases for American consumers highly likely,” the CEO said during the call.

However, the reaction in the stock market was not limited to companies sourcing their parts or ingredients from the newly tariffed nations:

Bank and retail stocks led the way down on Tuesday as investors feared that the levies could lead to another hit on economic growth.

Such were the big shocks of the first volley.

The inflation conflagration

From those comments by major retailers, we can say, so much for Peter Navarro’s vain assurances a few weeks ago that the Trump Tariffs would not cause inflation as well as the new US Treasurer’s assurances yesterday that said they would not cause inflation. I spelled those out as lies or gross naïveté already, but now we have proof as stores are practically lining up to state clearly they will be rapidly raising prices:

Shoppers could see higher produce prices within a matter of days after a 25% tariff on Mexican and Canadian imports took effect Tuesday, Target CEO Brian Cornell warned—as the levies sparked retaliatory measures from Canada and China and fears of a trade war.

Consumers “will likely see price increases over the next couple of days” on fruits and vegetables, Cornell told CNBC Tuesday, noting that the U.S. depends on Mexico for a “significant amount of supply” during the winter months.

As I wrote yesterday, companies are likely to be much quicker in handing tariffs off to consumer this time than they were last time because many companies have already eaten as deeply into their profit margins as they were willing to in order to initially avoid passing tariffs off and losing market share. (This is one of the big factors that I’ve said is different this time than with the first and much smaller tariff wars.)

As consumers became more willing to pay the increases as being inevitable, some companies may have adjusted their margins back up, and are making bigger overall profits because those margins are applied to much larger costs of goods sold. But, if they had the ability to do that an not lose market share, they won’t be so likely to hold off on doing it this time, now that they think the consumer is expecting to see inflation.

Maersk, the Danish shipping behemoth, has its octopus fingers broadly across the many pulses of commerce as most of those retailers use its services, and its CEO firmly agrees:

As a result of President Trump’s tariffs on Mexico and Canada, prepare for higher prices to hit soon.

That is the message from shipping giant Maersk about the escalating trade war between North American nations. While the White House says inflation is not a concern, Maersk’s view of the U.S. economy matches that of retailers and trade groups that the new tariffs on Mexico and Canada — and retaliatory tariffs from these countries — are an inflationary threat to the U.S. economy.

“The short-term effect of any tariff clearly is inflation,” said Charles van der Steene, president of North America for Maersk, the second largest ocean freight carrier in the world. “It’s inflationary in its essence,” he said….

Of course, Maersk has much to be concerned about because all these back-and-forth tariffs will have a huge impact on back-and-forth shipping. So, Maersk is undoubtedly not too happy.

I guess the White House talking heads, including newly minted Commerce Secretary Howard Lutnick, just were not smart enough due to not reading The Daily Doom to know why this time was going to be SO much different than the last time when Trump’s tariffs did not appear to cause inflation. I’ve been spelling out the major differences between now and then for them; but they’ve been strangely uninterested in reading here … as have a number of Trump followers who fled my site as paying subscribers for pounding the pain the tariffs will bring, assuming, that is, that Trump stays with them and doesn’t chicken out and then cop an excuse that says he achieved what he intended. As of now, he’s achieved absolutely nothing.

(However, I don’t write for popularity or wealth—though both would be nice—just truth wherever it may be found and against whomever it happens to fall, hoping against all hope that there is an audience for actual truth versus partisan politics. It often seems there no longer is. It may be a small audience, at best, but fine: then The Daily Doom will be a quaint, niche publication. So be it if that is where the truth lands me.)

One of the things I’ve pointed out as different this time is the state of the consumer for bearing up under inflation—the weariness of the average citizen of paying endlessly for the profligacy of earlier years of financial policy, particularly from Obama through Trump and then Biden. We get a measure of that price fatigue in another news story today—a fatigue that will make Americans much angrier over any renewed rise in inflation:

First, shoppers squeezed by inflation began ditching name-brand snacks and drinks in favor of lower-price store brands. But now, with costs for coffee, eggs and other basic grocery items surging, consumers are cutting out many cheaper items as well. That has TreeHouse Foods, one of the country’s largest manufacturers of private brands, feeling the pinch.

The maker of cookies, crackers, coffee and other goods for retailers such as Walmart, Whole Foods, Trader Joe’s and Target, gained ground in recent quarters as inflation pushed shoppers into cheaper food options. With sales growth now slowing significantly, TreeHouse is working to protect its margins by slashing costs and fine-tuning its list of products, anticipating that shoppers will remain stretched, at least for now….

Economic World War II

The first major tariff wars started by the United States occurred after World War I, and they left us in a global state of economic depression. The International Chamber of Commerce framed the Trump Tariff Wars in dire terms today, saying that the crossfire of tariffs on tariffs could easily send the entire world back into a Depression like the one we saw in the 1930s.

High tariffs on foreign goods imported into the U.S. in that decade contributed to a damaging global recession. The downturn plunged nearly a third of the global workforce into unemployment and slashed production at heavyweight industrial economies Germany and the U.S. by half, according to research from the International Monetary Fund.

The likelihood of a similarly severe blow to the global economy is high, Wilson said in an interview Tuesday. “Right now it’s a coin-flip,” he said. “It comes down to whether the U.S. administration is willing to rethink the utility of tariffs.”

So, the Second World War in tariffs could easily lead us into the second Great Depression just as the first such war in tariffs led us into the first Great Depression.

While the Don has showed every tendency to talk brash, slam people around and then back down from his brazen actions when he gets some minor form of capitulation, he has also said that tariffs are part of his new tax plan. So, without them, he cannot give all the income-tax cuts he promises. (Of course, tariffs are just a sales tax on American businesses and consumers that replaced income tax.) The extent to which Trump wants to switch the US to this form of revenue capture as a replacement to income taxes may make him reluctant to back down on his tariffs.

“That puts us in a remarkably precarious position that will cloud the global economy for the coming months,” Wilson said.

The dollar’s demise

Everyone reading here knows I’ve held out against the idea of any imminent dollar collapse due to the BRICS nations and sanctions against Russia and even crypto currencies and central bank digital currencies. The dollar would weather all of that, I’ve said, but that was all before any talk of the Trump Tariffs, much less the present spectacle of absolutely massive tariffs raining down all around us, practically compounding by the minute with retaliatory moves.

In this scenario, Deutsche bank adds a twist to the concern about a recession that turns into a global depression. DB suggested today that the tariff war could also finally be the straw that breaks the dollar’s back:

Deutsche Bank Sees Risk of US Dollar Losing Safe-Haven Status

“We do not write this lightly. But the speed and scale of global shifts is so rapid that this needs to be acknowledged as a possibility,” said George Saravelos, the bank’s global head of FX strategy, in a note to clients. “It is hard to over-estimate the scale of change taking place in global economic and geopolitical relations in a matter of days.”

No one will argue against the statement that Trump is making the most massive and rapid changes to government and economics most of us have ever seen; but with major changes happening so fast (and some being carried out by people barely past puberty), the chance for major mistakes—even catastrophic errors—is high.

Obviously, trade is the heart of the dollar’s role as the international trade currency. It is because the whole world sells so many products into the United State’s vast economy that the dollar has become king. Oil is a part of that as the dollar was particularly tied to oil trade by Nixon via Henry Kissinger’s diplomacy. With trade likely to go down more and more, the longer these tariffs stay in place, the less need there is going to be for dollars. That poses a huge additional collateral problem for financing the US debt.

With some nations already turning away from the petrodollar and transacting in their local currencies due to US sanctions, and with the European Union announcing today that it will be rapidly ramping up its defense spending to adjust to US President Donald Trump’s abrupt withdrawal of American security, likely by purchasing weapons from its own manufacturers, need for dollars is dwindling. What sanctions and BRICS retaliation never even came close to doing, US withdrawal from European defense and widespread implementation of very high tariffs may accomplish at last. Again, it depends on how far this goes.

Like Deutsche Bank, I am …

starting to become more open-minded to the prospects of a broader weaker trend unfolding” for the dollar, Saravelos said. “Two pillars of America’s role in the world are being fundamentally challenged: the US’s security backstop for Europe and the respect of rules-based free trade.”

I’m not there yet; but the past week’s sweeping chaos from Trump has stood so many global relationships in trade and defense on their heads in a mere matter of days that his changes may be diminishing the United State’s roll throughout the world enough to finally start knocking the dollar down. That is all the more likely as he is doing so much to raise anti-American sentiment all over the world at the same time (aside from the tariff wars), even among allies we’ve stood beside since the Great Depression and World War II. Old alliances seem to be crumbling at his command. Anti-American consumer and business and government sentiment by itself may start to push investors away from US debt just because they don’t want to think of themselves as, in any way, helping America. We are starting to stink in their perception.

As a prime example, the Canadian province of Ontario has just announced it will rip up its $68-million contract with Elon Musk’s Starlink, and the reasons given are clear:

“We’re ripping up Ontario’s contract with Starlink,” Ford said during a press conference. "It's done, it's gone. We won't award contracts to people who enable and encourage economic attacks on our province and our country."

While that hurts Musk more than it does the US, it shows how retaliation is now becoming the sole motivator for terminating business relationships that only a month ago people saw as positive. Gone. Out the window. In this way, Trump’s brash treatment of other nations will complicate the troubles of his tariff wars and of the dollar’s diminishment due to lack of trade in dollars. Nations doing all their trade with other nations can forego US dollars.

Ontario’s move does, however, hurt a broader swath of the US economy because Ontario’s premier included in the announcement that Ontario’s government will be terminating all contracts with all US companies. They will all be banned:

“This is not the outcome anyone wanted,” Ford remarked. “We could have poured our effort into making Canada [and] the U.S. the two richest, most successful, safest, most secure two countries on the planet. Unfortunately, one man, President Trump, has chosen chaos instead.”

The impact of foreign retaliatory tariffs on US goods

While US tariffs raise the price of foreign goods flowing into the US, the retaliatory tariffs raise the price of US goods being exported to other nations. That means our farmers and other producers will be facing the same pressures to lower their prices that Navarro & Co. said would force foreign sellers to lower their prices to pay for the tariffs. So, US soybean and corn growers and hog raisers will face either lowering their prices or losing export sales.

Prices may be forced down on things produced in the US that are sold to Americans too. The way that could work is that Farmers who cannot sell piles of pigs and stacks of soybeans into China as easily with high Chinese tariffs on those goods may face a growing supply overstock, which could pressure them to reduce prices in the US in order to clear stock. Either way, Americans take a loss. In that case, it will be American farmers, and it may be American taxpayers who are—just as happened under the first tiny Trump Tariff Wars—asked to pick up the tab and subsidize the farmers—a proud lot who have no desire to live off of welfare. The farmers may not be thanking him as Trump envisioned.

China’s retaliatory tariffs on agricultural exports from the U.S. could make the oversupply issue a bigger problem for American producers, at least temporarily, Hanley said. This is particularly true for soybeans, as about 42% of the U.S. soybean crop is exported, he said, with a big portion of that going to China.

“Imagine now we have all of those soybeans that we thought were going to go to China, they’re staying home. They’re staying home until we can find a new market. … That supply just weighs down on U.S. soybean prices because we go from having enough to having plenty,” Hanley said.

Peter Navarro sees this as offsetting inflation. However, since we import far more than we export, the reduction in prices due to American producers being pressed to sell all their products inside of America is still not going to even out inflation nor prevent the loss of jobs as overstocked American exporters reduce production. It’s hard to say with clarity, of course, how all of that will actually sort out because we don’t know to what extent American consumers will be pressed by loss of options due to the import tariffs to consume all of the export stuff that no longer exports. However, when you enact it all instantaneously, you are likely to find out the hard way.

Relationships of many kinds have changed massively in just the few weeks since Trump took office:

“As Canadians we must now recognize the relationship with our closest friend, ally, and trading partner has fundamentally changed,” Linda Baiton, president of the Canadian Association of Petroleum Producers, said in a statement. “In this moment, we must act with urgency to focus on the Canadian national interest.”

It might be nice to think we can always just flip the switch back and restore the relationships if this turns out bad for the US, but, as I wrote yesterday, we might not be able to do that. Sometimes people just decide they’re done with you!

For example, one problem I pointed out with Trump’s plan is that he is engaging so many nations in his Tariff wars that those nations can and must all turn to each other in order to win the war. Now, we see that playing out in today’s news, too:

Shifting exports into Asian and European markets will promote long-term stability for Canada, Baiton said.

No surprise. Of course, Canada, which now faces a much weaker market from the US for its exports will turn to exporting to other nations. Since some of those other nations are placing their own retaliatory tariffs on US products, those nations may even avoid buying the US products altogether, opening much larger market for Canadians who no longer have to compete with the US in those markets. Canadian producers, rather than lowering their prices a lot to offset large US tariffs, will simply lower their prices just a little, if event all, to gain more sales in other nations, which takes away sales from US exporters in a loss of market share that they may not easily get back once the US is no longer trusted as a reliable trading partner.

In terms of reliability, remember that Trump already negotiated trade deals with Canada and Mexico that promised not to engage in further tariffs, meaning they will see the US (or, at least, Trump) as an entity that cannot be trusted to even live up to its own deals.

The Second Great Depression

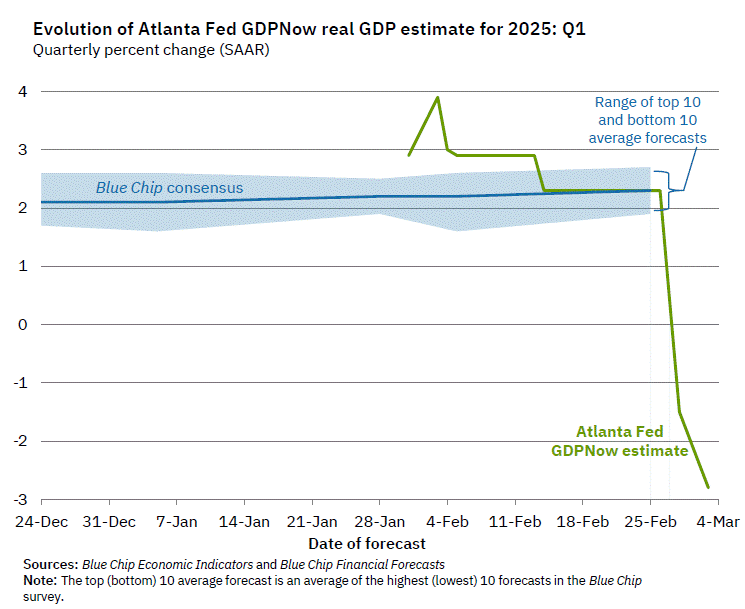

In light of everything that happened today, it is also no surprise to see what all did to that disastrous GDPNow report (if the report proves true) that I wrote about yesterday. It already went down another leg again today:

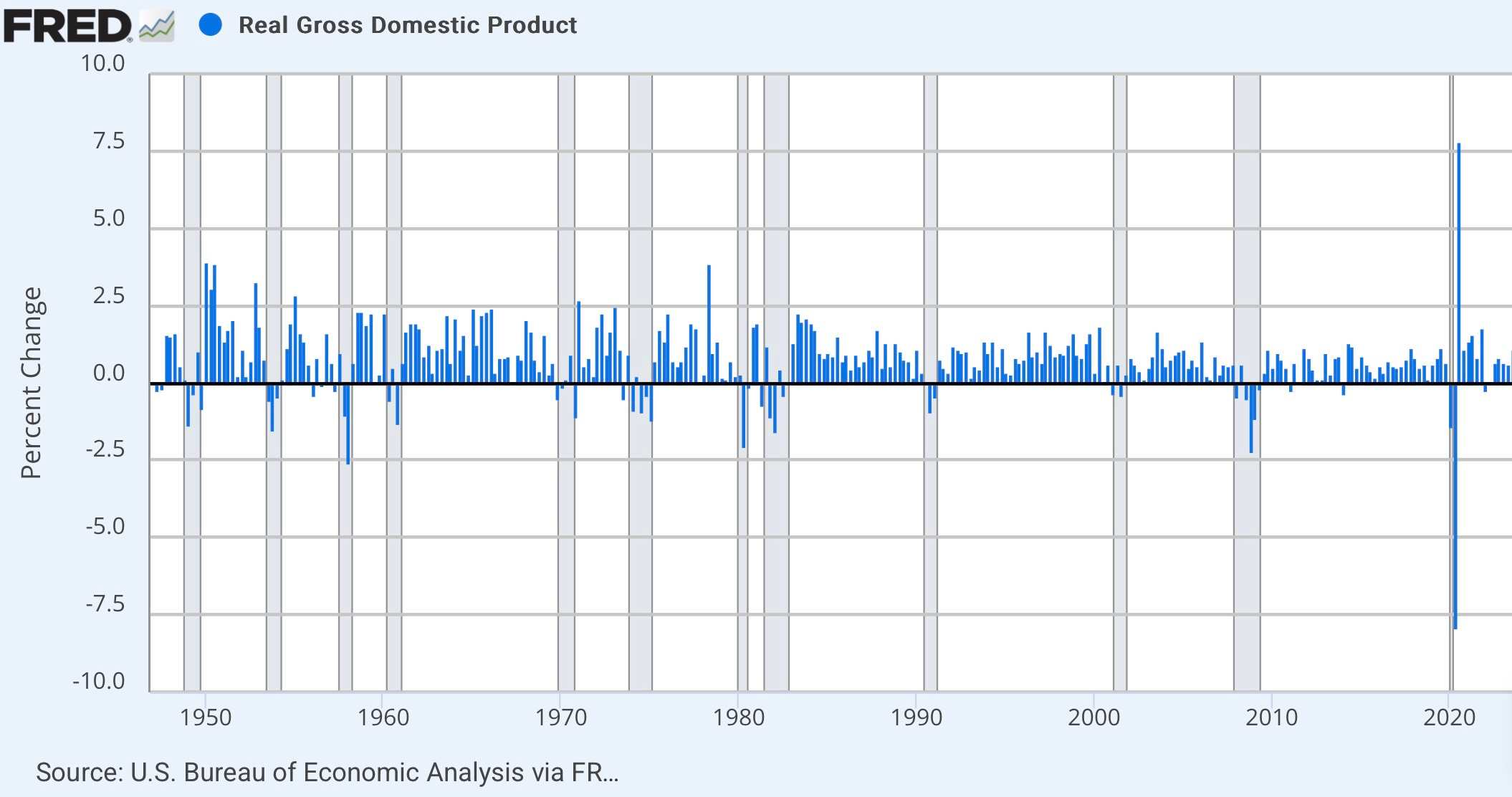

That puts the estimate down to a deep minus-3 real GDP recession. As you can see a minus-three recession, with the exception of the Covidcrash anomaly, would be the deepest recession in the Fed’s record:

Outside of the Covidcrash, a -2.5% quarterly change in real GDP is as bad as it has gotten, going back to the start of the Fed’s records of such things. And, if inflation gets worse (as it will), inflation is subtracted from raw GDP to get “real GDP,” so real GDP will be even worse!

Therefore, it is also not surprising that Team Trump has just come up with a new plan to raise GDP: Change the way it is calculated so it looks better! (Also in the news headlines below.)

Egads! Just when you thought it couldn’t get worse than the fake statistics we had under Biden. (That just shows you how truly bad they are afraid it is going to get.)

********